A few enterprising U.S. cities have found an unexpected source of revenue for supporting local renewable energy and climate action. Buried in most customers’ electric and gas bills, there’s an obscure line item often overlooked: it’s called a “franchise fee.”

In most states, cities may assess franchise fees on electric and gas utility bills within their boundaries. Fees are assessed on the bills of customers of private companies, not usually customers of cooperatives or city-owned utilities. Typically, a franchise fee recoups the cost of the utility companies’ use of public space––also called public “right-of-way”––for energy infrastructure such as power lines or gas pipelines.

In recent years, cities have considered using utility franchise fee revenue for activities to reduce energy use and promote renewable energy.

A 2017 news story from the Norman Transcript newspaper in Oklahoma explains how franchise contracts work, in general.

Can Your City Use Franchise Fees?

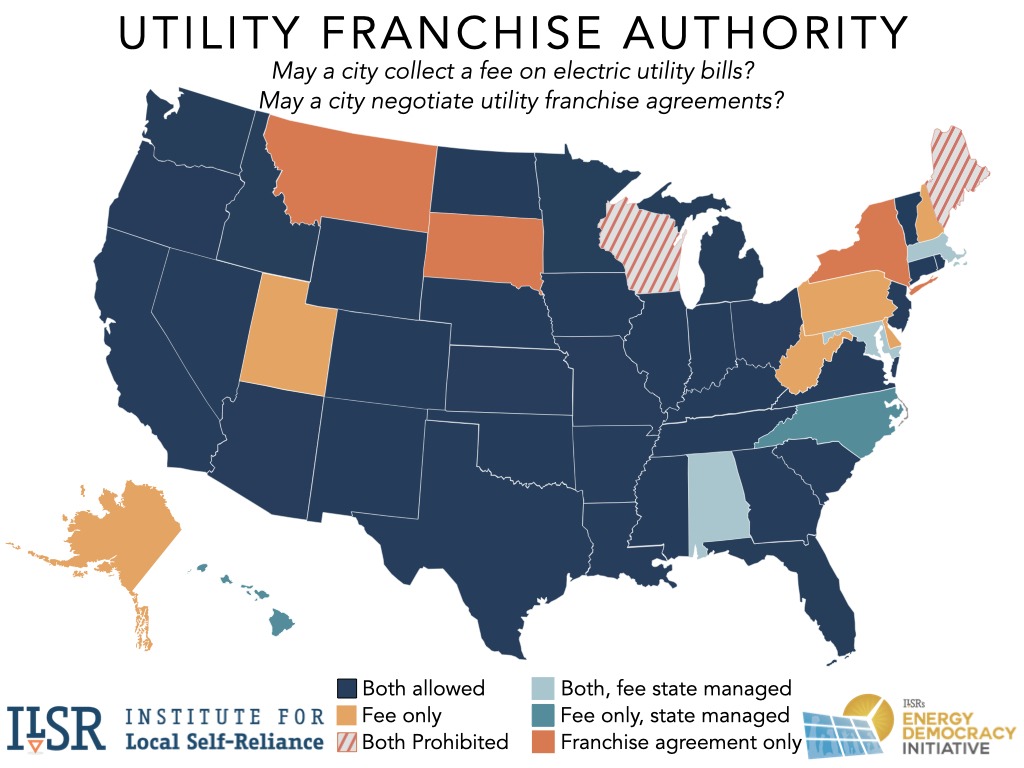

The American Public Works Association has published a guide for cities to identify their public right-of-way powers and how to implement a franchise agreement. ILSR has compiled a map, below, showing which states allow cities to assess franchise fees on utility bills (for links to sources, by state, scroll to the bottom). The map shows states where cities can have franchise fees and whether they have the authority to set the fee.The updated map below shows data for all states, concluding that franchise fees are allowed in 45 states. Franchise fees can be set at the city level in 40 states, at the state level in 5 states, and are prohibited in 5 states.

Cities in 40 states have the ability to pursue franchise agreements, with 10 states either excluded from this option (due to majority public utility or state management) or prohibited from doing so. Cities may be prohibited or excluded from pursuing franchise agreements, but are still able to set franchise fees. For instance, Tennessee and Nebraska both have the authority to assess franchise fees, but because their states are constituted by majority public utility, they are less likely to do so.

States in the dark blue allow cities to manage their own franchise agreements and set franchise fees. States in the light orange do not allow cities to manage their own franchise agreement but do allow cities to set the franchise fee. States in orange stripes do not allow cities to manage franchise agreements and franchise fees. States in the light blue allow cities to manage their own franchise agreements, but the state sets the franchise fee. States in the teal blue do not allow cities to manage their own franchise agreements, and the fee is set at the state level. Lastly, states in the dark orange do not allow franchise fees but do allow cities to manage their own franchise agreements.

How Cities Can Creatively Use Franchise Fees

A recent evaluation of over 3,500 cities by the National Renewable Energy Lab has revealed that over 3,200 have franchise agreements. Of those, 57 of the cities surveyed have a goal of reaching 100% renewable energy and 75 of the franchise agreements refer to renewable energy. For instance, the City of Dunnellon, Fla. used its franchise agreement to prevent Duke Energy from instituting limits on developing renewable energy and selling that energy back to the utility. The City of Alamosa, Colo. (with a handful of other Colorado cities) used its franchise agreement to set baseline expectations for both city and utility climate goals. Minneapolis, Minn., Salt Lake City, Utah, Denver, Colo., and more are going even further by using franchise agreements with their electric utility to create clean energy partnerships. Their franchise fees fund a substantial portion of cities’ climate and energy efforts.

Minneapolis, Minn., stands out as the most innovative user of the franchise fee in recent years. As its existing franchise contract with private, monopoly electric and gas companies Xcel Energy and Centerpoint Energy wound down in 2013, the city began an exploration of its legal options to accomplish Climate Action and local energy goals. In an “Energy Pathways” study (summary slideshow), the city explored the leverage of forming its own, city-owned utility (testing the sway of the “birch rod,” as President Franklin D. Roosevelt famously called the flexing of local authority in his 1932 “Portland Speech”).

In this 2014 blog post, ILSR discussed how cities like Minneapolis, Minn., or Edmonton, Alberta, could use franchise fees to support clean energy development. This post describes how a city used its franchise contract negotiations to advance its Climate Action Plan.

Instead of forming its own utility, the city opted to sign a new franchise contract and in doing so created a novel Clean Energy Partnership with its incumbent utilities establishing a shared commitment to meet the city’s climate and energy goals. The Partnership includes two representatives from each entity (two city council members, and two staff from each utility). In 2017, the city increased its existing franchise fee on utility customers by 0.5 percent, directing the fee revenue toward initiatives to reduce energy bills and greenhouse gas emissions of the city’s residents and businesses.

City franchise fee revenues in Minneapolis have been used as partially matching grants for energy improvements for residential or commercial customers, to buy down loans for customers in “Green Zones” (with lower-than-average household income), and to try novel methods of community engagement.

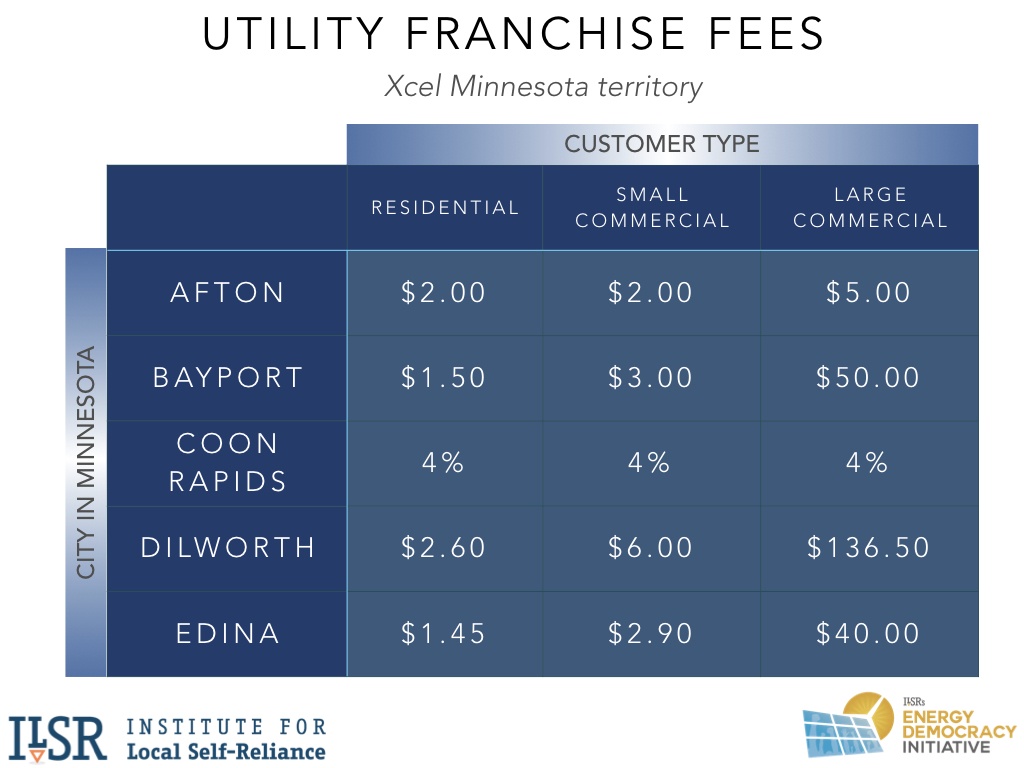

While Minneapolis stands out for its directed use of a franchise fee increase toward clean energy goals, the city is not alone in assessing a franchise fee. In Xcel Energy’s Minnesota territory alone, over 60 cities assess franchise fees on electricity customers. Some cities assess a flat fee, ranging from $1.00 to $4.00 per month per residential customer, and others use a percentage of the electric bill, ranging from 1.5 to 5 percent. A sample taken from Xcel Minnesota’s rate book is shown below:

Other Midwest cities also assess franchise fees, including over 150 Iowa communities, according to the Iowa Utility Association. Many Illinois communities have received free electricity or gas for city operations in lieu of payments.

Similar to the clean energy partnership pioneered by Minneapolis, Minn., Salt Lake City, Utah has incorporated clean energy goals into its franchise agreement. While the city does not assess franchise fees, both Salt Lake City Corporation and Rocky Mountain Power signed on to the city’s Joint Clean Energy Cooperation Statement in their franchise agreement. The joint venture establishes a cooperative relationship between the city and utility in achieving the city’s goal of 100% renewable energy by 2032. The city and the utility plan to work together on demand response, energy storage, renewable energy projects, energy efficiency, and other initiatives designed to help the city reach its clean energy and energy efficiency goals.

Three Models for Franchise Fees (Mostly Midwest)

A 2009 report for the U.S. Environmental Protection Agency looked at franchise agreements and fees charged in Upper Midwest cities. The fee structures fall into three categories (in some cities, multiple categories apply):

- Cities that do not charge a fee because:

- The utility is publicly owned;

- The municipality opts not to charge a fee; or

- The municipality receives free utilities in lieu of a fee.

- Cities that do charge a fee, structured as:

- An annual, fixed fee;

- A one-time application fee; or

- An annual fee based on gross sales.

- Cities that provide the utility a tax break on utility infrastructure (poles, conductors, wires, etc) in addition to franchise rights

In ILSR’s nationwide research, it anecdotally seemed that most cities levying franchise fees used model #2.

Other Franchise Powers

The 2009 study also noted that only one city (of those studied)––Ann Arbor, Mich.––had a franchise agreement including provisions for renewable energy. In particular, the franchise required the utility to provide at least 10% renewable energy by the fifth and final year of the contract. ILSR was unable to find an example franchise agreement from any other city with a similar provision. Unfortunately, fees charged by monopoly utilities on third parties and changes to Michigan state law invalidated Ann Arbor’s franchise agreement, and no fees have been collected in several years.

States may limit the power of localities to pursue such goals via a franchise, however. When Minneapolis negotiated its franchise contract renewals in 2014, for example, state law precluded including similar requirements in the contract.

How Can Franchise Fees Help Climate and Energy Efforts?

If a city retains powers like Ann Arbor, it may be able to directly negotiate clean energy outcomes with its utility. If not, the city can identify ways to spend its franchise fee revenue to boost local climate efforts.

While far from exhaustive, the following list covers several tools cities have deployed (or could deploy) with funds generated by franchise fees to help residents and businesses cut energy costs and tap the local economic benefits of clean energy:

- Reduce the cost of clean energy with direct subsidies, matching grants, loan subsidies, or subsidized home energy assessments.

- Expand use of utility energy efficiency and renewable energy programs through community engagement initiatives, particularly focused on communities that are underserved, such as people of color, immigrant communities, or renters.

- Expand access to money upfront for energy improvements by reducing perceived lender risk with inclusive financing mechanisms, such as a loan-loss reserve or loan interest-rate buydown.

- Increase coordination of city departments on energy-related activities, such as combining rental licensing or home inspections with opportunities for energy services.

- Improve understanding of the equity of utility energy programs by gathering data on both energy poverty in city neighborhoods and who existing programs reach or serve.

- Examine city databases such as building permits to identify buildings that have aging energy appliances, such as furnaces, to target with programs for efficient upgrades.

- Map building rooftops to allow residents and businesses to see if their building is suitable for solar energy.

Thousands of cities have the ability to leverage their franchise agreement negotiations into clean energy commitments from their electric utility. They can use franchise fees to fund new projects related to renewable energy, energy storage, and more. Cities interested in flexing their franchise fee muscle should search their state laws to identify the extent of their franchise authority.

For more information, check out this blog post on franchise fees as an oft-overlooked strategy, or this one telling the story of Minneapolis using its franchise contracts for leverage, or this press release about the franchise fee increase in Minneapolis. For other city-level tools to advance local, clean energy, see ILSR’s interactive Community Power Toolkit. For more information on which states grant cities and communities more authority over their energy future, see ILSR’s Community Power Map.

Sources for Franchise Fee Map

Franchise fees are collected in Indiana, Michigan, Ohio, Colorado, Wyoming, North Dakota, Idaho, Utah, California, Oregon, Washington, Nevada, Arizona, New Mexico, Oklahoma, Kansas, Texas, Missouri, Arkansas, Louisiana, Kentucky, Virginia, West Virginia, Georgia, New Jersey, Tennessee, Mississippi, Florida, South Carolina, Delaware, Rhode Island, Alaska, Nebraska, Pennsylvania, Vermont, New Hampshire, Massachusetts, Connecticut, Illinois, and Iowa.

Fees are also collected, but set at the state level in Alabama, North Carolina, Maryland, Massachusetts, and Hawaii.

Franchise fees are not allowed in Wisconsin, Montana, South Dakota, Maine, or New York (looks like a special property tax instead).

Photo credit: Jeremy Brooks via Flickr