The electric utility monopoly is breaking up, but will renewable energy become another form of wealth extraction or will community renewable energy enable communities to capture their renewable power?

Download the Report

Download the Executive Summary

Executive Summary

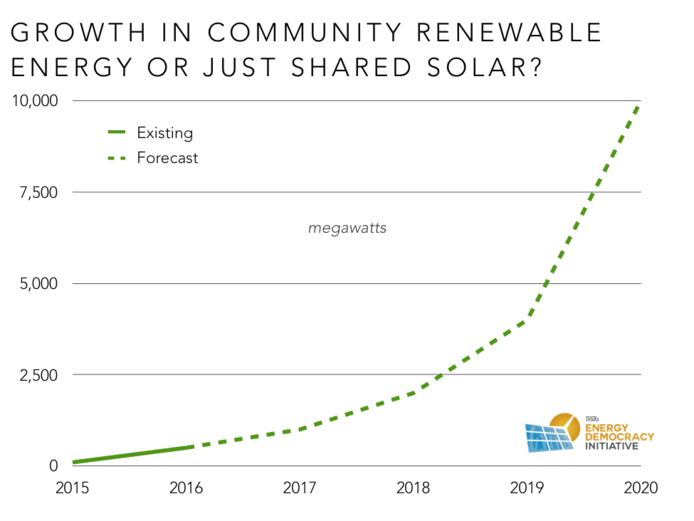

In the past five years, the opportunity for community renewable energy has coalesced around “shared solar,” where participants share the electricity output from a nearby solar array in the form of credits on their electricity bill. Some forecasts suggest that shared solar could supply 5-10 gigawatts of new power capacity in the next 5 years.

But shared solar is just a small slice of the community renewable energy opportunity, which could include many other renewable technologies such as wind or geothermal, but also community-owned projects that would allow greater local capture of economic benefits. While shared solar is a model shown to avoid several of the pitfalls typical for community renewable energy, these pitfalls could be bridged to much more broadly expand the economic opportunity.

U.S. Barriers to Community Renewable Energy

Three major barriers still inhibit widespread expansion of community renewable energy, much as they did when ILSR published its community solar report in 2010.

- Federal and state securities laws, meant to shield ordinary people from Ponzi schemes and bad investments, are often too onerous for community-scale renewable energy projects.

- Federal tax incentives require specific and sufficient tax liability, in ways that often precludes ordinary community investors.

- Finally, legal limitations to sharing electricity output from community-based renewable energy projects mean only states with explicit exemptions are likely to see substantial growth in community renewables.

Busting the Barriers?

Within limits, policy makers have found ways to work around or reduce the barriers to community renewable energy, but their solutions haven’t yet proven widely scalable without significant compromise.

- State and federal crowd funding laws have carved out exemptions from securities limitations, although the laws remain substantially complex and compliance is expensive.

- Successful community renewable energy projects have found third party “tax equity” partners to provide access to a fraction of the tax incentives, but far less than if they could have captured the incentives themselves. The long-term phase out of federal renewable energy incentives (and potential substitution of low-cost capital) may finally address the incentive inequity between community-based and single-party, for-profit projects.

- Shared solar typically has third party or utility owners of community-based projects with participation limited to compensation via electric bill credits. In this manner, the third party or utility allows shared solar to overcome the securities and tax incentive barriers. Although proven to be the most replicable, shared solar usually requires a sacrifice of community ownership and control. Additionally, some utility-run programs may offer poor payback or be designed to divert customers from individual solar ownership.

- Cooperatives, very popular in the grocery and agriculture industry, solve the securities barrier by allowing unlimited fundraising from members and retain economic benefits for member-owners. A promising solution, cooperatives may face the same challenges (i.e. access to federal tax incentives) as other community-based institutions.

Exceptional Community Renewable Energy Projects

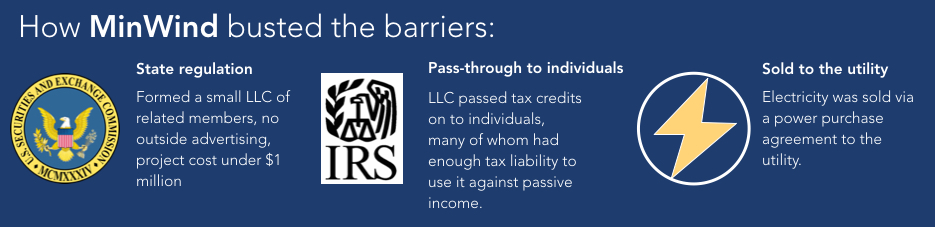

Despite the barriers, a number of clever entrepreneurs have pulled together community renewable energy projects that combine local, community-scale renewable energy and local ownership. Selected examples from the report include:

- A 35-member LLC in University Park Maryland installed a community solar array on a local church

- Nearly 200 Iowa rural residents financed 6 community-owned turbines

- Over 600 South Dakota residents are owners in a 7-turbine wind power project hosted by Basin Electric Cooperative

Cities as “Community”

More than 2,000 cities have municipal electric utilities. Cities with municipal utilities like Georgetown or Denton, Texas, have already signed contracts for 70 to 100% renewable electricity. Many more cities have pooled their resources to procure renewable energy in joint ventures. In a few states, municipalities are able to make clean energy procurement a priority via “local energy aggregation,” and two California aggregations, Marin Clean Energy and Sonoma Clean Power, already offer electricity at competitive prices with a higher portion of renewable energy than incumbent utilities.

A Community Renewable Energy Gold Standard

There are four key principles to successful and meaningful community renewable energy:

- Tangible benefits for participants

- Flexibility of ownership structure

- Additive to other renewable energy policies

- Access for all

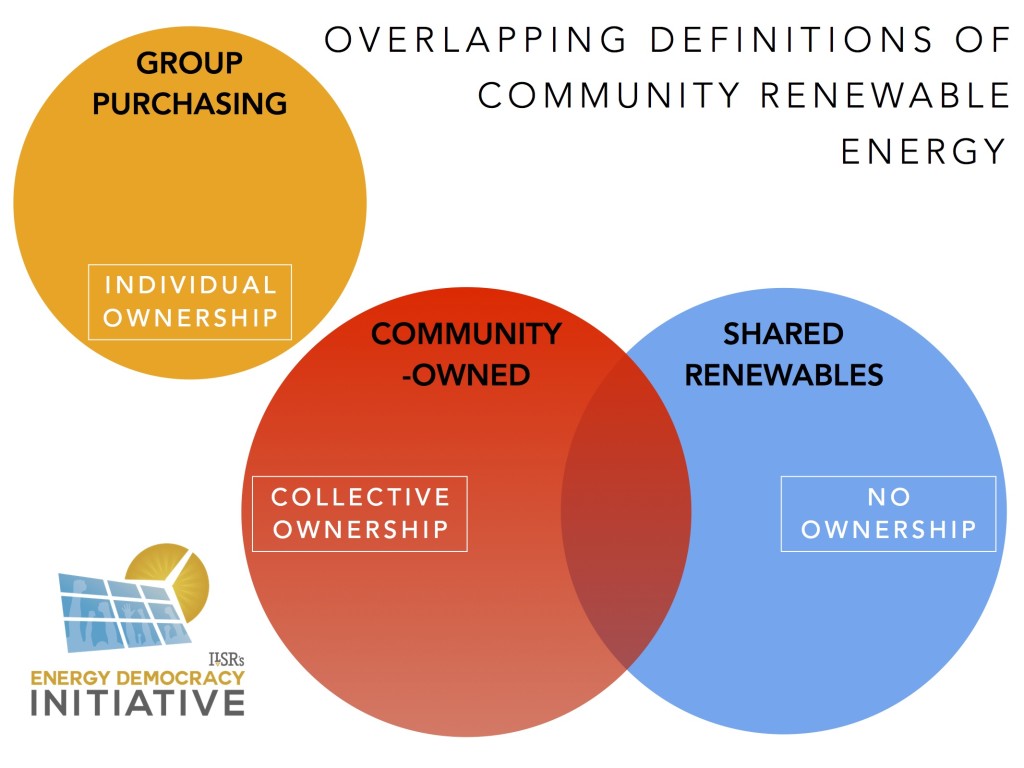

While these principles apply to all community renewable energy, ILSR prioritizes community-owned renewable energy, in particular, for its greater economic benefits and local control. As is shown below, community-ownership may be distinct from shared solar, or from collective action that supports individual ownership, such as group purchasing. Some examples of the three categories are shown in the full report.

Shared renewables have led the development of community renewable energy and the forecasts for growth because it bypasses two of the most significant barriers, securities regulation and access to tax incentives. But proponents of community renewable energy should look beyond sharing. Ownership allows local decision making about location, hiring, and participation that shared solar may not, and it will require all forms of community renewable energy to make it as ubiquitous in the 21st century as utility ownership was in the 20th.

Acknowledgements

Thanks to David Morris, Nikhil Vijaykar, Subin Varghese, Al Weinrub, and Anya Schoolman for their thoughtful review. Thanks to Rebecca Toews and Nick Stumo-Langer for making sure more than 5 people read it. All errors are our own responsibility.

Contact John Farrell (jfarrell@ilsr.org).

Introduction

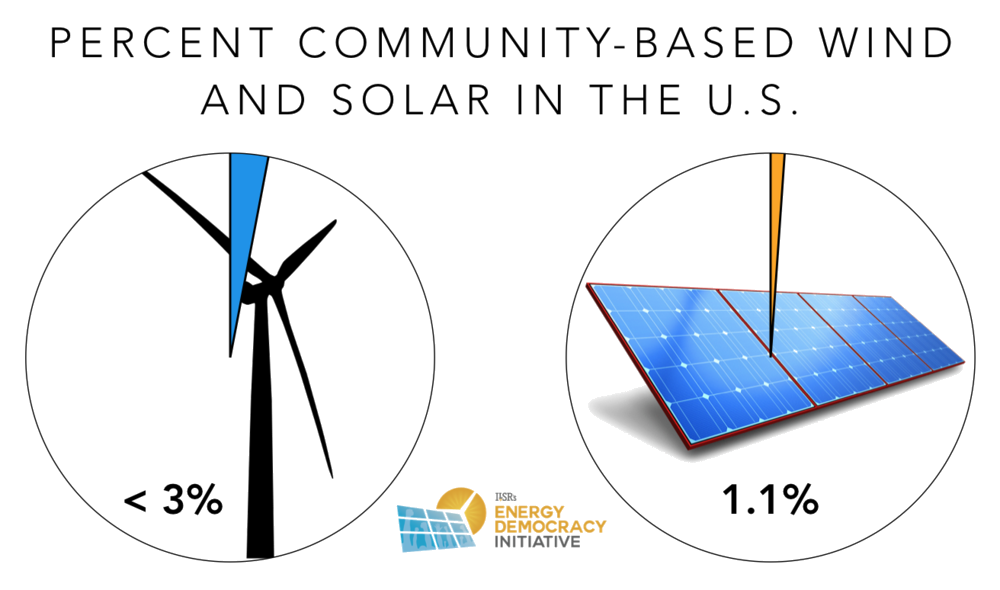

By the end of 2015, U.S. renewable energy capacity from wind and solar power eclipsed 100,000 megawatts, with another year of historic growth. Despite its many advantages, however, community renewable energy has been a small fraction of this impressive figure.

By the end of 2015, U.S. renewable energy capacity from wind and solar power eclipsed 100,000 megawatts, with another year of historic growth. Despite its many advantages, however, community renewable energy has been a small fraction of this impressive figure.

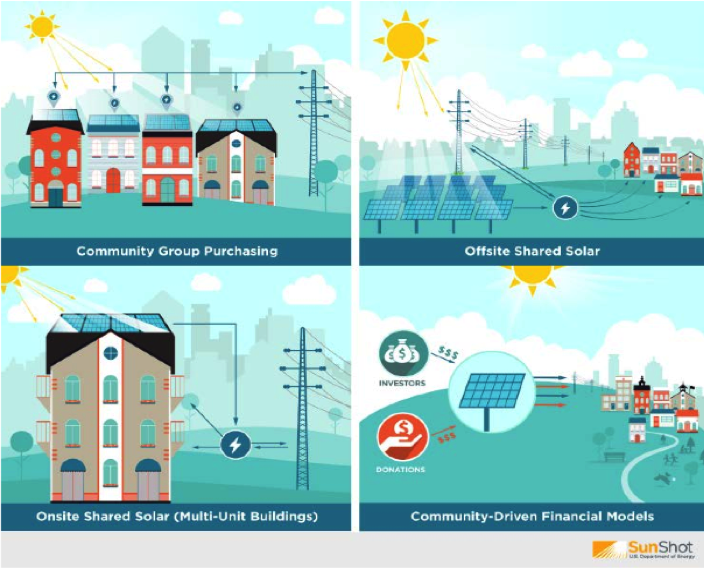

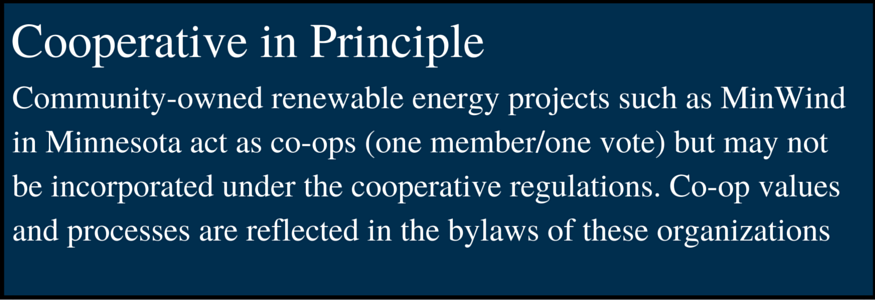

In this report, we talked about several forms of community renewable energy. Community-owned renewables are owned locally, by members of the community. Shared renewables may or may not be locally owned, but the community can share the output. Group purchasing involves collective action to purchase renewable energy, such as rooftop solar arrays, but the benefits accrue to the individuals who host the solar on their rooftops.

Unlike traditional electricity generation, wind and solar are very compatible with the first criteria—community scale—because both wind and solar power plants are made up of several to several hundred modular power sources (turbines or panels). Distributing power generation from these sources is relatively easy and economical under the current rules for the electricity system, especially in comparison to the severe limitations on collective ownership.

For wind power, the scale of most wind farms makes them expensive, and their remote location makes sharing electricity output with the typical policies nearly impossible. The result is that less than 5% of total installed wind power capacity was part of a community renewable energy project through 2010. Less than 3% of wind power capacity added since then has been community-owned (and none have shared output).1

For wind power, the lack of collective ownership in the U.S. may not come as a surprise, but it should. In Denmark, for example, wind turbines were legally required to be owned by electricity consumers. Danish wind projects are typically owned by several to several hundred landowners and farmers in “wind partnerships.” The result is that 20% of Denmark’s power comes from wind, and 85% of that is owned by the residents of Danish communities.2

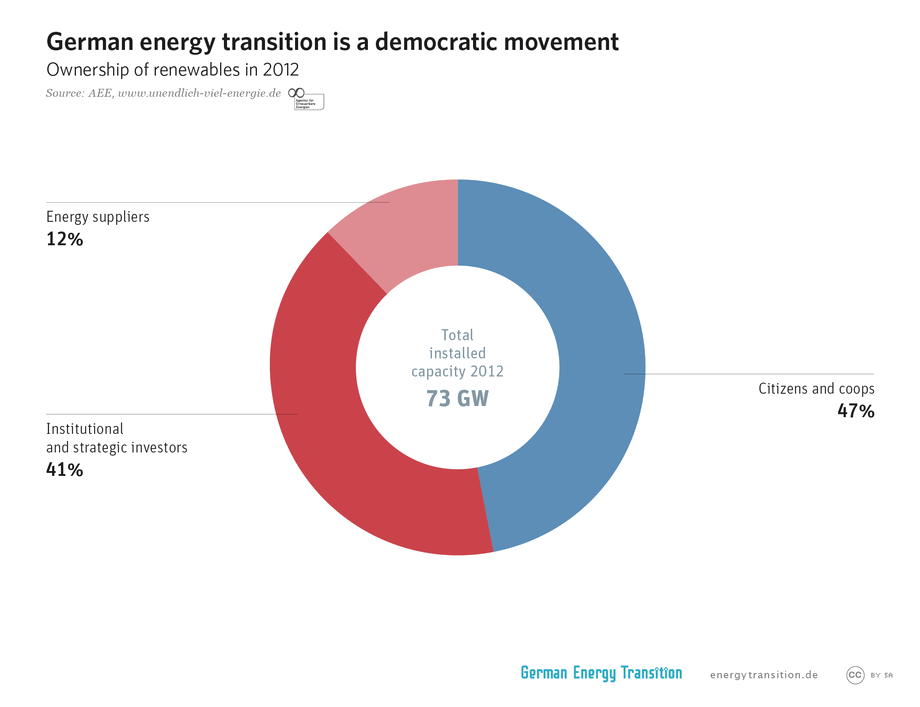

For U.S. solar energy, there has been massive growth in distributed generation, but limited opportunity for collective ownership. Half of the 25,000 MW of solar serves single residential or commercial property owners, with a scant 70 MW of community solar projects through the end of 2015.3 On the one hand, this is an impressive figure, mimicking the 50% of renewable energy capacity in Germany owned by citizens and cooperatives (below).4 On the other hand, with nearly half of U.S. households and businesses unable to host their own solar panel, continuing growth in citizen ownership will require options for collective ownership or shared benefits.

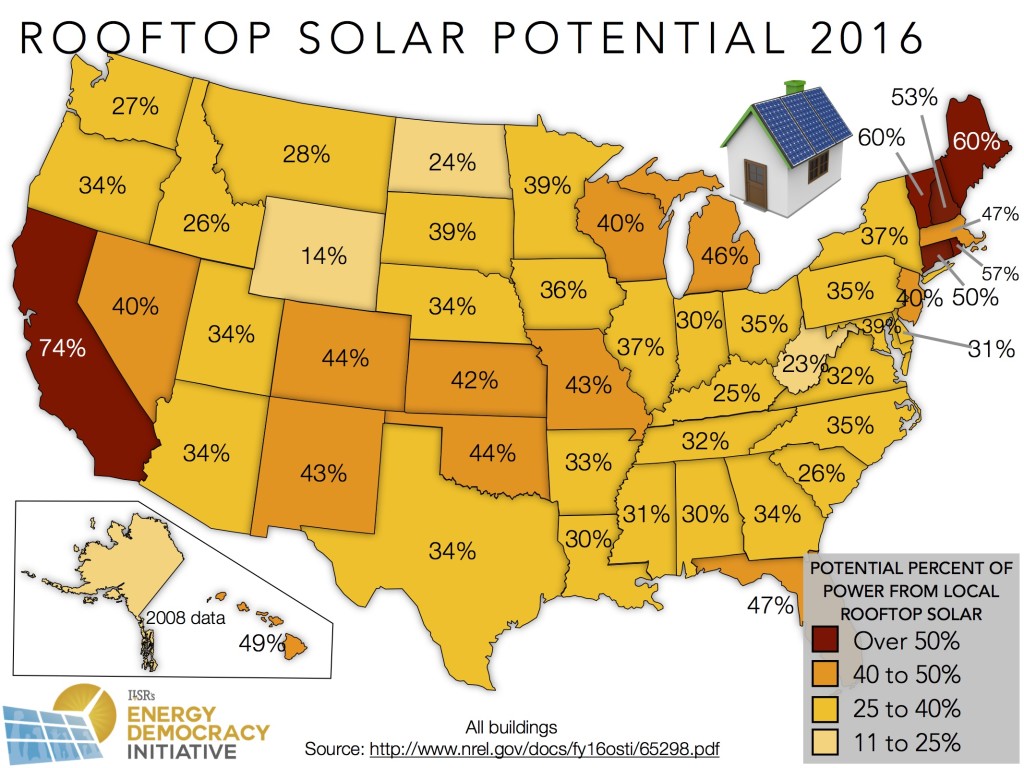

The relative dearth of U.S. community renewable energy stands in stark contrast to the opportunity for distributed power generation and the need for collective ownership options. The following map shows that nearly every U.S. state could get 25% or more of its electricity from rooftop solar alone, and two-thirds of states could get 33% or more.

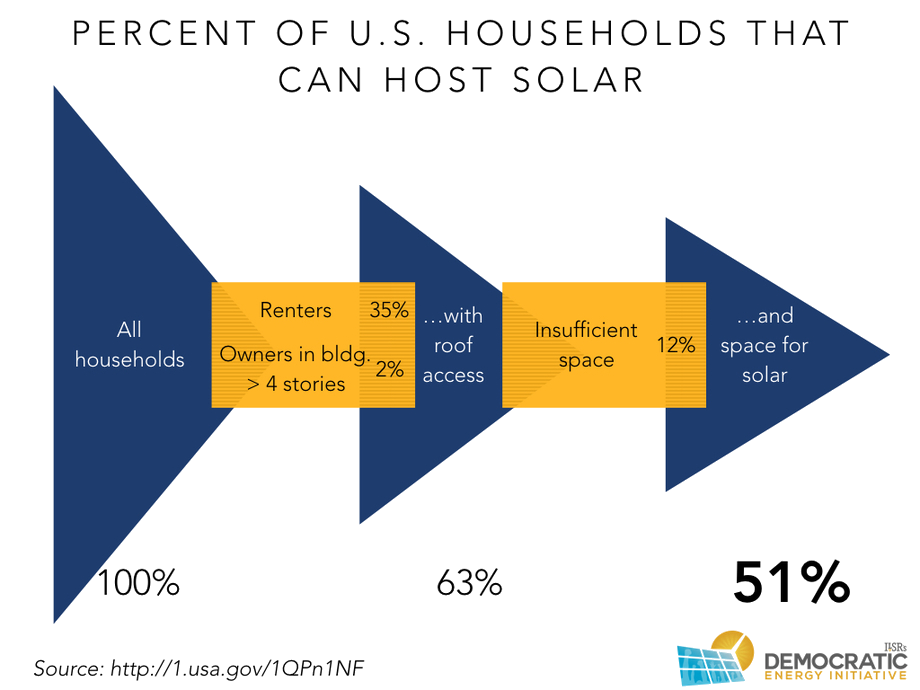

But millions of homes and businesses can’t host solar arrays or wind turbines but have an interest in reducing their reliance on fossil fuels and on distant utilities. For example, the following graphic shows that half of U.S. households don’t have access to a sunny rooftop with sufficient space for a solar array. Similarly, about half of businesses lack control of sufficient roof space to meet significant portion of demand.5

Additionally, many homes and businesses with or without the physical property to support solar or wind lack the financial wherewithal to make the upfront investment in renewable energy, despite its long-term economic benefits.

Community renewable energy can extend the benefits of the electricity system’s transformation to everyone and building political support for its acceleration. It’s a timely opportunity, with an electricity system in the throes of a major transformation on the very issues of scale and ownership.

Power generation is being distributed and decentralized, and with it the power over the grid itself. After a century of utility energy monopolies in electricity generation, the 21st century is bringing a transition to energy democracy. This report explores the opportunity of energy democracy and community renewable energy by illustrating:

- The benefits of community renewable energy.

- The major barriers to community renewable energy.

- The barrier-busting policies and strategies to unlock its full potential.

- The remarkable examples of community projects that have already overcome the barriers.

- How cities and electric cooperatives represent existing “communities” than can go renewable.

Benefits of Community Renewable Energy

The benefits of community renewable energy fall into four categories: benefits from renewable energy, benefits of distributed power generation (scale), benefits of community scale and offsite generation, and benefits of local ownership. The benefits are cumulative from top to bottom.

The benefits of renewable energy include:

- Price certainty, because of zero fuel costs for wind and sun. In Minnesota regulators value the zero fuel cost of solar at 3.2¢ per kilowatt-hour of natural gas electricity avoided, a total of $13 million if all natural gas power generation in the state were supplanted by solar energy.6,7

- Health benefits due to zero environmental externalities from power generation, estimated at 2-5% of Gross Domestic Product, or between $360 to nearly $900 billion.8

The benefits from distributed generation include:

- Reducing variability of renewable energy production.9

- Minimizing losses of electricity through long-distance transmission.10

- Use of brownfields or already-developed property for energy generation.

- Ability, in the aggregate, to reduce maintenance and capital expenses for distribution grid infrastructure. For example, the Long Island Community Microgrid will use 25 megawatts of distributed solar and battery storage to avoid a $300 million grid upgrade.11

- Resiliency, by providing power generation locally to power important community buildings, e.g. powering hospitals when the larger grid fails.

The benefits of community renewable energy include:

- Greater participation:

- An opportunity to go solar for the 50% of American homes and businesses that can’t host solar

- With an average of 213 participants per megawatt, the first 40 MW of community solar projects helped over 8,500 people go solar.12

- Economies of scale, because community-scale institutions are less costly per Watt of capacity than individual solar arrays.

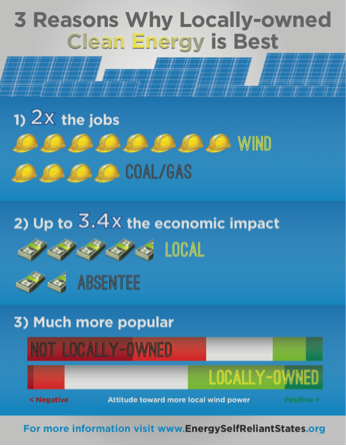

The benefits from community-owned renewable energy include:

- Substantially greater economic benefits and job creation in the host community.13

- Reducing concentration of political and economic power in the electricity business.

U.S. Barriers to Community Renewable Energy

Despite the enormous benefits, U.S. rules for renewable energy development have yet to catch up to the 21st century opportunity for community renewable energy. Federal securities laws make raising capital for community renewable energy relatively onerous. Federal incentives largely favor individual or corporate ownership and hinder ownership by community-benefit entities, such as public or nonprofit organizations. State rules allow monopoly utilities to wield enormous influence over potential competition on the distributed grid and generally prohibit sharing electricity from a solar or wind project owned in common.

The following sections provide more detail on these barriers.

Costly Securities Regulation

The first question in developing any energy project is “where’s the money coming from?” Community renewable energy, especially community-owned energy, faces a unique challenge in raising capital because the owners of the wind or solar project are often distinct from the property owner, and spread over a wide geographic region.

The simplest way to raise capital is through an existing entity, such as a community institution, local government, place of worship, or nonprofit organization. But as discussed in the next section, these entities can raise money for community projects, but not access tax incentives to fund and finance them.

Alternatively, a community-owned energy project can be financed through a new organization and raise capital from the community directly.

Enter securities law.

To raise money from potential investors, large and small, a community renewable energy project must file with the relevant federal (Securities and Exchange Commission) or state securities agency (e.g. Department of Commerce) to explain their offering, their pitch to investors, and to have their financials reviewed.

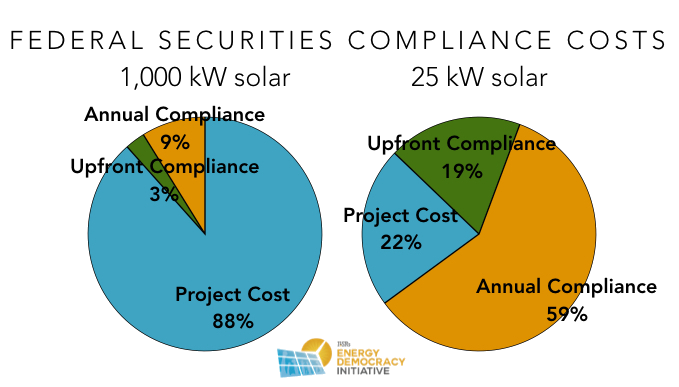

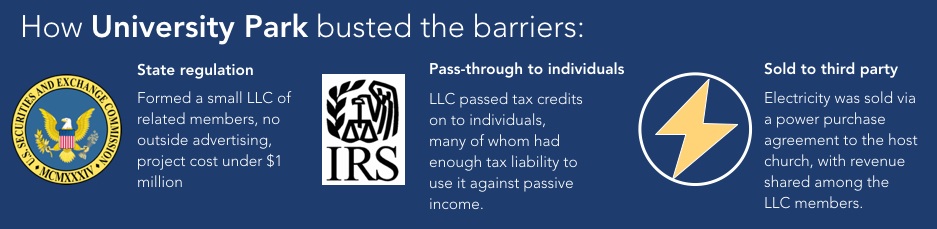

Federal and state statutes designed to protect investors from fraud represent high-dollar compliance costs for many relatively small-dollar community renewable energy projects. Federal compliance is particularly costly, with upfront and annual compliance costs in the hundreds of thousands of dollars.14 For a 1 megawatt solar project on an IKEA store, the upfront costs and first year compliance costs are more than a tenth the total project cost. For a small, 25 kilowatt solar array like the University Park community-owned solar project, compliance costs exceed 75% of the project’s installed cost.

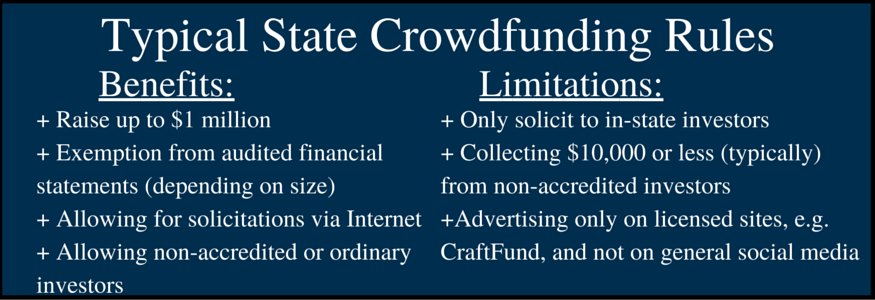

Fortunately, states offer exemptions to securities registration with the federal government for smaller projects, but the exemptions have limitations on the number of “non-accredited” investors (a.k.a. non-wealthy folks) and on advertising. Compliance costs are lower than for federal registration, but still run in the tens of thousands of dollars annually. The result is relatively few successful community renewable energy offerings. The following table illustrates the exemptions to federal securities registration and their limitations. Additional state-level rules may apply.

Exemption |

Restrictions |

| Regulation D, rule 506(b) | Allows up to 35 non-accredited investors, “so long as they have a certain amount of financial sophistication and are provided a certain disclosure document.”

No advertising |

| Regulation D, rule 506(c) | Accredited investors only. |

| Regulation D, rule 504 | Limit of $1 million.

General solicitation/advertising typically not allowed. |

| Intrastate, rule 147 | Must get 80% of its proceeds from within the state, have 80% of its assets, and 100% of purchasers from within state.

May only advertise within the state. |

| Regulation A | Up to $5 million. |

| Private placement | Must have prior relationship with investors.

No advertising. |

Source: Multiple

Inaccessible Tax Incentives

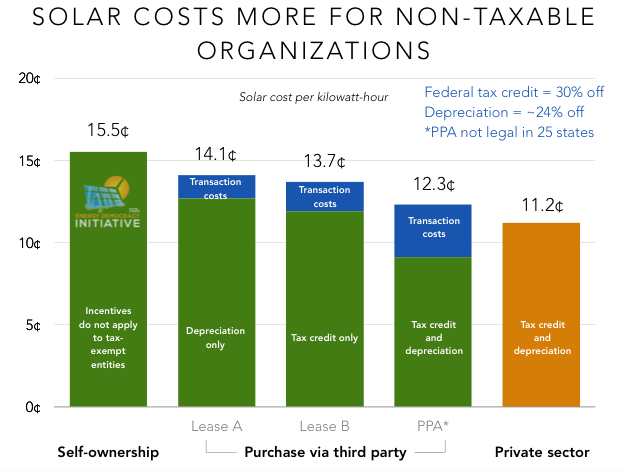

The federal tax incentives for renewable energy (the 30% tax credit for solar and the 2.2¢-per-kilowatt-hour production tax credit for wind) have long made community renewable energy more complex. Many of the logical entities to invest in community-based projects – local governments, most cooperatives, places of worship, or other nonprofit organizations – don’t pay federal income tax and can’t use tax credits.

Even when community-owned projects are organized as for-profit partnerships or limited liability companies, the participants often lack sufficient tax liability to use the federal incentive. For example, a typical 2 megawatt wind turbine generates more than $130,000 in tax credits each year, which would require 18 owners with average tax liability of $7,500.15 But it gets more complex.

Even with many owners splitting the tax credit, unless they are involved in the day-to-day operation of the wind or solar project – behavior the IRS called “material participation” – their investor status allows them to only use the tax credit to offset “passive income.”16

For many individuals, the only tax liability they can offset with the tax credits may be the income from the renewable energy project itself (unless they invest in other ventures in a similar fashion, or have rental property). Although the federal tax credit can be carried forward to next year’s tax filing, it’s unclear for how long.17

These limitations drive community developers into partnerships with large companies or Wall Street banks who can use tax credits and provide capital, but who take a substantial cut of the project revenue in exchange. The “flip” arrangement was commonly used in community wind, where a big investor retains nearly-full ownership of a community wind or solar project for years to absorb the tax incentives (usually 10 or more years for wind and 6-7 years for solar), and then ownership of the project flips back to the local owners.18

These arrangements increase the cost and complexity of developing community renewable energy projects relative to private or corporate ownership, but can still benefit of participants. In our 2010 report on community solar, for example, only one-third of successful projects were able to use the federal tax credit, but they were generally the most financially worthwhile “investments.”19

The chart below illustrates this issue of tax credit access by comparing the cost of solar electricity for projects owned by a non-taxable entity. On the left is a solar project priced without any federal tax incentives. In the middle are three common options for third-party ownership where the city or nonprofit retains some of the economic value of federal tax incentives. The bar on the right shows that none of a non-taxable entity’s strategies to own solar can compete with a private, for-profit entity that has straightforward access to the federal incentives.

There was one significant exception to the inaccessibility of federal tax credits. After the financial crisis in 2008, legislation included in the federal Recovery Act allowed conversation of the tax credit into a cash grant for projects begun between 2009 and 2011. The law addressed a severe shortage of tax liability to absorb the renewable energy tax credits due to the collapse of the economy, but by removing the tax liability barrier it also opened the door to several of the exceptional community renewable energy projects highlighted later. It was also much more efficient, delivery more of the dollars directly to projects, rather than to Wall Street tax equity partners.20 Unfortunately, the cash grant program was allowed to expire at the end of 2011.

Limitations to Sharing Power

For community renewable energy projects that overcome the first two challenges, the issue of electricity production awaits.

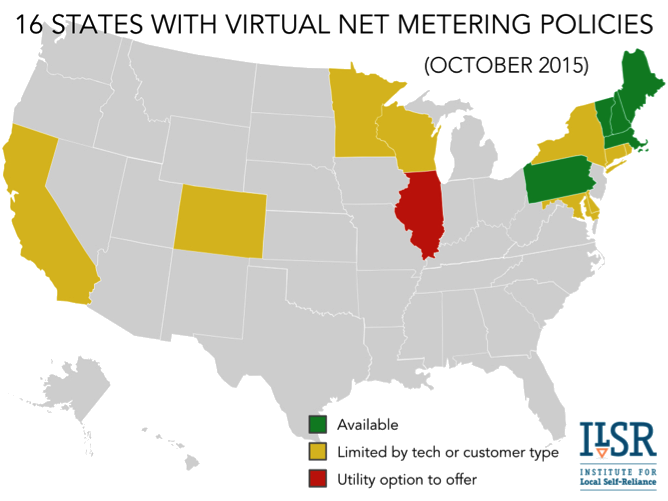

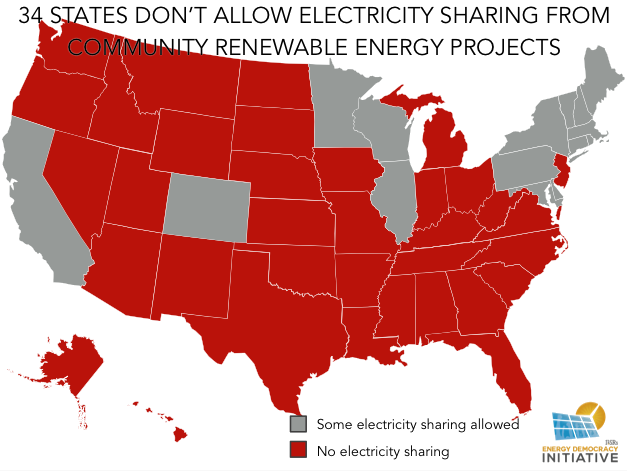

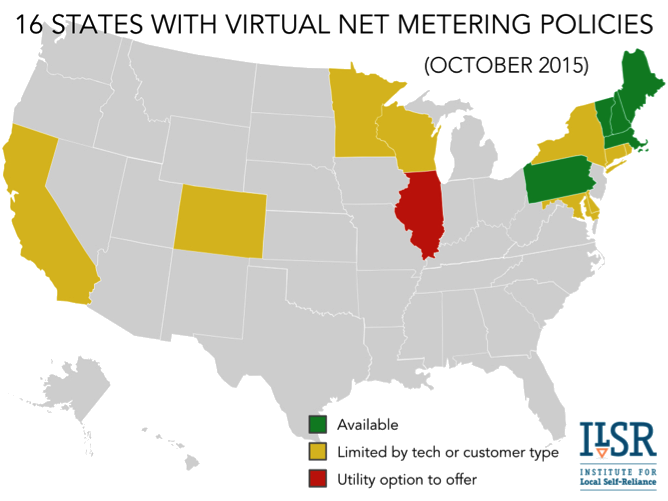

A fundamental concept in a community renewable energy project (beyond ownership) is sharing the electricity produced. But while individuals can use on-site solar or other renewable generation to offset their electric bill in 44 states (called “net metering”), the rules for sharing electricity from non-utility projects are much more limited. In many cases, utilities have been fighting to weaken traditional net metering laws and so far, only 16 states have a policy that allows electricity sharing.21

In most states, no one but the utility can sell electricity to customers within a given geographic area. These are called monopoly or franchise rights. There are three common exceptions, all of limited value to community renewable energy. Self-generation, usually supported by net metering, allows a single property owner to offset power use with on-site power generation, but not to share those electricity credits with others. Selling power to the utility directly means competing with large-scale power plants on price, even though distributed generation has higher value. Selling to third party owners is allowed in about two dozen states, but requires identifying a property owner who is willing and able to host a community renewable energy facility.

In other words, there’s no widespread policy that allows for easy sharing of electricity generation from community renewable energy projects. The only resolution is changing the rules.

Barrier Busting

There are three big tools for breaking down the barriers to community renewable energy: using non-tax-based incentives for renewable energy, simplifying the process of raising capital, and adopting formal “community energy” laws that enable power sharing. The impact of adoption could be enormous. In the community solar market alone, the National Renewable Energy Laboratory estimates that residential and commercial customers who can’t have their own rooftop solar array could be participants in 5,500 to 11,000 megawatts of solar (a 22 to 44% increase over the total installed base) by 2020 with the right rules in place.22

Tax Structure

There are two solutions to the federal tax incentive problem for community renewable energy projects. One is to change federal incentives so they do not favor taxable over nontaxable entities. For example, Congress could opt to offer the incentive as a cash grant, as it did during the financial crisis (2009-2011). Later, we feature two examples of community wind projects enabled by this time-limited opportunity.

Although the tax credit for both wind and solar remarkably won extension in late 2015, its design wasn’t improved relative to non-taxable entities. This is in part because the rules of legislating typically require a single Congressional approval for tax credits, but at least two votes for cash payments: authorization and appropriation. Political simplicity means greater financial complexity for community ownership.

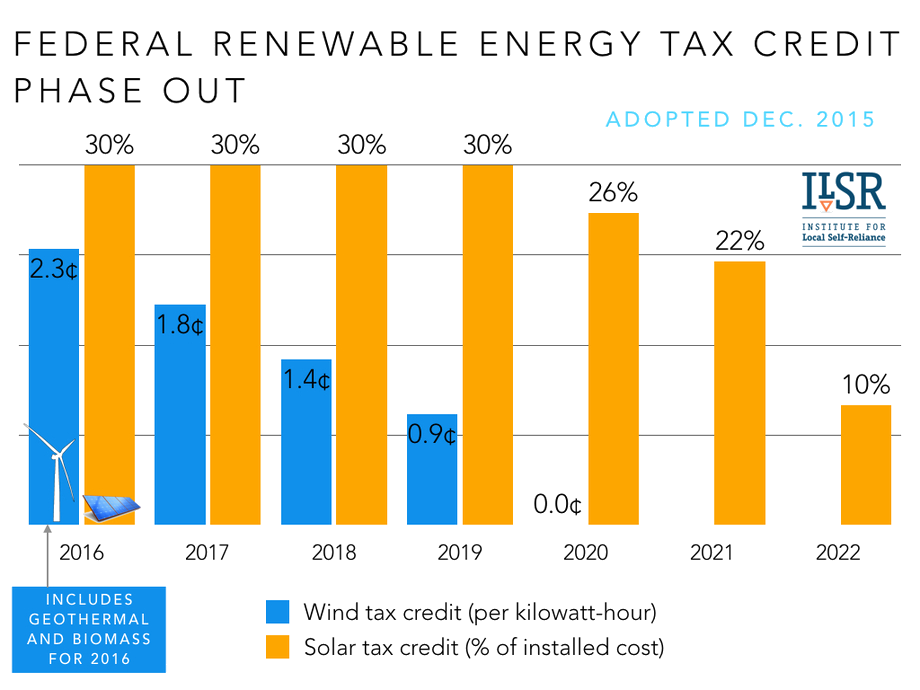

The second solution to the unequal incentive problem is to move to low cost financing rather than relying on tax incentives. The 2015 federal tax credit extension already includes a scheduled phase out (shown below), by 2020 for wind, geothermal, and biomass projects and by 2023 for solar.

This eventual expiration may reduce the disincentive toward public and community ownership structures because developers (community or otherwise) will no longer have to seek Wall Street “tax equity” partners to absorb the tax incentives. Such partnerships have been expensive.23

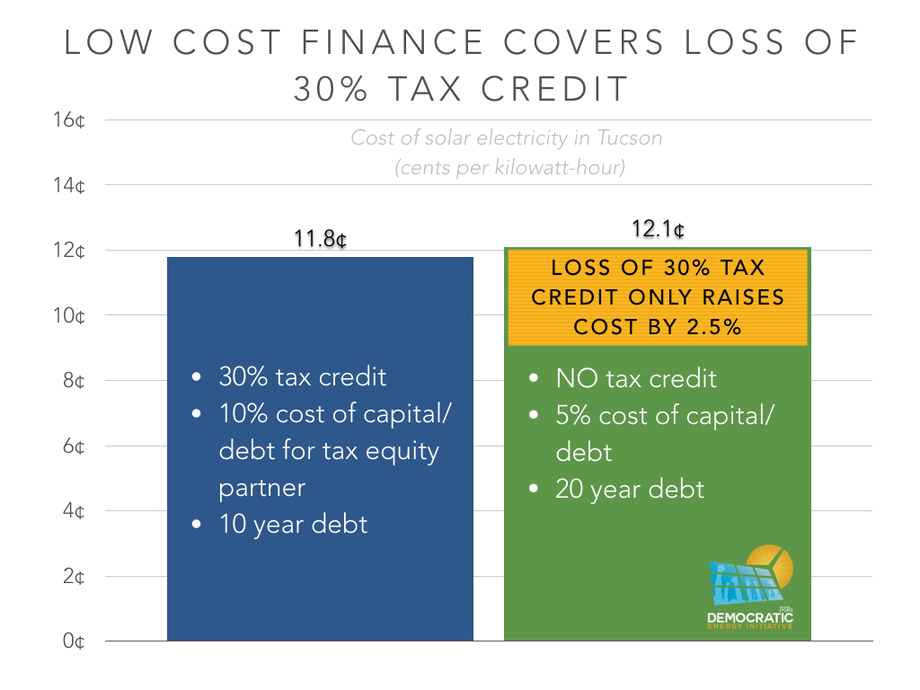

The following chart shows how losing the 30% residential solar tax credit would only increase the cost of solar energy by 2.5%, if by forgoing tax equity partners the residential solar developer can access debt or equity at 5% interest instead of 10%.24 The assumption is that without a tax equity market (limited by the number of potential investors and their ability to demand high returns), financing for solar would be taken up by more conservative, institutional investors with an eye toward stable and less lucrative long-term returns.

Although phasing out incentives for wind and solar unfairly gives fossil fuel power plants an economic advantage (despite their significant and unaccounted for environmental cost), it may result in more diverse renewable project ownership structures.

(The Promise of) Financing in the Crowd

In 2012, a California-based organization called Solar Mosaic garnered significant attention with its launch of crowd financing for community-based solar projects.25 Mosaic’s platform allowed ordinary folks in California and New York, and accredited investors everywhere, to make a modest (4 to 6%) investment return on community-based solar installations in their state, with the company expected to expand to other states. By 2014, Mosaic had expanded to two dozen projects and over 3,000 investors, supporting a variety of projects on private and community buildings, such as a youth employment center in Oakland, CA, and a convention center in Wildwood, NJ. It had yet to use crowd-sourced dollars to support community-owned solar, but Mosaic president Billy Parish expressed interest in the idea in this 2014 podcast with ILSR’s John Farrell.76

Concurrent with Mosaic’s rise in prominence, the federal government passed the JOBS Act, promising a new way for small groups of ordinary people to pool their money to invest in renewable energy (and many other kinds of) projects.26

The excitement of crowd finance in those years makes the ensuing silence much more profound.

Sometime in 2015, Mosaic changed strategy to finance individual residential, rather than community-based, installations. Investors could still make a return, but by providing low-interest loans (5% over 20 years) to individuals for solar on their own property, to promote ownership rather than leasing.77 And the federal rules? Draft rules were released for comment in October 2013, but not finally adopted until October 2015, with an additional 6-month delay until implementation.27

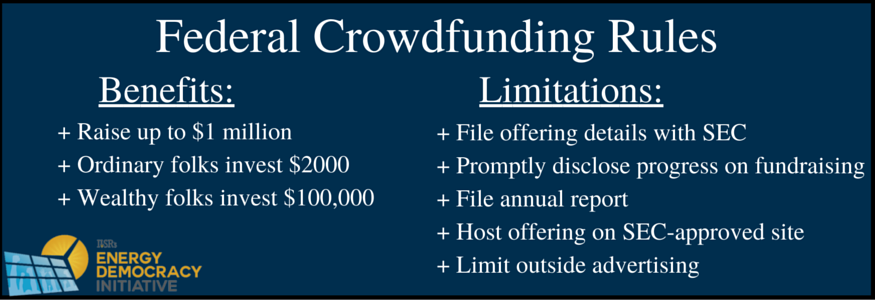

The adopted rules promise to less onerous compliance rules for small dollar projects, and an avenue for ordinary investors to participate (more detail in the Appendix).

It remains to be seen whether the new federal rules will prove a boon or not, because they may not be significantly less onerous than other securities requirements. Business lawyers at national law firm Dorsey and Whitney aren’t very optimistic:

“Compared to a traditional private placement under Regulation D, the costs of compliance – particularly the preparation of the offering statement, necessary financial statements, as well as the ongoing reporting requirements –in relation to the maximum offering size, may impede widespread reliance on the new crowdfunding rules.”28

On the whole, the rules may not provide much advantage over existing exemptions from federal crowdfunding rules, other than allowing interstate investment. And the state rules have been in place, sometimes for several years, while the federal government was evaluating its rules.

State Crowdfunding Laws

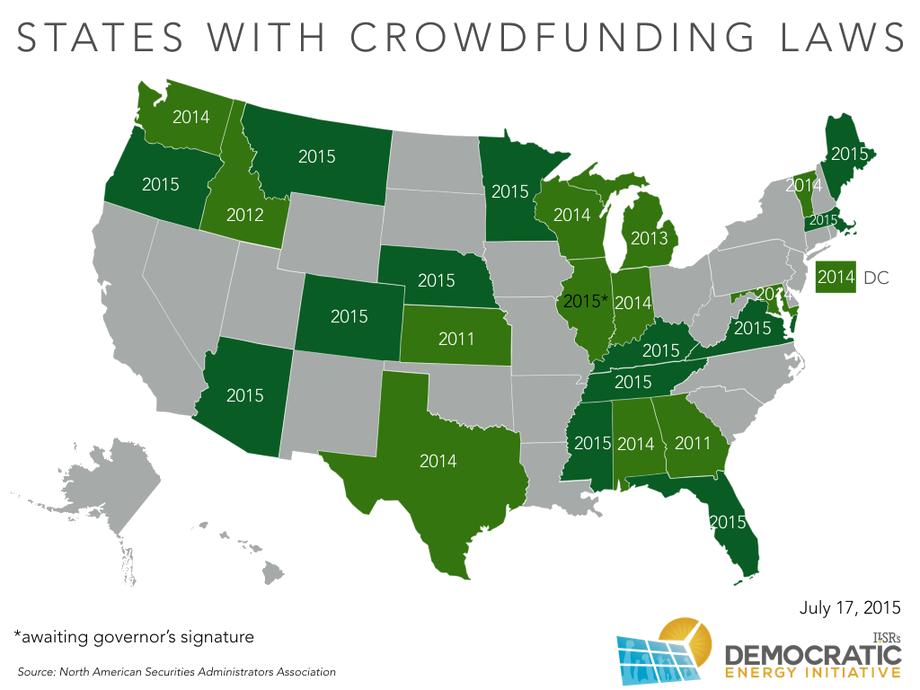

Many state level crowdfunding laws, based on existing exemptions from federal oversight, were implemented while the federal rules were bogged down. Through 2015, 25 states plus the District of Columbia adopted rules to simplify financing for small projects (see map below).

The adopted state laws (more detail in the Appendix) have very similar terms to the recently adopted federal crowdfunding rules.

Despite the more rapid adoption of policies, the state crowdfunding programs haven’t scaled up quickly. According to the New York Times, through June 2015 just 95 companies successfully raised capital using state-based crowdfunding laws despite being available in half of U.S. states.29

The lone exception to the general malaise of crowd financing community renewable energy is the donation model. Oakland-based RE-VOLV has a unique offer: a “pay-it-forward” contribution.87 So far, 765 donors have made over $120,000 in tax-deductible contributions to fund solar installations on a food cooperative, place of worship, and dance studio. The solar recipients pay nothing upfront, but lease the system from RE-VOLV (paid for by their energy savings). RE-VOLV, in turn, uses the lease revenue as seed money to fund the next community solar project. It’s the “people funded sun pay-it-forward” model, with a promise of accelerating growth as the existing projects continue to help fund future ones.

Although crowdfunding has enjoyed significant success when “investors” are making donations, as with Kickstarter (for a variety or products) or RE-VOLV (for solar), there remains significant tension between securities laws to protect investors and the relatively unsophisticated market of community renewable energy projects.

Community Shared Solar

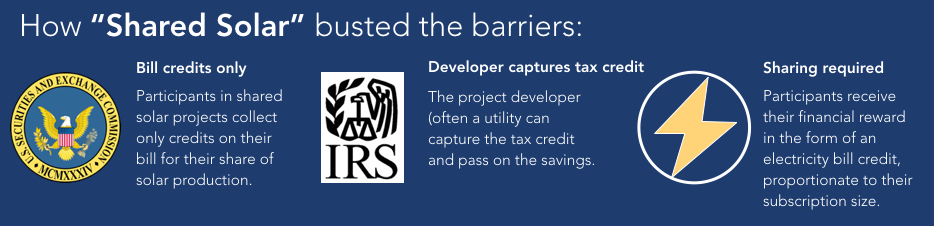

The most promising policy for breaking the community renewable energy barrier has been commonly called “shared solar.” In most cases, these projects are owned by the electric utility or third parties, with participants purchasing a “subscription” for a share of the electricity output for a limited time (e.g. 15-20 years).

The upside is that a subscription (rather than ownership) limits exposure to risk and simplifies raising capital. Subscribers don’t have to process or manage filing for tax incentives, and shares can be purchased for as little as $250. Furthermore, the subscriber model insulates projects from securities law limitations because instead of being investors, subscribers are essentially pre-paying for electricity that will be credited to their bill.30

This upside is also the downside: shared solar projects are not collective ownership.

The following graphic from the Department of Energy’s SunShot initiative illustrates the difference between the community-driven financial models (where investors pool money to sell electricity to a community) or group purchasing (where individuals bid together for solar arrays for their individual use) and the offsite or onsite “shared solar” concept.31

The key policy to enable on- or off-site shared solar is often called “virtual net metering.”32

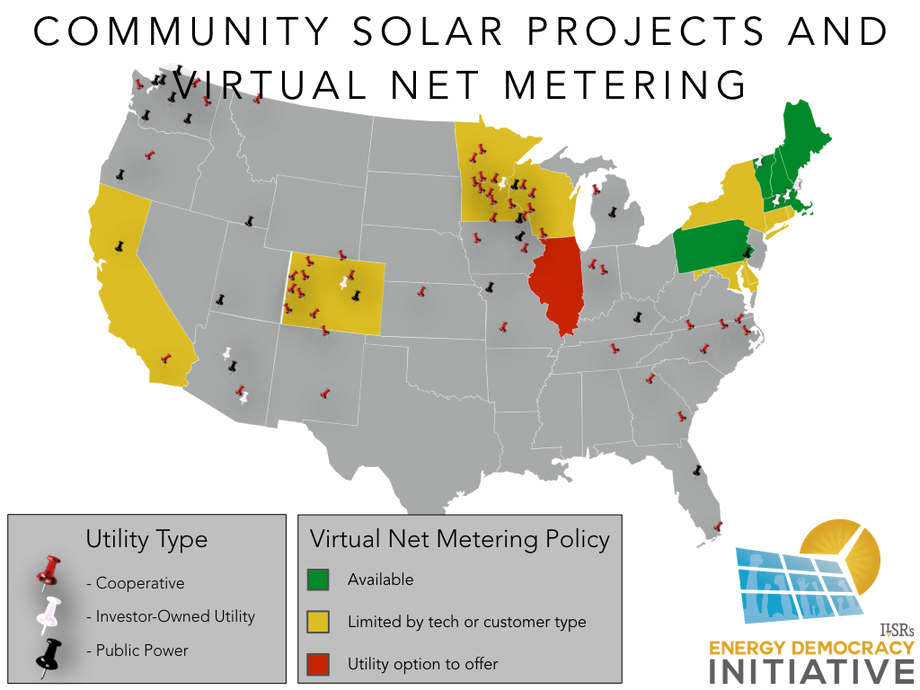

Unless a utility offers a program voluntarily (typically one in which they own the solar array), shared solar is enabled by virtual net metering or explicit community solar laws.33 Most of the 16 states with such laws restrict availability to solar energy and many limit availability to municipal governments or select electric customers. The following map illustrates.

The map below shows the success of implementing good state policy.34 Most existing community solar programs overlap with favorable state policy regimes. Washington is an interesting exception, where the state lacks a virtual net metering policy, but has a history of a very generous state tax incentive for community-owned solar that spawned a number of projects.

Although much more likely there, community shared solar projects aren’t limited to states with adopted policies. A number of utilities—particularly rural electric cooperatives—have offered community solar projects to their customers in other states including Georgia, Iowa, Michigan, and North Carolina.35 New policies are also under active consideration in New Mexico and Virginia.36 Hawaii enacted a law in 2015, and its program launch is awaiting a “value of solar” determination after an initial (poorly designed) utility program was shut down by the state’s Commission.37

Colorado company Clean Energy Collective has pioneered the development of a shared solar model that has been successful across eight states and even more utilities. The company sells 50-year ownership shares in community solar projects arranged in partnership with the hosting electric utility. The for-profit company is able to capture and pass through the federal tax credit, thereby lowering the cost of purchasing or financing a share of ownership. Perhaps its biggest contribution is solving the issue of sharing electricity output by negotiating arrangements with utilities that are not compelled by law.70

The company is also striving to solve the upfront cost barrier (at least for credit-worthy Massachusetts customers) by offering a “pay as you go” option. With the “SolarPerks” program, customers pay nothing upfront and simply substitute power from Clean Energy Collective for power from their utility, at a price that is “below the prevailing retail rate.”71

Their community solar offerings may also offer a discount relative to individual ownership, for those who have the option. In a recent project developed for the Wright-Hennepin electric cooperative in Minnesota, for example, the Collective’s community solar project offered a 12-year reduction in payback for a solar investment, from an abysmal 32 years to a still-long 20 years.72

For more on Clean Energy Collective’s model and business, listen to this 2013 podcast with CEO Paul Spencer.

The “Simple Solar” offering by the Cedar Falls, IA, municipal utility is another good illustration. Customers will receive a credit to their electric bill for their share of electricity production, but (unlike with net metering), the energy credit will be based on the “market energy supply costs for the billing period.”86 Originally much smaller, high demand led the utility to increase the size of the solar project to 1.5 megawatts, and it now has over 1,200 residential and business subscribers. The increased size also drove down the price to $270 per 170 Watt panel ($1.59 per Watt), far less than a comparable individually-owned system (typical installed costs are around $3.00 per Watt).

A relatively recent community renewable energy model piloted by a Vermont law clinic may take advantage of electricity sharing laws and avoid securities regulation issues. The model has participants purchase their shares directly from the solar installer, rather than via the community solar organization.38 Instead of acting as an aggregator of capital, the community solar organization (usually a limited liability company) has a more limited role, and “jointly maintains the array, sharing expenses for insurance, taxes, cutting the grass.”39 The direct purchase means each individual is shopping separately, not investing collectively, and thus there is no security to advertise. However, the model hinges on the Vermont’s virtual net metering law, allowing each individual to net the production from their share of the community solar array against their home energy use.

Aided by new policy, community shared solar is expected to expand rapidly in the next five years. In a report published by the National Renewable Energy Laboratory in April 2015, researchers estimated that shared solar could account for 5 to 11 gigawatts of solar capacity, for residential and non-residential participants, by 2020.40 With relatively high participation rates (213 participants per megawatt) in early community solar projects, these figures suggest that over a million Americans could participate in shared solar in the next 4 years.41

The big questions for the subscriber model, aside from falling short of collective ownership, is whether it can meet the other principles for community renewable energy, including tangible benefits, be additive to other renewable energy policies, and ensure access to all.

Limitations of Shared Solar

The biggest limitation on shared solar is policy. Community shared solar may be simpler than the ownership model, but to be developed by anyone other than the utility company, it requires utility cooperation (e.g. such as Clean Energy Collective) or enabling state legislation.

Be even where implemented, shared solar has room for improvement.

For one, shared solar programs should always offer ownership options beyond utility ownership, and program rules should facilitate collective ownership where possible. In most cases, ownership is retained by the utility or a third party, giving the participants little say in the decisions of the community solar project, from hiring to contracts with other local businesses, to the project location. The tradeoff seems relatively inexpensive when tax law limits how much of the tax benefits can be captured locally, but as the incentives fade in prominence, the loss of control may be more than it is worth.

Another potential improvement is expanding beyond solar. Community wind projects have proven popular with community ownership, but face many of the same barriers as community-owned solar. Shared renewables policies should be broadened to include non-solar technologies, from wind to geothermal (as district heating, for example) to anaerobic digesters, to provide a workaround for securities limitations.

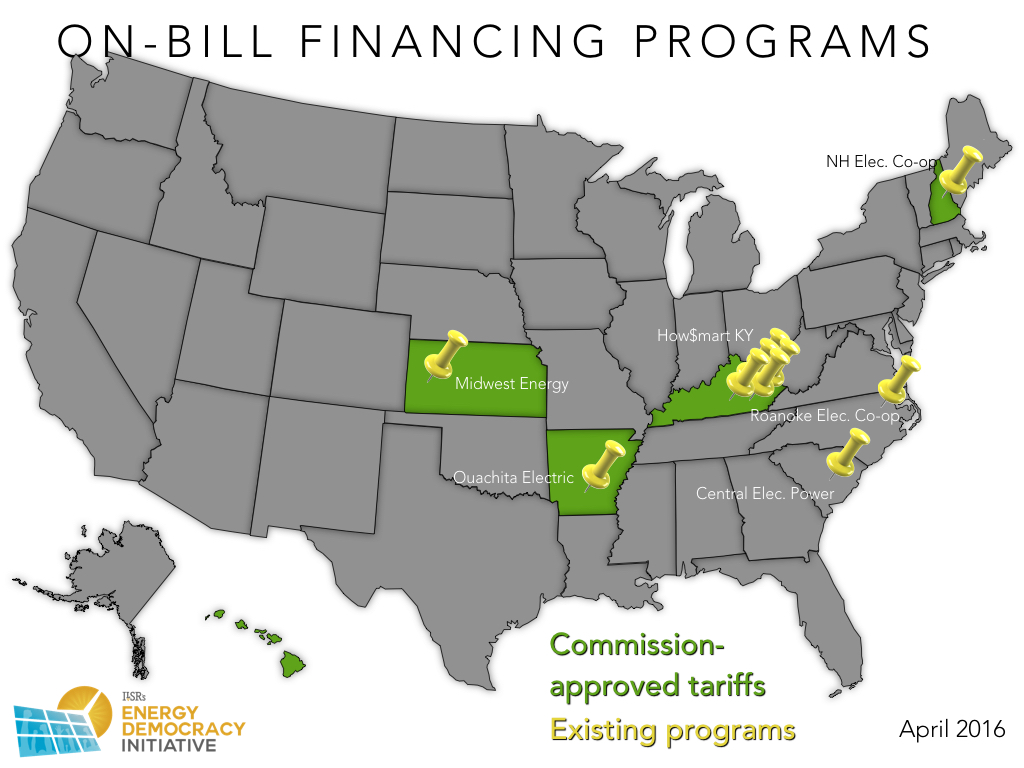

A third place for improvement (in all forms of community renewables, not limited to shared solar) is financing. Especially with early shared solar programs, participants had to pay an upfront cost from several hundred to several thousand dollars to buy a share. Even as the programs have expanded to include financing, only participants with high credit scores are able to access financing. Full deployment of community solar will require financing options that can be accessed by low- and moderate-income households. Some promising options include on-bill repayment of subscription costs via the utility bill, which have much lower default rates than consumer loans, or institutional anchor tenants for community solar projects that are committed to claiming subscriptions of participants who fall short on payments.

Despite having a heavy reliance on large-scale fossil fuel generation, rural electric cooperatives have been much more likely to experiment with community solar and tools like on-bill financing to allow member participation. The following map shows active on-bill financing programs, almost entirely provided by rural electric cooperatives.

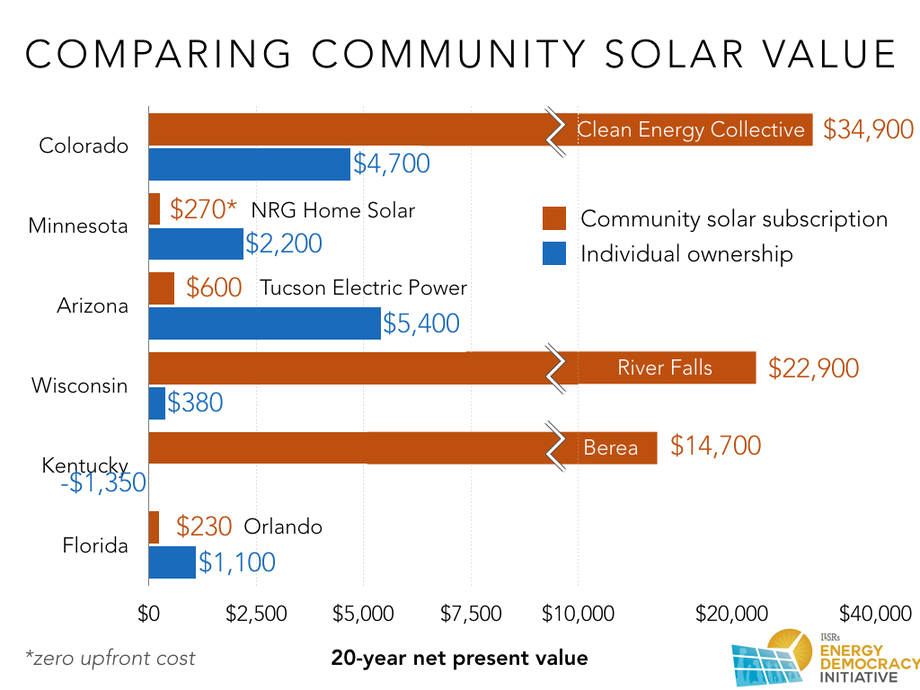

A final issue for shared solar is transparency of participant costs and benefits. Early program and project designs vary widely, leading to wide variance in financial benefits. The following chart compares the 20-year benefits of a 5-kilowatt community solar subscription (top bar of each set, in orange) to a comparable 5-kilowatt customer-owned solar array on their property (bottom bar, in blue).

Utility sponsored programs in Arizona (Tucson Electric Power) and Florida (Orlando Public Utilities Commission) create very modest savings, and are less lucrative than an individual having solar on their own roof. In the case of Tucson, the financial benefit is basically a roof rental fee from the utility, far less than the value of reducing energy purchases with a rooftop solar array. In Orlando, the bill credit starts out several cents lower per kilowatt-hour than the retail electricity price, costing the customer more out of pocket until the credit rises above the retail rate in approximately year 10.

In contrast, utility-offered programs by municipal utilities in Kentucky and Wisconsin both offer significant benefits over the long term. In both cases, relatively low upfront costs are offset quickly by energy savings, even though the savings rates in both cases are less than 8¢ per kilowatt-hour.

In Colorado, where third parties provide community solar, the community solar savings (from Clean Energy Collective, in this case) far outstrip individual panel ownership, because the full retail credit quickly offsets the high upfront cost. In Minnesota, a similar program structure is a strength, with bill credits actually higher than the retail rate due to the inclusion of solar renewable energy credits of 2-3¢ per kilowatt-hour. The savings from the NRG Home Solar program are smaller than for ownership over 20 years because the subscription cost escalates, potentially faster than the bill credit. But with zero upfront cost for credit-worthy customers, it may be more attractive than the modestly higher returns from having a solar-adorned roof.42

California provides an example of where “shared solar” becomes a lot like “green pricing,” where customers pay a premium for power from community solar. Part of the program is literally that, where customers will be able to green up their electricity supply from utility-owned solar arrays, but will have to pay 15 to 35% more per kilowatt-hour. For the more traditional “shared solar” model, the program is likely to be stymied by bill credits of around 8¢ per kilowatt-hour, far less than the retail electricity prices.

Ultimately, shared solar is a relatively new tool with ample opportunity to improve. Despite the relatively large number of states with programs and voluntary utility-provided programs, there are just over 100 megawatts of community solar projects online (a tiny fraction of total U.S. electric generating capacity).

Community Group Purchasing

Acting collectively doesn’t always mean collective ownership, and one successful tool has been to organize individual homeowners and businesses to buy into solar together. The “SUN” chapters of the Community Power Network, for example, organize cooperative associations of homeowners to collectively bid for solar installations on their homes, lowering prices by as much as 25%.78

The notion was pioneered by the Mt. Pleasant Solar Cooperative in Washington, DC.79 This local effort helped get solar installed on 10% percent of properties in the neighborhood, and spawned several buying cooperatives in other DC neighborhoods.80 By 2015, the Network served communities in D.C., Maryland, Virginia, and West Virginia. In total, it has aided low-cost installation of nearly 6.5 megawatts of solar for thousands of participants.81

Below is our 2013 podcast interview with Anya Schoolman from the Community Power Network.

Another example is the “Solarize” model started on the opposite coast, in Portland, OR. “The Solarize approach allows groups of homeowners or businesses to work together to collectively negotiate rates, competitively select an installer, and increase demand through a creative limited-time offer to join the campaign.”82 Solarize campaigns are now operating in California, Connecticut, Maryland, Massachusetts, New Hampshire, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Texas, Utah, Vermont, Washington, and Wisconsin.83 Several of these campaigns are government or utility sponsored and, cumulatively, the various Solarize efforts have installed over 20 megawatts of solar, at a modest price discount to individuals acting alone.84

For more information on group purchase programs, see the Solarize Guidebook published by the NW SEED in partnership with the National Renewable Energy Laboratory.85

Selling on a De-Monopolized Grid

Another possibility is that community renewable energy projects will become wholesale power providers. In this case, the community-owned project simply sells power into the competitive market, with revenue shared among participants. As more states consider de-monopolizing the distribution grid, in particular, there may be greater opportunities for sales at the local level, replacing the need to share electricity output with a simpler revenue-sharing model.

Cooperatives

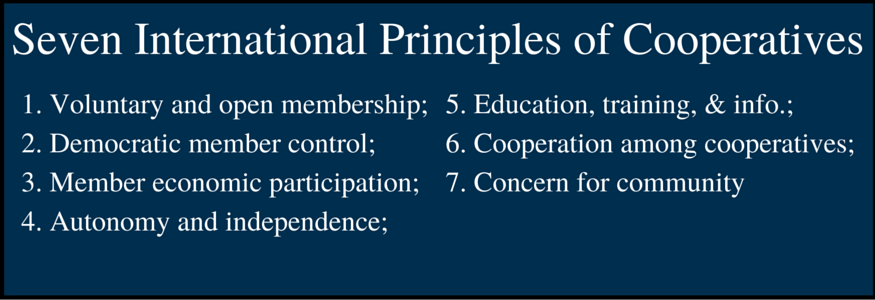

It may seem odd to distinguish between “community” and “cooperative” renewable energy projects. However, “community” can describe geographic or ethnic or simply solar-loving groups of people, whereas a cooperative is a formal legal structure with a history of democratic governance and equitable distribution of benefits.

Cooperatives are common in other economic sectors but in electricity are almost entirely represented by decades-old and conservative monopoly rural electric cooperatives. Despite this, the cooperative structure—used to first bring electricity to many communities that would have otherwise gone without—could be last century’s gift to solve this century’s problems of organizing community renewable energy projects.

There are unfortunately few examples of cooperatives in the renewable energy field. There are a few are worker-owned cooperatives, owning an enterprise that provides renewable energy services but not developing community renewable energy projects. At PV Squared, a solar installation company in the Pioneer Valley of Massachusetts, the workers make the decisions about the direction of the company and share in the profits.43 Namaste Solar is also a worker-owned energy services companies, and it is also a part of the Amicus buying cooperative (discussed below) for solar installers.44

Cooperatives can also pool their buying power for consumers or businesses. Cooperative Community Energy is a member-owned solar and energy services company in California. Members get access to bulk discounts on hardware, the cooperative lobbies for more favorable policy, and members get a dividend check if the cooperative turns a profit.45 The Acorn Renewable Energy Cooperative in Vermont provides bulk purchase benefits on a variety of renewable resources, including wood chips, heat pumps, and solar.46 Amicus Solar is a cooperative of dozens of solar installation companies, giving them a collective purchasing power that can compete with the largest installers in the country, without having to merge companies.47 Cooperative Energy Futures is a small, for-profit cooperative in Minneapolis that has organized households to provide energy efficiency and solar energy services with bulk purchasing.48 In 2014, they began offering a solar leasing program and in 2016 they plan to offer their first community solar project under the state’s community solar program.

In many European countries, there are hybrid electricity cooperatives where the cooperative owners are consumers of power, but also producers.

“In the 1970’s, three rural Danish families banded together and installed a wind turbine, creating the world’s first green energy co-op. Today, the 10,000-member Middelgrunden co-op owns and operates the world’s largest offshore wind farm outside Copenhagen harbour.” Overall, 80% of Danish turbines are cooperatively owned by over 150,000 families.50

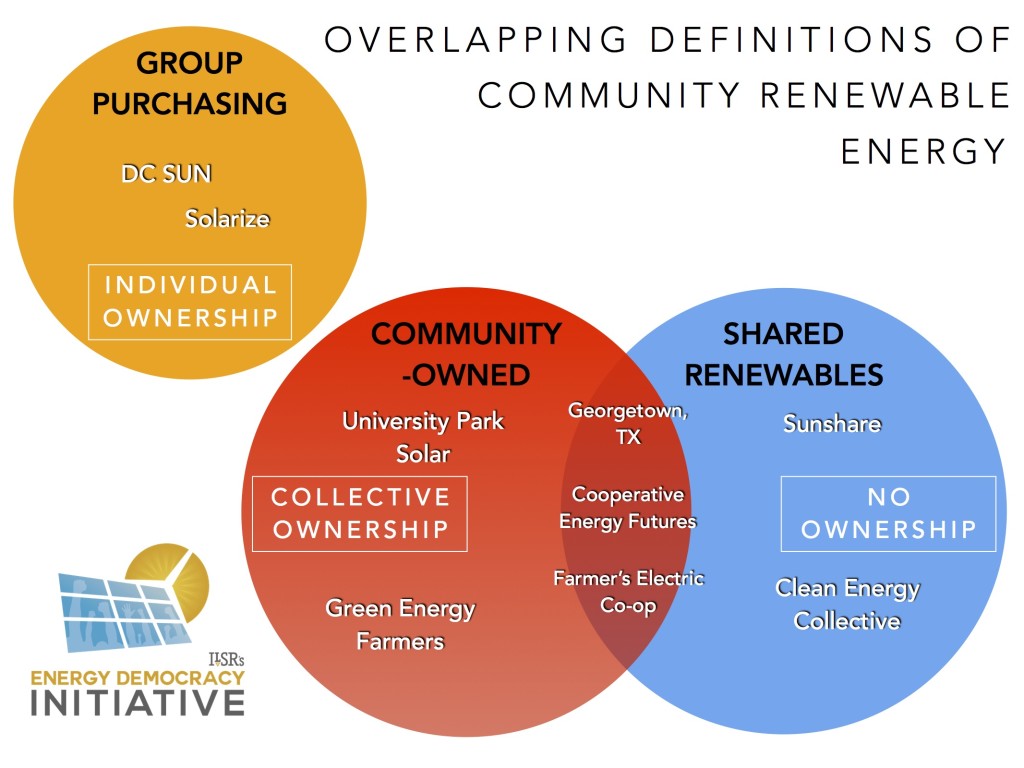

The success of wind cooperatives in Denmark is based on a history of cooperative ownership of utilities and very favorable policy. Beginning in 1979, wind projects could get a 30% capital subsidy, a policy that morphed over time into a fixed payment for production (a feed-in tariff). The fixed payments were supplemented with an income tax exemption (with tax rates exceeding 50%) for revenue from cooperatively-owned wind projects.51 In the U.S., challenges with accessing renewable energy incentives have meant most “cooperative” ownership models for renewable energy have used limited liability corporations, like MinWind.52

There are also advantages to cooperatives being used for community renewable energy. Timothy Den-Herder Thomas of Minnesota-based Cooperative Energy Futures notes that the cooperative structure can solve the securities challenges that face typical projects because they can raise unlimited amounts of capital from members. Cooperatives also don’t have to file separate securities registration, cutting the cost to raise capital by 90% or more. In his November 2015 interview with ILSR, Timothy also warned that the use of cooperatives can’t just be for the purposes of raising capital. Cooperatives can only raise capital from members, who have to be “materially involved in the cooperative…you can’t become a member just to invest.” 53

Not coincidentally, Cooperative Energy Futures is one of the first non-utility cooperatives to develop community renewable energy projects (along with Acorn Renewable Energy Cooperative in Vermont and Vineyard Power in Massachusetts).

In addition to solving securities issues, the upside of cooperatives is that they increase the potential community energy project value for participants. In the case of the Shiloh Temple project in Minneapolis (organized by Cooperative Energy Futures), member-subscribers will get electric bill credits but also dividends should the project turn a profit.54 It’s likely to, since most solar developers offering community solar projects earn a profit on the difference between subscription fees and the project cost, and member-owned Cooperative Energy Futures is both owner and developer. After project debt is retired in the first 10-15 years, the organization may have additional revenue to distribute.

Cooperatives won’t automatically solve the challenge of accessing federal tax incentives, although they are at no greater disadvantage to other typically non-taxable entities. For one, cooperatives can act as for-profits, distributing profits (and tax credits) through to members, although this would likely trigger the same passive income barrier mentioned earlier. Cooperatives could also secure a tax equity partner to absorb the tax credits, as have other non-profit organizations. In the next few years, however, the federal tax incentives will sunset, and cooperatives may prove even more advantageous in addressing the remaining barriers.

Exceptional Community Energy Projects

Despite the challenging legal and financial barriers facing community renewable energy, a surprising number of projects and project models have succeeded. These projects have brought together hundreds of people into ownership of renewable energy, often saving them money, and keeping more of the money they spend on energy in their own community.

The models range from forming independent limited liability companies to municipal ownership to donations. Unfortunately, many are not easily replicable, taking advantage of unique circumstances from now-expired incentives to pro bono legal or financial expertise. But they illustrate the many ways communities can come together to take charge of their energy future.

The following graphic illustrates the range of community renewable energy projects, on the basis of ownership, with examples drawn from the following pages.

University Park Solar is a 35-member, private limited liability company in Maryland formed to share the economic benefits of electricity production from solar panels on the University Park Church of the Brethren started with the technical assistance of Community Power Network. The 23-kilowatt solar array cost $130,000 to install in 2010, financed with the purchase of shares by the 35 members, at $1,000 apiece. Electricity from the solar array serves 100% of the church’s electricity needs, with excess sold to the grid.

University Park Solar is a 35-member, private limited liability company in Maryland formed to share the economic benefits of electricity production from solar panels on the University Park Church of the Brethren started with the technical assistance of Community Power Network. The 23-kilowatt solar array cost $130,000 to install in 2010, financed with the purchase of shares by the 35 members, at $1,000 apiece. Electricity from the solar array serves 100% of the church’s electricity needs, with excess sold to the grid.

In addition to federal and state tax incentives received at the time of construction (including a state grant), the community solar investors receive revenue from the sale of electricity to the church, to the grid, and the sale of the solar renewable energy certificates in the Maryland market (1 certificate for each megawatt-hour of electricity produced). Ongoing costs include panel maintenance, insurance, and bookkeeping. Through 2015, net of expenses, each member had recouped about 60% of their upfront investment.55

Although University Park Solar is a single project, it has inspired three other projects of similar design. Sun Harvester Community Solar LLC is a forthcoming project for an urban farm in Baltimore. It will not only generate revenue for members, but also make the farm carbon neutral.56

Greenbelt Community Solar is a 22-kilowatt solar array, producing power on the roof of and with electricity sold to the Greenbelt Baptist Church. The 34 members received nearly $11,000 from the state of Maryland and the 30% federal solar tax credit (in the form of a $34,000 grant) to reduce project costs. The project has ongoing revenue from electricity sales to the church ($3,800 in 2012) and from the sale of solar renewable energy credits in the Maryland market ($4,700 in 2012).57 Assuming a similar installed cost to University Park solar, the project will make back the upfront investment in about 10 years with electricity and credit sales.

Community Solar Thermal is unique for selling therms rather than electric kilowatt-hours. It’s a 30-member effort to offset gas use at a local restaurant, selling therms at a 10% discount to the utility’s prices to the restaurant. The purchase agreement covers 13 years, and then the project will sell the equipment to the restaurant at 10% of the original cost.58

MinWind was one of the first successful community wind projects, but also serves as a cautionary tale for community ownership. The Minnesota-based 13.5-megawatt wind project was completed in two phases, attracting over 300 mostly local investors to put up $5,000 per share.59 Ownership was limited to Minnesota residents, but diversified with at least 85% from rural areas and a cap of 15% on the ownership share of any one investor.60

The 9-turbine project (each organized as an independent LLC) benefitted from a state wind production incentive of 1.5¢ per kilowatt-hour (paid over 10 years) and U.S. Department of Agriculture grants worth $178,000 apiece for the final 7 turbines. The option to capture the federal Production Tax Credit was passed through to individual owners based on their own tax liability (although ILSR’s research suggests few would have been able to fully use it).61,62

The project successfully generated revenue for nearly a decade without major incident, but the turbines were damaged in an ice storm in 2013, and the owners didn’t immediately have the capital to complete repairs. The financial shortfall became a crisis in 2014, when the Federal Energy Regulatory Commission informed the project owners that they were delinquent on filing eight years of reports required of “qualified facilities” under the 1978 PURPA. Under threat of $1.91 million in fines, the MinWind owners filed for bankruptcy in early 2015.63

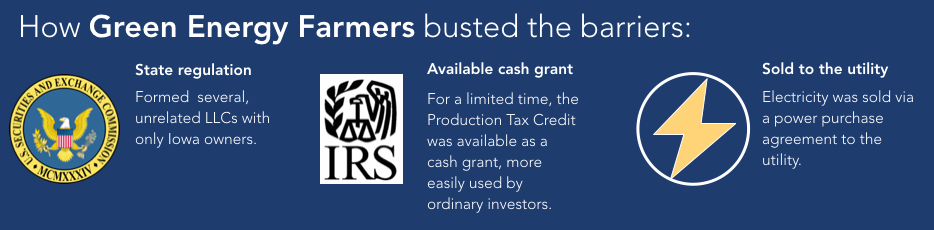

The idea for Green Energy Farmers began back in 2007, when Randy Caviness had an idea to build two wind turbines for the rural electric cooperative serving nearby Iowa farming communities. With grants from the U.S. Department of Agriculture rural development program, 10-year Iowa production tax credits, and federal tax incentives taken as a cash grant, the two turbines were built by 2010.

Seizing on a one-year extension of the cash grant program through 2011, Randy and his fellow energy farmers made plans to erect six more turbines, financed by 180 local investors. Shares in the projects were sold to friends and neighbors in the community. Most of the investors live within 30 miles of the turbines they own, and the dividends, tax-credits, and economic benefits remain in the community.

The legal work was complicated, but not insurmountable. The state tax credits were capped at 2.5 megawatts, per owner, so each of the wind turbines are financed and owned by separate LLCs. Randy, along with local banks, was instrumental in setting up the financing schematics for all eight turbines.

Each turbine provides revenue from tax incentives, land lease royalty payments, property taxes and dividends totaling $1.08 million annually over a period of 10 years.64 Unfortunately, the expiration of the federal cash grant means there are limited opportunities to replicate the projects.

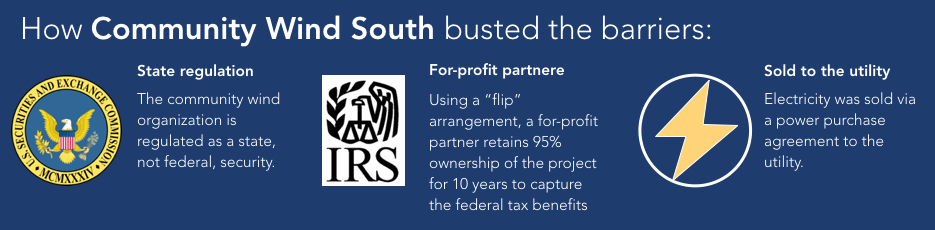

South Dakota Wind Partners took shape in the shadow of the rural cooperative Basin Electric‘s proposed wind farm near Crow Lake, SD, with local farmers and other South Dakotans interested in joining in.65 The result was a community-based carve out of the 100+ megawatt facility: 7 turbines owned by over 600 farmers and local residents, each investing $15,000 per share. The turbines were constructed as part of the larger wind farm, and the Wind Partners organization contracted with the cooperative electric utility for operations, maintenance, and purchase of the electricity.66 Like Green Energy Farmers, South Dakota Wind Partners was able to take the federal tax credits as a cash grant.

Financial ownership took two forms: an equity share allowing the investor to share tax credits, and a debt share allowing the investor a fixed rate return on investment.67 Individual investors were aided by $80,000 in early seed money from four participating organizations: the local East River Electric Cooperative, the South Dakota Corn Utilization Council, South Dakota Farm Bureau and South Dakota Farmers Union.68

At least one other community wind project has been inspired by South Dakota Wind Partners. Black Oak Wind is a proposed 16-megawatt wind project in upstate New York, and currently has over 150 investors.69

Community Wind South is a 5% community owned, 95% developer owned 30-megawatt wind project in southwestern Minnesota.73 It raised over $3 million in community capital and uses a standard flip arrangement where an outside investor holds a controlling interest for several years.

The project started in 2003, but was caught waiting for a 5-year resolution of cost allocation debate over expansion of transmission power lines for wind within the Midwest Independent System Operator. Finally, in 2011, investor Juwi purchased its share and some turbine components to make the project eligible for the expiring federal tax credit (available as a cash grant). Shares were sold to 28 landowners and nearby residents.74

Although successful, the project has faced a few challenges. Federal rules allow a clawback of the cash grant if there is too much participation from non-qualified investors. Additionally, local investors wanted specific financial benefits for the community (beyond the state’s production tax), but such benefits can’t be secured until the project flips to local ownership after year 6.

Vineyard Power Cooperative is an interesting mix of electric cooperative working to develop renewable energy in a competitive electricity market. Most electric cooperatives have a monopoly service territory within which they serve all electric customers, but Vineyard is one of several choices available to customers on the small island of Martha’s Vineyard off of Cape Code, Massachusetts. It was incorporated in 2009 and now has over 1,300 members. The difference between Vineyard and other suppliers is that Vineyard customers are also members that will elect directors of the cooperative.

The cooperative has developed about 300 kilowatts of solar projects on parking lots and capped landfills, and aspires to develop offshore wind. Like other suppliers, it can purchase power on the wholesale market when it’s own projects aren’t generating sufficient power for its customers.

City as Community

Collective ownership of renewable energy doesn’t have to be one-off or small scale. Cities have a long history of being energy providers to their residents and businesses, with over 2,000 municipal electric utilities. A few of these city-owned utilities have invested heavily in renewable energy resources.

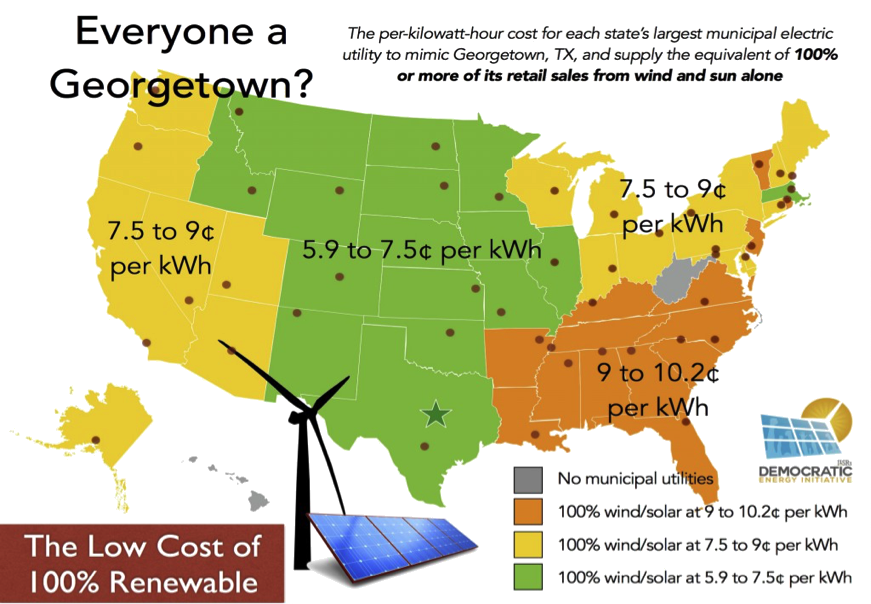

Georgetown, TX, recently made headlines when it contracted to get 100% of its electricity supply from wind and solar energy, with plans to sell excess generation to the Texas electric grid.88 The wind power will come from a share of a new wind power plant being constructed near Amarillo and the solar energy will be supplied by a new 150 MW solar project being built by SunEdison in 2016.89 Just 4 hours up I-35, the municipal utility in Denton, TX, has already reached 40% renewable energy in its supply through a 60 MW wind power project 30 miles north of town.90 In late 2015, the city announced plans to acquire part of a new solar power facility to increase the share of renewables to 70% of the electricity supply.91

The following map was inspired by Georgetown, TX, and looks at the approximate cost for municipal utilities to purchase solely wind and solar electricity for their municipal grids.92

Municipal utilities can also pool their resources to own energy generation. Currently, most municipal utilities source their energy from jointly-owned municipal power agencies (such as Wisconsin Public Power Inc. Energy) or federal power agencies (such as the Tennessee Valley Authority). Power from either is typical sourced from aging fossil fuel-fired power plants, nuclear power plants, and hydro dams. But municipal utilities can also team up to purchase renewable energy. The Berkshire Wind project, for example, is a cooperative 15-megawatt wind power project owned by a municipal power agency and 14 additional municipal utilities.93 The Kimball Wind Project near Lincoln, NE, provides 10.5 MW of wind power for the 57 communities represented by the municipal power agency.94 The Delaware Municipal Electric Corporation has installed almost half the state’s 58 megawatts of solar capacity on behalf of its municipal members, and the Indiana Municipal Power Agency has also installed several solar farms.95,96

While cities can be more responsive to local demands for renewable energy, they also operate at the same disadvantage as cooperatives, unable to use federal tax incentives for renewable energy. And although some prominent exceptions have been noted, most municipal utilities or their power agencies have procured little more clean energy than what is required by state law, despite it being very cost effective.

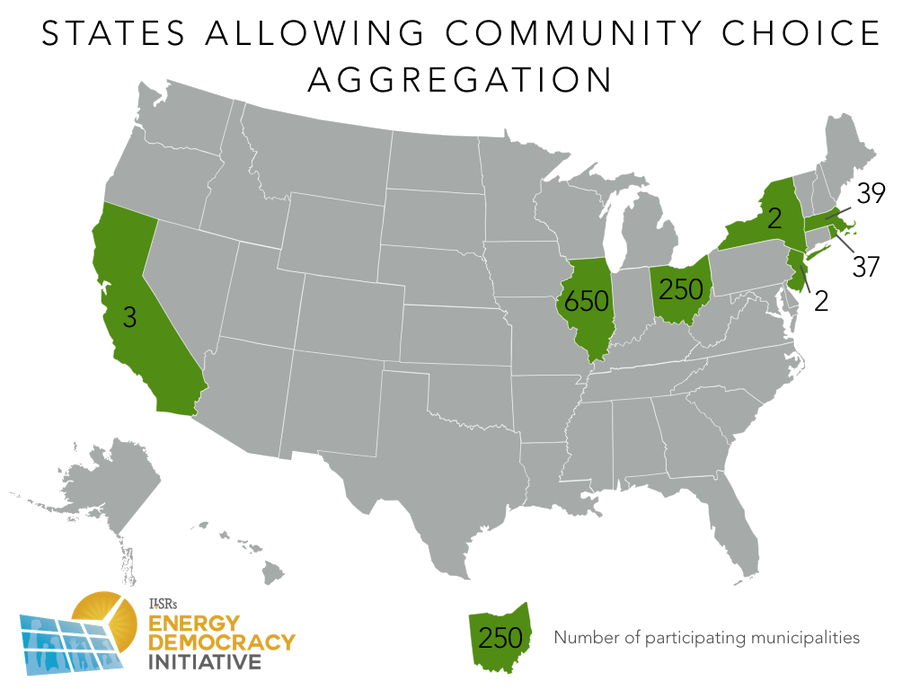

Cities without municipal utilities have to be more creative in their pursuit of clean energy. In six states (and a pilot in a seventh), a policy called community choice aggregation allows local governments (or groups of local governments) to join together to make energy purchasing decisions on behalf of residential and small business customers in their community. In practice, it means that cities can choose their energy suppliers on the basis of cost, pollution, and local economic benefits, without having to own and maintain the electric grid.

In most states, local aggregation has little to do with clean energy, but gives cities purchasing power to procure electricity at lower prices. In California, however, local energy choice is being deployed much as its forebears had hoped. Marin Clean Energy, launched in 2011 after a 10-year and multi-million-dollar battle with the incumbent electric utility.97 Through its purchasing power, the aggregation of several cities and counties north of San Francisco was able to procure electricity supply that was 27% renewable at comparable price to the half-as-renewable electricity available from incumbent Pacific Gas & Electric.98 Although a small part of its portfolio so far, the local utility is using funds from a green pricing program to help with pre-development of local solar projects, has signed contracts for several other small wholesale solar projects, and offered a solar feed-in tariff.

Sonoma Clean Power serves communities in Sonoma County, Marin’s northern neighbor. Launched in 2014 with 20,000 customers, the local utility will offer a default supply of 33% renewable electricity (50% greater than the incumbent utility) at a lower rate. The power option was made possible in part by a geothermal power plant able to provide 15% of the utility’s needs, but the utility is also offering a price premium on net metering for excess power production and a feed-in tariff to procure more local solar energy.

The city of Lancaster has plans to launch its aggregation soon, and the city of San Diego, San Francisco and Alameda County (among others) are investigating.99,100,101

Unfortunately, expansion of community choice aggregation is likely limited, as it is viewed by most electric utilities as a competitive threat. It took nearly a decade from the time the policy was authorized for Marin Clean Energy to launch its energy services, for example, due to millions of dollars incumbent Pacific Gas & Electric spent lobbying to undermine the local aggregation.

Municipalities don’t have to own a utility to develop renewable energy projects, although they may be limited by laws granting utilities exclusive rights to serve local customers. As shown in our recent Public Rooftop Revolution report, major cities in 25 states could host nearly 5 gigawatts of solar power on municipal property, at minimal cost.102 And there are several other prominent examples of municipal activity on renewable energy.

In St. Paul, MN, the city partnered with nonprofit organizations and the downtown business district to create a hot water district heating system. In the decades since the 1983 demonstration project, the system has grown, incorporated cooling as well as heating, and is now primarily powered by a steam plant fueled with urban wood waste, generating heat and electricity.103

In New Bedford, MA, the city contracted with a solar company to provide solar electricity from municipal rooftops and nearby solar arrays. The investment saves $6 to 7 million per year on electricity expenses.

In Lancaster, CA, the city similarly contracted with a third party to install 9 megawatts of solar, enough to serve electricity demands of all its schools and 90% of use for five municipal buildings. The city is also investigating forming a local energy aggregation.104

In West Union, IA, a revitalization plan for downtown included a district geothermal loop system to provide heating and cooling for commercial businesses. The city formed a separate limited liability company to manage the system, which has successfully connected about 20 businesses (of a potential 60). The company is leasing the system from the city for five years, after which the city may take control of management.105

A Community Renewable Energy Gold Standard

The wide range of structures and benefits suggests a need for core principles for community renewable energy projects. ILSR and many allies working on community solar have adopted four key principles: tangible economic benefits for participants, flexibility in project design and ownership, additive clean energy, and access to all customers.

The wide range of structures and benefits suggests a need for core principles for community renewable energy projects. ILSR and many allies working on community solar have adopted four key principles: tangible economic benefits for participants, flexibility in project design and ownership, additive clean energy, and access to all customers.

Tangible benefits mean that customers should see energy savings or profits commensurate with their level of risk and the benefits of distributed clean energy (such as fixed fuel costs and minimal losses in transmission). In Minnesota’s community solar program, for example, participants receive bill credits worth about 14¢ per kilowatt-hour, 2¢ premium more than they are paying for electricity. In Massachusetts, virtual net metering means customers subscribing to solar will get the same value in bill credits as those with a solar array on their own rooftop.

In contrast, California utilities allow customers to “subscribe” to solar projects at a premium of 15 to 35% more than they would pay for regular electricity.111 In Washington, DC, the Public Service Commission set a bill credit rate for community solar subscriptions at about half the rate folks with solar on their rooftops receive.112 These are poorly designed community energy programs.

Flexibility means that there should be many forms of project ownership, including options for and even encouragement of non-utility and community ownership.

The Additive principle means that community or shared solar programs should not be used to shift customers away from self-generation. For example, two utilities in Arizona, Tucson Electric Power and Arizona Public Service, have introduced utility-owned distributed solar programs while also lobbying the state Commission to reduce compensation for net metering customers.113

Access means that shared solar should be available to electric customers regardless of race or income. Given historical disparities, this means policy makers must require utilities and community solar market participants to make proactive efforts to reach historically marginalized customers, especially people of color and those on low-income energy assistance.

There are numerous ways to help:

- The federal government can allow energy assistance dollars to be redirected into long-term bill reduction through community solar.

- Cities, utilities, and shared solar developers can identify ways to extend financing to customers with otherwise higher credit risk, including on-bill repayment programs such as rural electric cooperatives are using for energy efficiency.

GRID Alternatives, a nonprofit organization based in Colorado, has shown how community solar can have a double benefit to low-income communities by providing jobs and energy savings for those communities. Grand Valley Power is just one of dozens of projects (comprising nearly 20 megawatts) that the organization has developed.114

Conclusion

Community renewable energy is decades old, but the opportunity for growth is now. Dramatically falling costs have made shares of clean energy projects affordable for many Americans, subscriber models have removed much of the risk, and financing has made participation easier than ever. Given the challenges, a surprising number of enterprising models have emerged for community-owned renewable energy.

The barriers are falling or being evaded. Federal tax incentives can be accessed through third parties and subscriber models. The scheduled expiration of the federal tax credits will drive more potential lenders to support development models that don’t rely on tax equity. Federal and state crowdfunding laws offer new safe harbors for community-based projects to raise capital from their neighbors. Cooperatives, popular in food and other sectors, may yet become a tool for capturing more local economic benefits of renewable energy. Municipal and local energy aggregation offers new local authority over energy purchasing, and can drive greater local ownership of renewable energy. New community solar (and potentially community renewable) policies and virtual net metering can expand access to solar for those without a sunny rooftop.

The view isn’t entirely rosy. Utilities have fought back against net metering rules and reduced compensation for solar owners, and some utility “community solar” programs seem to be a harmony to the anti-solar melody by reducing the benefits of going solar. Subscription models also reduce community control, shrinking the opportunity to use community energy projects to accomplish social goals such as quality employment for disadvantaged populations. Low-income folks still struggle to access shared renewable energy just as they have individually owned systems, and policies continue to erect financial barriers. Finally, community solar has been a stand-in for community renewable energy, which should be broadened to include all renewable energy technologies.

But community renewable energy is growing and it’s a remarkable opportunity to re-localize the economic benefits of and control over the electricity system. The policies to enable it are just beginning to grow and we have the opportunity to make sure they uphold the best principles of community-centered, community-owned, and distributed power.

Recent ILSR Publications:

Re-Member-ing the Electric Cooperative by John Farrell, Matt Grimley & Nick Stumo-Langer, March 2016

Mighty Microgrids by Matt Grimley and John Farrell, February 2016

Independent Business Report by Stacy Mitchell and Olivia Lavecchia, February 2016

SandyNet Goes Gig: A Model for Anytown, USA by Chris Mitchell, November 2015

Building Local Equity: ILSR’S Impact in 2015 by Jen Foy and Stacy Mitchell, November 2015

Hawai’i at the Energy Crossroads by Matt Grimley and John Farrell, July 2015

Comcast’s Big Gig Rip-Off by Hannah Trostle and Chris Mitchell, July 2015

Public Rooftop Revolution by John Farrell and Matt Grimley, June 2015

Beyond Utility 2.0 to Energy Democracy by John Farrell, December 2014

Walmart’s Dirt Energy Secret by Stacy Mitchell and Walter Wuthmann, November 2014

Correcting Community Fiber Fallacies by Chris Mitchell, October 2014

Walton Family Undermining Rooftop Solar by Stacy Mitchell, October 2014

Since 1974, the Institute for Local Self-Reliance (ILSR) has worked with citizen groups, governments and private businesses to extract the maximum value from local resources.

This work is licensed under a Creative Commons Attribution-Non-Commericial-ShareAlike 4.0 International License by the Institute for Local Self-Reliance. Permission is granted under a Creative Commons license to replicate and distribute this report freely for noncommercial purposes.

![]()

Photo Credit: Free Stock Photos

Appendix

Community Wind Power Estimates

Windustry reports that community wind represented over 4% of total wind power capacity in 2010, but figures after that date come from AWEA, which included utility-owned projects if the utility was a cooperative or municipal utility. Using that definition, 650 MW of community wind was added in 2011-12, 3% of the nearly 20,000 MW added in that timeframe.115 In 2014, AWEA reports 2.5% of the 4,800 MW added to the grid was community wind.116

Federal Crowdfunding Rules

The adopted federal crowd financing rules will, finally, allow:117

- An entity to raise up to $1 million per year.

- Ordinary individuals to invest $2,000 or 5% of their annual income (or net worth) in crowd financing ventures, whichever is greater.

- Wealthy individuals to invest up to 10% of their annual income or net worth, or $100,000, whichever is less.

The federal rules facilitate raising money from many “unsophisticated” investors (e.g. regular people) but still require substantial disclosure and reporting requirements. Crowdfunded projects must:118

- Provide prospective investors and the Securities and Exchange Commission (SEC) with the “offering and its business, [including] financial statements.”

- Promptly disclose to the SEC when it has raised 50% and 100% of its offering.

- File an annual report with the SEC and publish it publicly.

- Host the offering on an SEC-approved crowdfunding platform, such state-approved Michigan Funders.119

- Limit outside advertising to the terms of the offering, factual information about the project (e.g. name/address), and references to the crowdfunding platform site.

State Crowdfunding Laws

Most states follow a similar template in their crowdfunding laws, including the offering limit, benefits, and limitations. The following are typical in many state crowdfunding laws.:120

- Available for offerings under $1 million (limit varies)

- Benefits include:

- Exemption from audited financial statements (depending on offering size)

- Allowing for solicitation via internet

- Allowing non-accredited or ordinary investors (those with less than $200,000 in annual income)

- Limitations include:

- Only soliciting to investors within their state

- Collecting $10,000 or less (typically) from non-accredited investors

- Advertising only on licensed sites, e.g. CraftFund, and not on general social media

Details on crowdfunding laws in three selected states are shown below, for Michigan, Kansas, and Georgia.

Michigan’s crowdfunding law was adopted in 2013 and includes:121

- $1 million limit for businesses without audited financial statements

- $2 million limit for businesses with audited financial statements

- Non-accredited investors can put in up to $10,000. Accredited have no limits.

- Intrastate

- Must use escrow account at financial institution

Michigan also provides a guide for potential project developers.122,123

The Kansas crowdfunding law, adopted in 2011, includes:124

- Option to sell securities to accredited and non-accredited investors

- For-profits can raise up to $1 million per year

- $1000 per company limit for non-accredited investors

- Can advertise to Kansas residents

- Has only been used by 6 companies in 2 years

The Georgia crowdfunding law, also adopted in 2011, is very similar to Kansas, but with a $10,000 limit for non-accredited investors. However, like Kansas, it is rarely used, with only 6 companies tapping it in all of 2013.125

More detail on crowdfunding laws can be found at the following links for Wisconsin, Oregon, and Vermont.125,126,127,128,129,130

Common Exemptions to Federal Securities Registration

- Regulation D – Rule 506(b) and (c), and Rule 504, “private placements” or “nonpublic offering.”131

- 506(b) uses accredited investors and up to 35 non-accredited investors “so long as they have a certain amount of financial sophistication and are provided a certain disclosure document.” No advertising.

- 506(c) – Accredited only, advertising allowed.

- Rule 504 – Up to $1 million only, state requirements. General solicitation and advertising usually not permitted.

- Intrastate (Rule 147) – within state. 80% of proceeds in state. Only advertise in state. State regulations. 100% of the purchasers are residents of the state. 80% of the company’s assets are located in the state. 80% of the offering proceeds will be used on facilities within the state.

- Nonprofits – not often used.