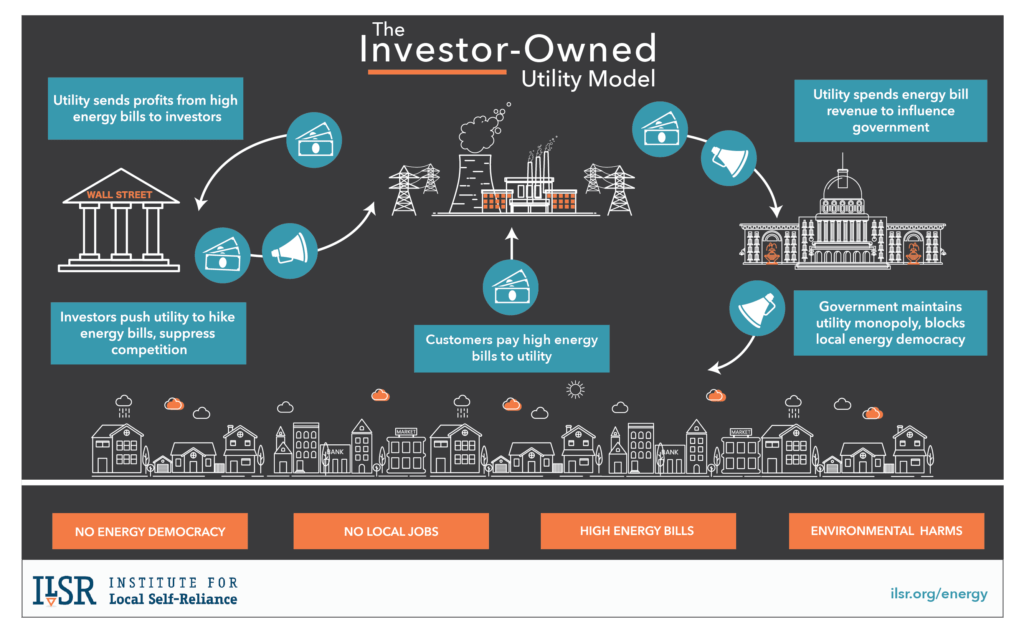

Investor-owned utilities exercise their monopoly power in a vicious circle of maximizing profits at the expense of their customers, using that money to gain political power, and then using that power to defend their monopoly and make even more money.

What is an investor-owned utility (IOU)?

An investor-owned electric utility is a for-profit company, owned by shareholders, that delivers electricity to customers. IOUs serve three-quarters of all U.S. electric customers and in most states, the government guarantees these utilities a monopoly in exchange for regulation of the rates they charge customers.

Captive customers pay for electricity delivered by the utility.

With competitors effectively banned by most state governments, investor-owned utilities get away with charging their customers high prices. Their customers have no choice but to pay up (and up, and up) for electricity, or have their power shut off. The impact of high utility bills and power shutoffs falls disproportionately on customers of color – with Black, indigenous, and Latine households paying more of their income toward energy bills and facing more shutoffs than their white counterparts.

The utility sends profits from customer bills to its investors.

Investor-owned utilities make extra-high profits by overcharging their customers – by about $20 billion or $150 per residential customer per year. The utilities then pass those profits to their shareholders, who get significantly higher returns on their investment than they could expect from most other low-risk industries.

Investors push the utility to hike energy bills and suppress competition.

Chasing ever-higher returns for their shareholders, investor-owned utilities are incentivized to maximize profits by overcharging customers, under-investing in energy efficiency, and crushing competitors. Although state and federal governments are supposed to tightly regulate utility rates and energy markets, investor-owned utilities marshal huge resources to overwhelm, mislead, and outright bribe lawmakers into doing their bidding.

The utility spends revenue from customer bills to influence lawmakers.

Investor-owned utilities use revenue from customer bills to influence state and federal lawmakers via a combination of campaign contributions, lobbying, politically-motivated charitable donations, and illegal bribes. In the past decade, utilities donated $130 million to federal candidates and spent $294 million on statewide races and ballot initiatives. Investor-owned utility executives have been found guilty in multi-million dollar bribery scandals in multiple states, and utilities have been ordered to pay billions in fines and regulatory penalties.

The government – state and federal – enforces the monopoly for the utility.

Influenced by investor-owned utility lobbying, donations, and bribes, state and federal legislators and regulators have repeatedly made rules and taken actions that erect barriers to entry for utility competitors and protect utility profits. Even in response to disastrous negligence and criminal behavior, no regulator has ever revoked a utility’s monopoly status.

This article originally posted at ilsr.org. For timely updates, follow John Farrell on Twitter or get the Energy Democracy weekly update.

Featured photo credit: iStock