I am loathe to engage in lists, but year-end is a good time for reflection on big changes in the energy world. Plus, this beats the alternative of showing photos of cats in Christmas outfits, trying to co-opt a meme of baby Yoda, or just posting links to ILSR’s top 10 energy things. Here are three things we saw as big stories in 2019 and implications for 2020.

1. The Bankruptcy of Pacific Gas & Electric

To the casual observer or even bankers, it was wildfire-induced liabilities that drove one of the country’s largest electric utilities to its knees. But this bankruptcy has several fascinating story arcs:

- It highlights the ongoing issue with the market incentives of regulated monopoly utility companies. Once again, an investor-owned utility cut spending on basic maintenance to boost investor profits. Unlike most cases of favoring profits over people, this one came back to bite the shareholder, big time. To paraphrase someone famous, we can’t expect this market model to produce different results with the same rules for profits.

- It highlights the power of meaningful competition. Just after the utility’s last bankruptcy, in 2002, the California legislature empowered communities to get out from under the monopoly thumb by building local procurement agencies. Nearly 25 percent of the state’s customers are served by these community choice aggregations, and it could rise to 50 percent by the end of 2020. These local power programs are building more renewable energy and staying competitive on price, as well as serving many other public goods from community representation to local jobs. (Note: ILSR is releasing a major report on the power of community choice as a monopoly utility alternative in January)

- It opens the door to change. The utility is bankrupt, providing a unique opportunity to buy the grid infrastructure at “fire sale” prices. As it has demonstrated leadership in many other energy strategies, California has an opportunity to model what a “grid as commons” rather than “grid as shareholder asset” might look like. A few possibilities: robust data aggregation and sharing with distributed energy service providers, competition to meet grid needs with non-infrastructure strategies, robust investment in upkeep, maintenance, and resiliency. For more on this concept, check out the proposed Distributed Energy Resources Authority in D.C.

What to look for in 2020: Bankrupt shareholder-owned utilities are an enormous opportunity to restructure the electricity system and disperse the economic opportunities far beyond Wall Street. But the structural changes coming from the utility bankruptcy in California could have far-reaching implications for competition in electricity markets in many other states with monopoly utilities.

2. The Evidence of a Coming Gas Flame Out

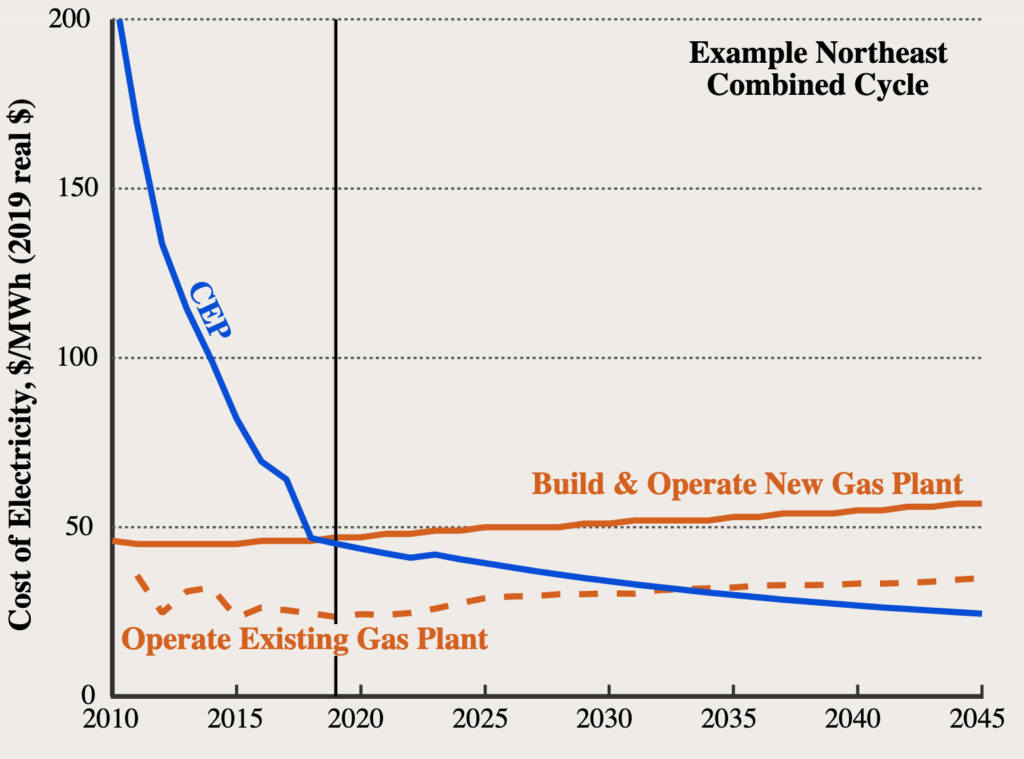

Last year, we released a report called Reverse Power Flow that helped document the financial challenges that distributed energy presented to new and existing fossil fuel power plants. This year, Rocky Mountain Institute put their substantial intellectual weight behind the analysis with The Growing Market for Clean Energy Portfolios. Bottom line: few gas power plants operating in 2035 will be financially feasible compared to “clean energy portfolios:” optimized combinations of wind, solar, energy storage, and demand-side management. The following chart illustrates.

More evidence for this comes from scattered regulatory denials of gas plants. A moratorium in Arizona halted new large-scale gas plant deployment. Regulators in Minnesota unanimously denied a utility the purchase of an existing gas plant.

A key connection between this gas flame out and the Pacific Gas & Electric bankruptcy? With the coal phaseout, many regulated utilities were looking to gas plants as a way to keep their asset base large. The more power plants they own, the higher the investor returns. With gas plants unlikely to pay off, state regulators will require a lot more lobbying to allow them to enter the rate base.

What to look for in 2020: Where will asset-hungry utilities go next? Renewable energy. In Michigan, Consumers Energy released a landmark resource plan that forecasts only additions of energy efficiency, demand response, and renewable energy through 2040. But it also anticipates dropping purchases of clean energy from third parties in favor of utility ownership. In states passing clean energy laws, utilities are eager to help if they can lock in ownership of the wind and solar assets. Colorado’s clean energy mandate (Senate Bill 19-236) virtually guarantees utility ownership of half of all new clean energy assets. New Mexico’s clean energy bill allows the utility to own all replacement power for dirty energy that’s retired.

3. Cities Are Flexing Their Energy Muscles

Over 100 U.S. cities have made a commitment to reach 100% renewable energy. Some have already achieved the goal, others are pushing hard in that direction (listen to several stories in ILSR’s Voices of 100% podcast series). What leverage do cities have?

- In nearly any state, they can take over the incumbent utility with the power of eminent domain. Even if it takes a while (see: Boulder, Colo.), this power can be leveraged for local energy benefits.

- In many states, cities have franchise agreements with utilities. Cities can use these negotiations to push their utility companies to provide more clean energy.

- Cities often have the power of permitting, and they are using it to limit expansion of the gas network and require all-electric buildings.

- Cities have taxing power, and have used it on electric bills or taxed large retail businesses to fund local clean energy efforts.

- In nine states, cities can use community choice aggregation to take charge of electricity (and sometimes gas) purchasing on behalf of residents, using the bulk buying power to get more renewable energy, and more.

What to look for in 2020: Cities will demonstrate how fast we can take action on climate change better than states, and they work across electricity, gas, transportation, and building sectors. In particular, cities can confront gas use in another venue: local distribution networks for space and water heating. Expect big things!

This article originally posted at ilsr.org. For timely updates, follow John Farrell on Twitter, our energy work on Facebook, or sign up to get the Energy Democracy weekly update.

Featured Photo Credit: Reeding Lessons via Flickr (modified by John Farrell)