Key Links:

Download: Executive Summary

Download: Full Report

View: video and slides from the webinar

Listen: a series of paired podcast episodes about electric vehicles…

Executive Summary

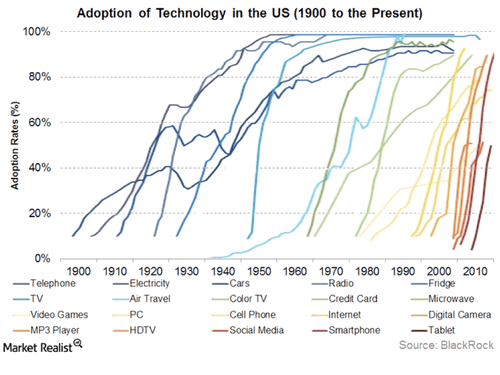

The U.S. vehicle market will undergo a massive technology disruption from electric vehicles in the coming decades. Many analysts see the potential for surging sales of these efficient vehicles to enable smart grid management, but few have explored the local impact of electric vehicles: promoting energy democracy. Electric vehicles offer a natural use for solar energy, a pathway to pump more local solar power onto the grid, and a source of resilient power when the grid goes down. Ultimately, electric vehicles are another tool to miniaturize the electricity system, providing unprecedented local control.

The imminent transformation requires immediate attention to policy and planning. Electric utilities typically produce 15-year or longer “resource plans” to map out additions of new power plants and power lines that will last for decades. But electric vehicles may have an impact much sooner than the 40-year lifetime of these traditional resources, or even the 15-year timeframe of resources plans. The rising numbers of electric cars on U.S. roads may impact utility plans well within their current planning horizon. The time for action is now.

Surging Electric Vehicle Sales

Surging Electric Vehicle Sales

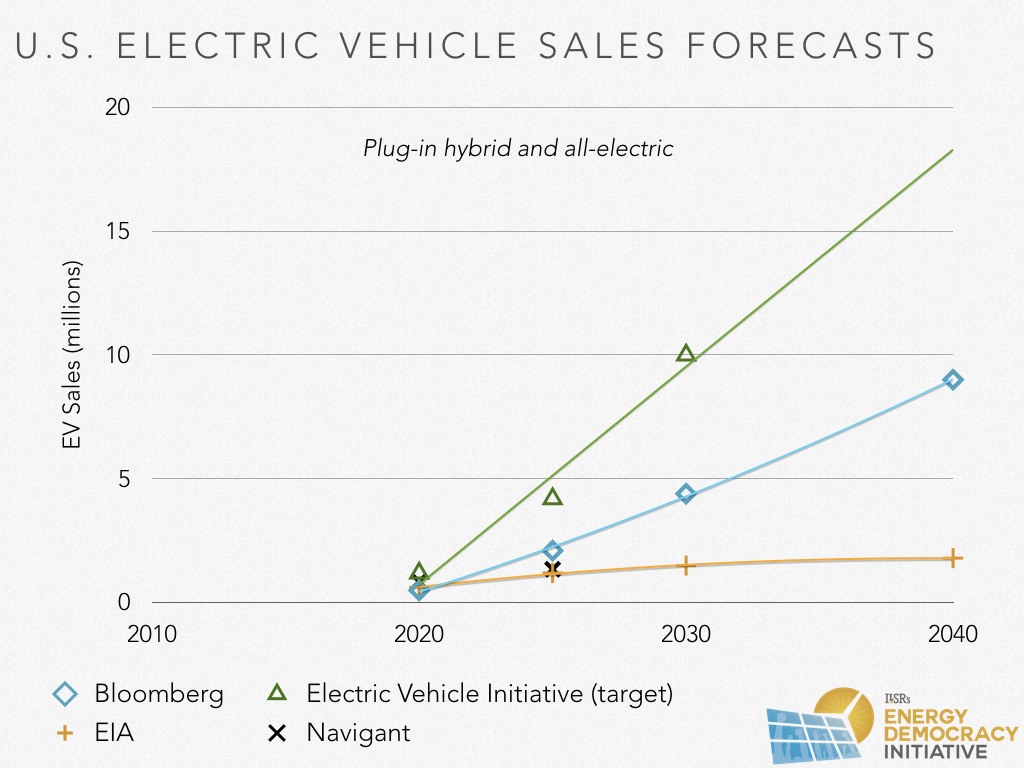

With sales rising rapidly as range expands and costs fall, many forecasters expect significant deployment of electric vehicles by 2040. Electric grid managers will have to account for the impact of transportation electrification and accommodate a wide range of vehicle adoption forecasts.

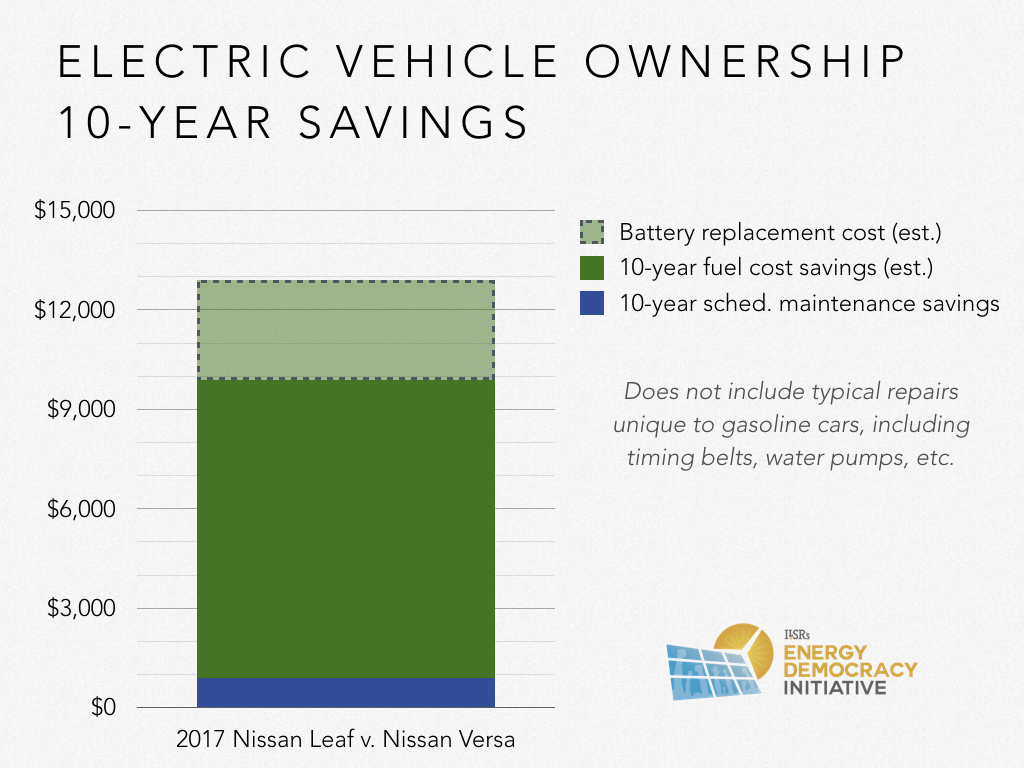

Prospective car buyers will also consider the long-term opportunity, as the total cost of electric vehicle ownership becomes comparable to gas-powered cars. Already, avoided scheduled maintenance and fuel costs are likely to save electric car drivers as much as $10,000 compared with owning a comparable internal combustion vehicle.

Making the Grid More Efficient

Making the Grid More Efficient

As a large new source of electricity demand, electric vehicles can cut transportation-related pollution and give grid managers unprecedented ability to make the electricity system more efficient.

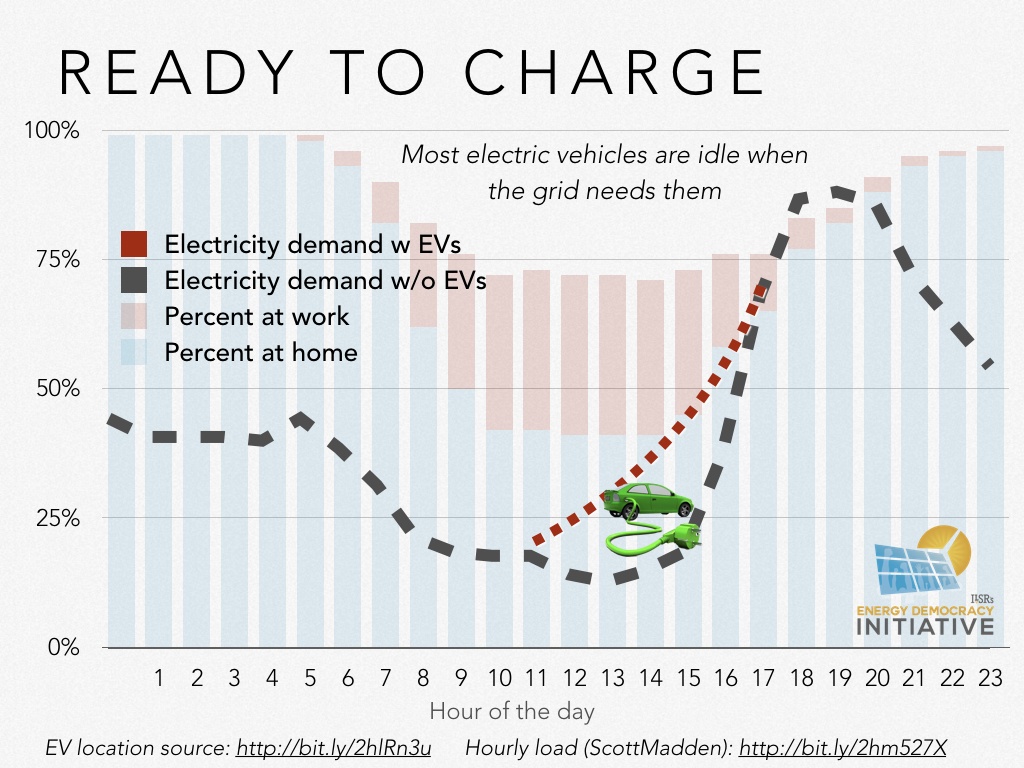

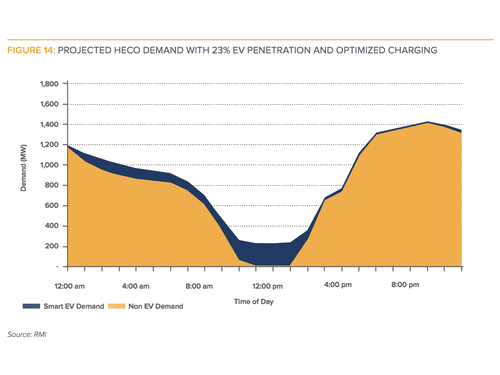

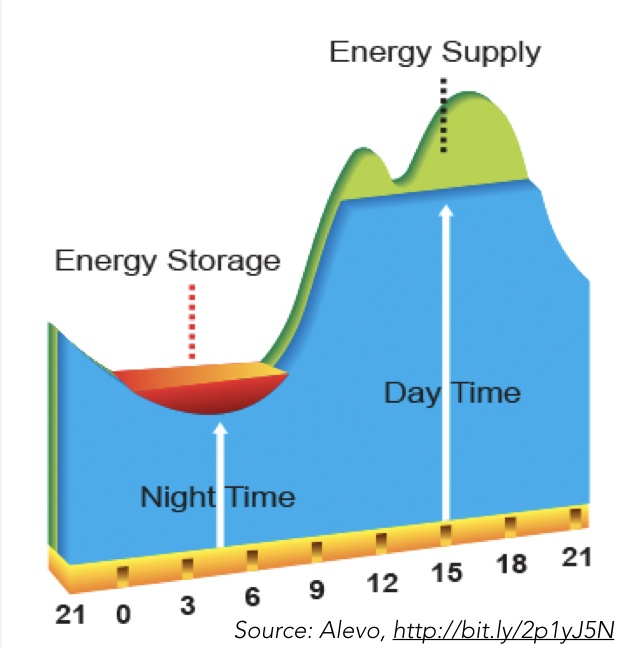

Timed charging of electric vehicles means afternoon surges in electricity demand can be smoothed out (shown right) by steadily increasing demand from electric cars.

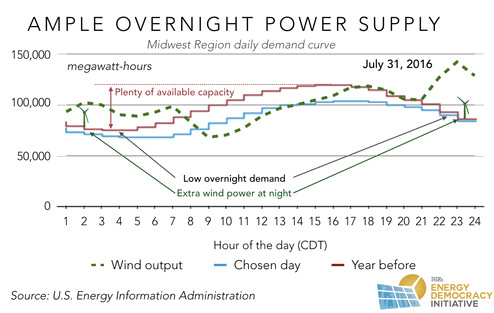

Additionally, electric cars can soak up excess energy supply by charging overnight to absorb surplus wind energy, as shown in the following chart from the Midwest Independent System Operator.

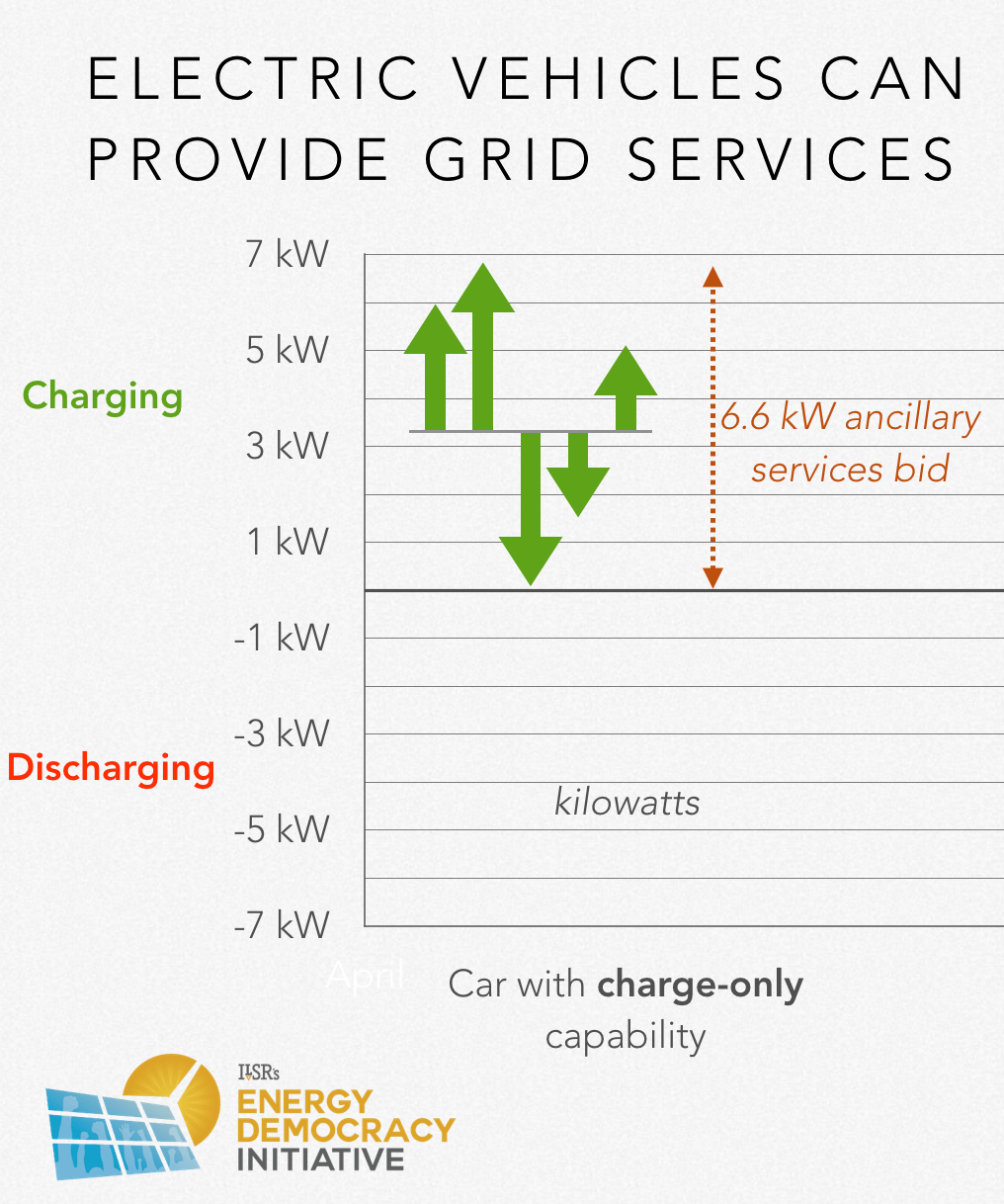

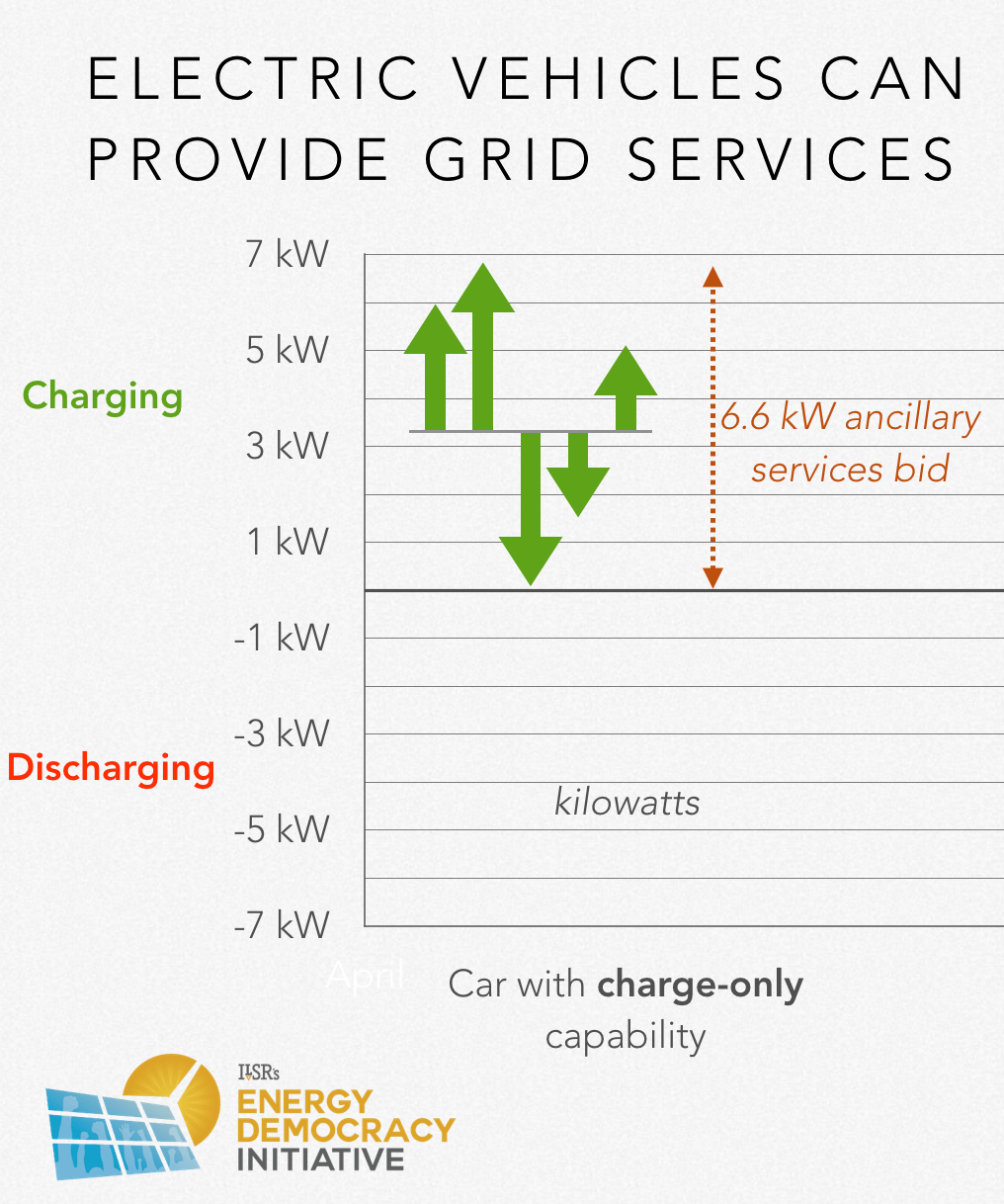

Finally, electric cars can support the basic balancing act of the grid by adjusting their charging levels second-to-second in order to maintain a steady voltage and frequency (a practice called “ancillary services”). Taking advantage of this power will require new market rules, but vehicles with nothing more than a Level 2 charger could provide valuable services to the grid, often able to respond more quickly than than existing power sources.

Finally, electric cars can support the basic balancing act of the grid by adjusting their charging levels second-to-second in order to maintain a steady voltage and frequency (a practice called “ancillary services”). Taking advantage of this power will require new market rules, but vehicles with nothing more than a Level 2 charger could provide valuable services to the grid, often able to respond more quickly than than existing power sources.

Enabling Energy Democracy

Electric vehicles can crucially expand the opportunity and capacity for local energy production and resiliency. Like solar, electric cars are a conspicuous way to burnish an owner’s environmental or self-reliance bona fides and to save money. But the combination of the “sexy electrics” — solar and electric cars — is also a marriage of complementary technologies, an increasingly inexpensive power source and a flexible power user. Individuals can fuel their vehicle using sun from their rooftop. Communities can generate more solar locally by putting more of that power to use at home, to power vehicles. The following graphic illustrates how electric vehicles could absorb daytime solar energy, enabling more homes and businesses to go solar without requiring grid upgrades.

Finally, electric vehicles can provide resilient power to communities under threat of severe weather or natural disasters, since today’s electric vehicles already have enough battery power to run an average American home for 24 hours.

Getting the Right Rules

The power of electric cars won’t flow automatically, but instead requires the proper rules to expand and refine charging infrastructure, charging policies and prices to incentivize grid-friendly behavior, and incentives for access that ensure all Americans (car owners or not) can benefit from transportation electrification. ILSR’s recommendations are below:

Infrastructure

- Utilities should finance private chargers and invest in public charging networks based on future revenue from sales of electricity to power vehicles (and/or implement inclusive, tariff-based on-bill financing). Regulators should ensure choice and competition in charging hardware for private and public chargers.

- Public charging infrastructure should be well distributed geographically and equitably, especially in areas where private parking and charging is less available, such as near multi-family housing and business districts.

- Cities should allow residents and businesses to use Property Assessed Clean Energy (PACE) financing for electric vehicle charging hardware, and also lead by example by electrifying fleet vehicles and providing public access to fleet charging stations.

Charging

- Utilities should offer charging plans that include substantial discounts for charging during off-peak hours or absorbing excess renewable energy supply.

- Utilities should lower barriers (such as hardware and installation costs) to accessing discounted charging programs.

- Utilities, charger manufacturers, and automakers should harmonize technology to allow for vehicle charging to follow and accommodate renewable energy supply.

- Cities should work with utilities and car dealers to offer bundled solar and electric vehicle purchases, and deploy policies to support on-site charging from solar.

Incentives and Access

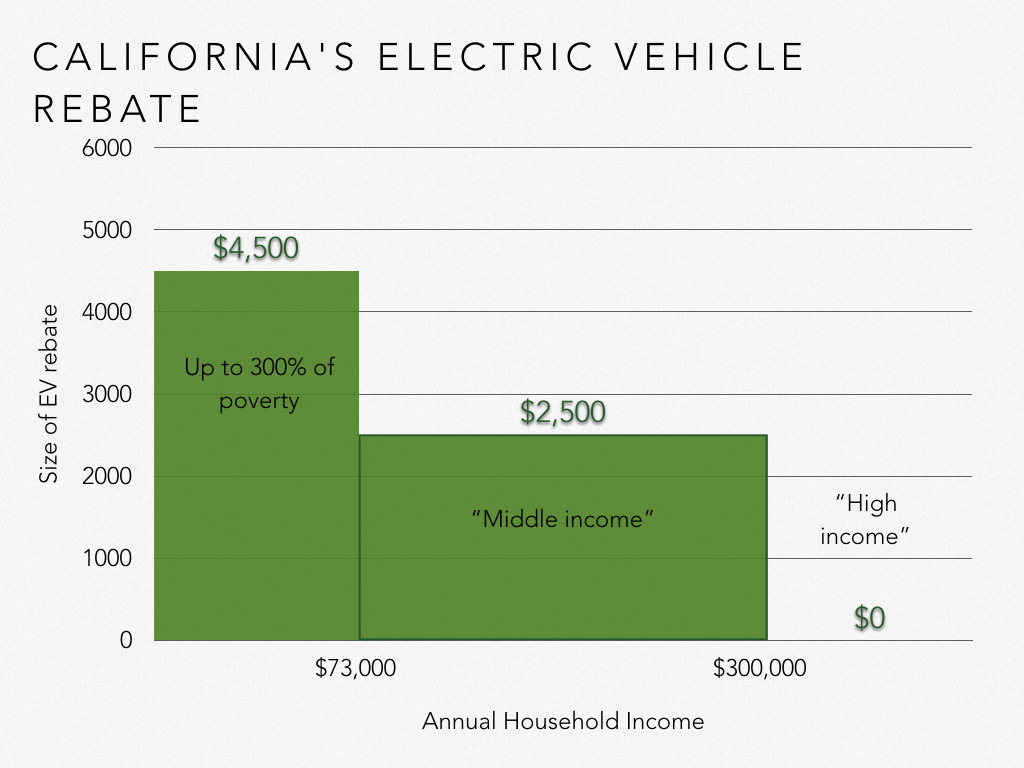

- Electric vehicle incentives should be means-tested.

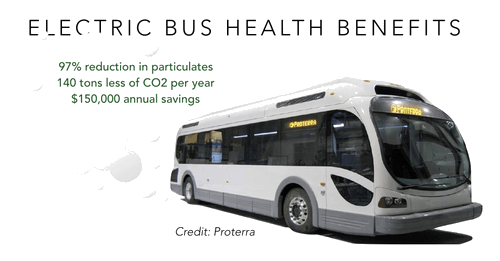

- Car-sharing and transit systems should be electrified due to widespread health and environmental benefits.

Introduction

Electric cars aren’t new.

At the dawn of the U.S. auto industry in the late 1800s, electric vehicles outsold all other types of cars. By 1900, electric autos accounted for one-third of all vehicles on U.S. roadways. Of the 4,192 vehicles produced in the U.S. and tallied in the 1900 census, 1,575 were electric.

Electric vehicles sales remained strong in the following decade and provided a launchpad for fledgling automakers, including Oldsmobile and Porsche, that would go on to become industry titans. Even Henry Ford partnered with Thomas Edison to explore electric vehicle technology. Battery-powered models, considered fast and reliable, sparked a major transportation renaissance.

Electric vehicles sales remained strong in the following decade and provided a launchpad for fledgling automakers, including Oldsmobile and Porsche, that would go on to become industry titans. Even Henry Ford partnered with Thomas Edison to explore electric vehicle technology. Battery-powered models, considered fast and reliable, sparked a major transportation renaissance.

But the momentum shifted over the first few decades of the 20th century, as the electric starter supplanted hand-cranking to start gas engines. The prices of those models dropped. A network of inter-city roadways enabled drivers to travel farther — more easily done in those days in gas-powered vehicles — and the discovery of domestic crude oil made gasoline cheaper.

The internal combustion engine gained a superiority that would persist for decades.

Nearly 100 years later, a second wave of electric vehicles arrived, driven by California’s zero-emissions vehicle policy in the late 1990s. Unfortunately, it faltered. The enthusiasm of electric vehicle owners couldn’t overcome the reluctance of cash-flush automakers to invest in alternatives to gas-powered vehicles. Automakers also mounted successful lobbying efforts to weaken the zero-emissions vehicle policy. In 1999, General Motors ended production of its own promising electric vehicle, the EV1, after just three years. The automaker removed all 1,100 models from the roads, despite outcry from their drivers. It blamed its pivot away from electric vehicle technology on the EV1’s 100-mile range and the high cost of development compared to sales. Oil giants, still powerful political lobbies, also opposed electric vehicle innovation.

However, the undermining of all-electric cars laid the groundwork for today’s innovation. Hybrid electric cars like the Honda Insight and Toyota Prius — with a small battery-powered electric motor assisting the gasoline engine — became the preferred answer to California’s modified low-emission program, and sales grew steadily. Other hybrid models followed.

Now, nearly two decades later and 120 years after its introduction, the electric car is making an unmistakable comeback. This time, it’s aided by better technology as well as environmentally sensitive consumers and policymakers looking to supplant fossil fuel use with renewable electricity.

Absent smart planning, adding tens of thousands of new electric vehicles to the grid could make grid operations more costly. But electric vehicles also represent a transformational opportunity. By optimizing when vehicles are charged, they can soak up excess nighttime electricity supply or extra renewable energy. Electric car batteries can increase the capacity of local grids to absorb more wind and solar power. They allow for further decentralization of power generation, and of the ownership of that power generation, than ever before.

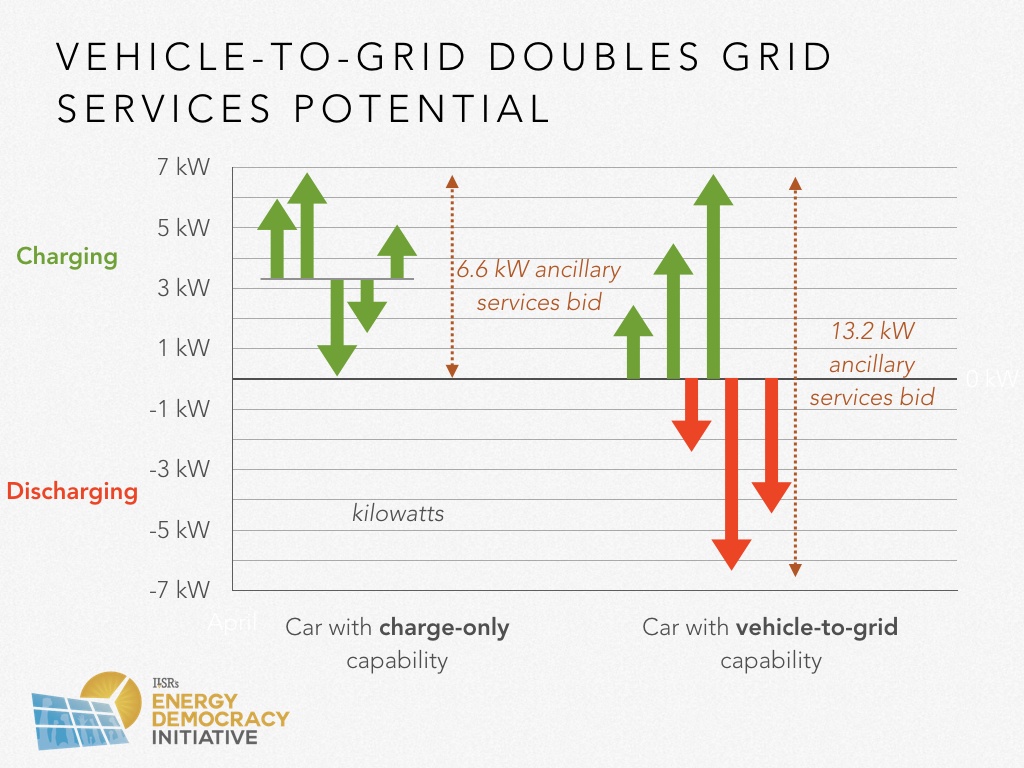

These opportunities can be enhanced by vehicle-to-grid (V2G) technology, which allows electric cars and the grid to exchange energy. This two-way relationship is still under development, but a car with a 30 kilowatt-hour battery — like the 2017 Nissan Leaf — stores as much electricity as the average U.S. household consumes in one day.

This report explores how electric vehicles will compete with gasoline-powered cars and the widespread implications beyond transportation. It shows how electric vehicles can stave off an electricity sales slump, bolster renewable generation, and make the grid more efficient and resilient. In addition, this report also explores how electric vehicles can move the U.S. toward energy democracy — decentralizing and distributing local power generation, and the ownership of the energy system.

[RETURN TO TOP]

Electric Vehicles Going Mainstream

Sales of electric cars are growing. Technology improvements in the new millennium have solved the shortcomings of earlier models, providing longer ranges, improved battery technology, and competitive pricing. Juiced by favorable federal, state, and local policies as well as the increasingly positive image of electric vehicle ownership, the electric-drive tide is rising.

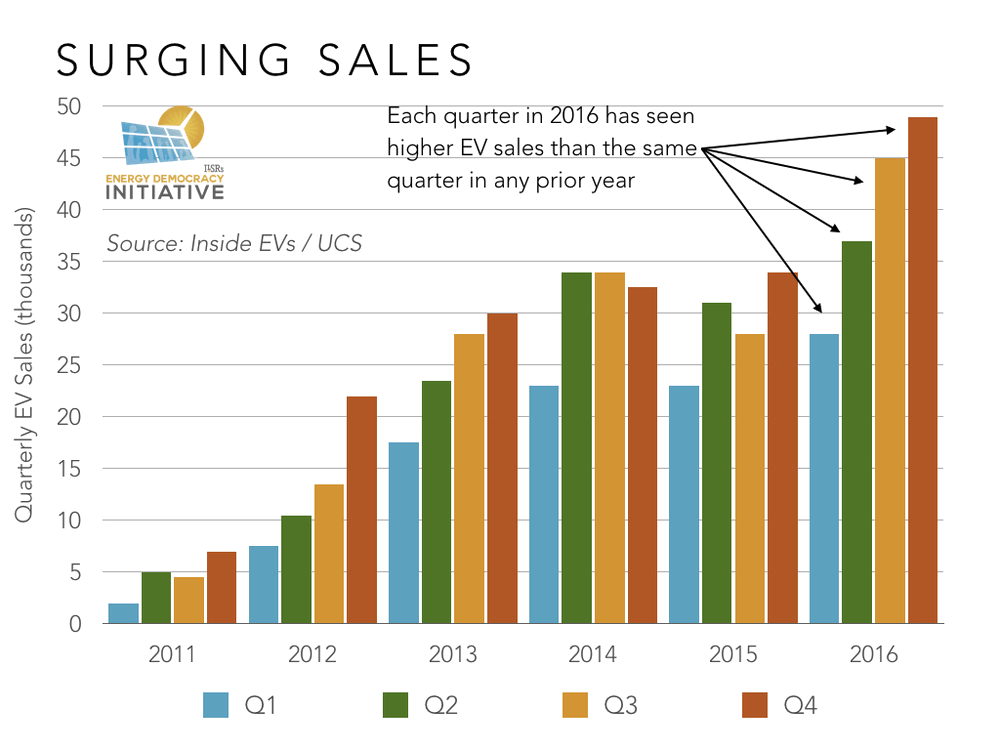

In just the first quarter of 2011, for example, more electric cars were sold than General Motors leased throughout the entire 1990s. In 2016, U.S. auto dealers recorded 158,000 plug-in vehicle sales — up more than 30 percent from 2015. The trend shows no signs of stopping, especially as more sophisticated production technology drives down vehicle costs, and even as automakers continue to advertise their non-electric models far more often.

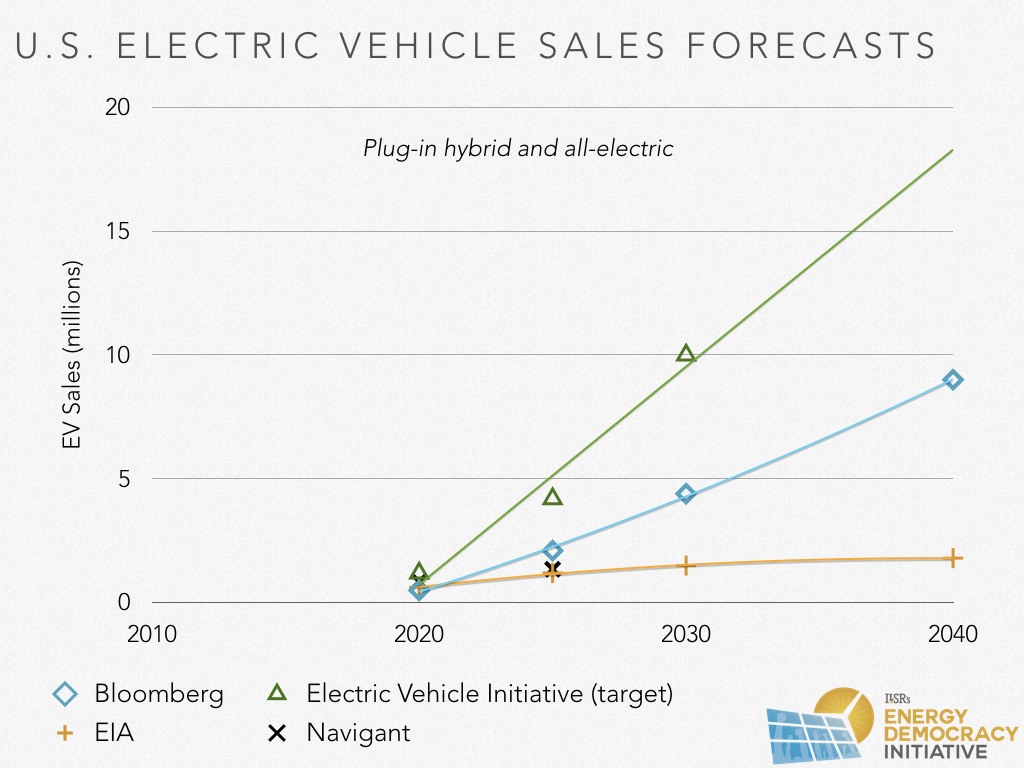

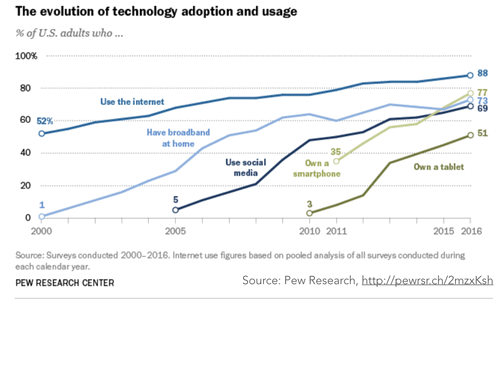

Buoyed by cost-competitiveness, many forecasts show electric vehicle sales ramping up. Bloomberg New Energy Finance expects electric vehicles to comprise 35 percent of global auto sales worldwide by 2040. Other forecasts vary widely. The chart below shows various projections or targets set by four different organizations.

If electric cars penetrate the global marketplace as deeply as Bloomberg predicts, they would displace demand for 13 million barrels of crude oil per day (over 13% of worldwide use) while using 2,700 terawatt-hours of electricity — equal to 11 percent of global electricity demand in 2015.

Bloomberg New Energy Finance expects electric vehicles to comprise 35 percent of global auto sales worldwide by 2040. If they penetrate the global marketplace that deeply, they would displace demand for 13 million barrels of crude oil per day (over 13% of global use).

An Innovation Hotspot

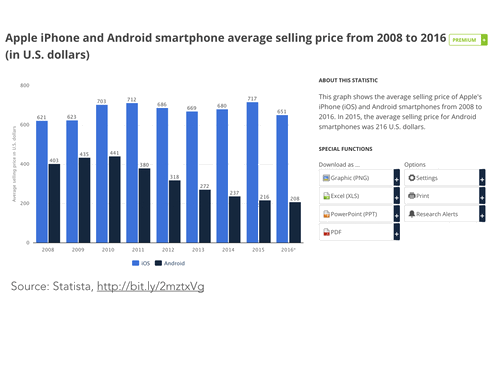

Despite being the most prominent electric vehicle manufacturer, Tesla is not the only player looking to cash in on electric car technology. A healthy growth outlook for the industry has lured multiple technology companies into the space alongside many traditional auto manufacturers.

Tech giant Apple spent more on its electric vehicle research and development than all major automakers, according to a May 2016 report by Morgan Stanley analysts. At that time, the company had outspent even Tesla by more than 10 to 1, and invested more in its budding vehicle business than it had on the Apple Watch, iPad, and iPhone combined. Although it has since changed course to focus on vehicle software, the company had planned to release an electric vehicle by 2019.

The following sections illustrate the factors behind the recent and forecast growth in electric vehicles.

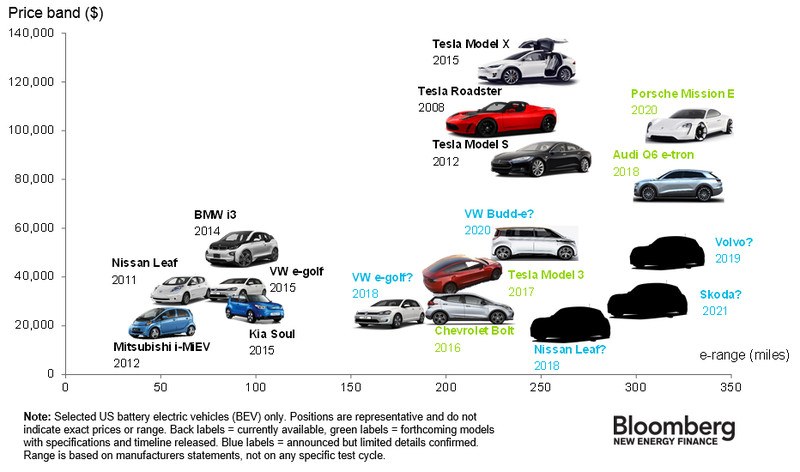

Range Concerns Diminishing

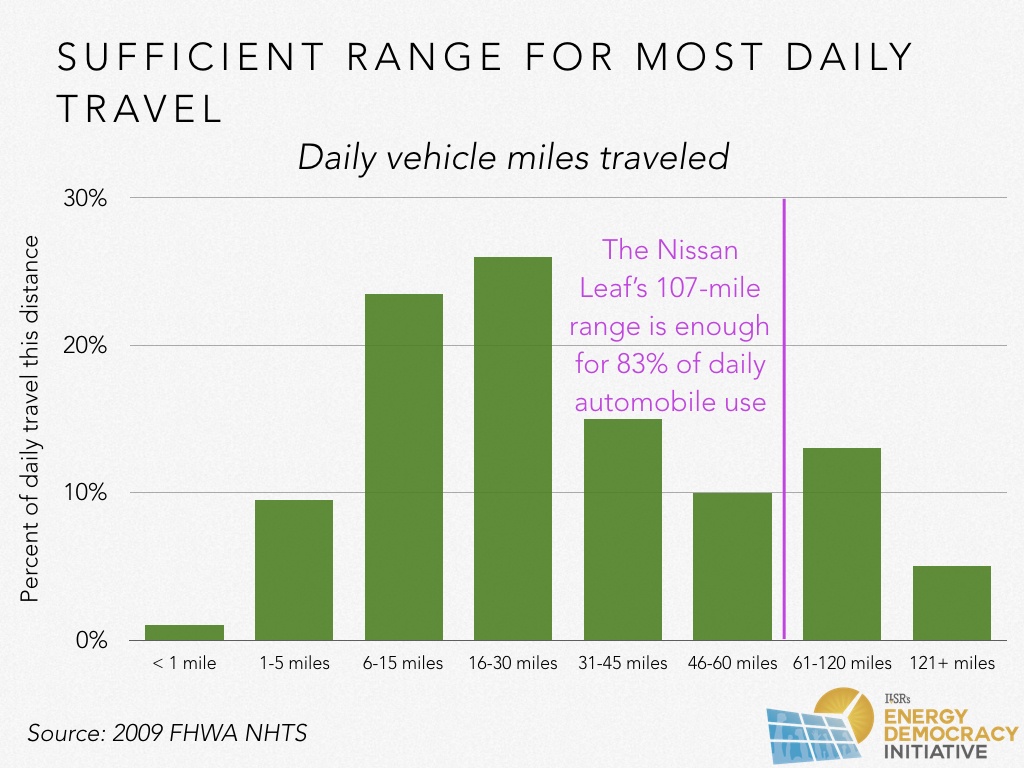

Today’s electric vehicles would generally need more frequent fueling than gasoline cars if home or workplace charging were not possible. The 2017 Nissan Leaf, a popular battery-powered vehicle, can travel up to 107 miles on a single charge in optimal conditions.

While the Leaf covers much less ground than the 350-400 miles offered by a single tank of gasoline in other vehicles, it already satisfies most drivers’ daily needs (Americans cover an average of 29 miles per day and a median of just 10 miles). Eighty-three percent of Americans’ daily auto travel covered less than 60 miles, according to a periodic government survey of driving habits last conducted in 2009.

With today’s electric vehicles already able to cover most drivers’ daily travel needs, and generally able to refuel completely each night, the extended range of next-generation electric cars will all but eliminate the issue of “range anxiety.” A recent test drive of a pre-production Chevy Bolt found it exceeded the EPA-listed range of 238 miles on a drive along the California coast. Cross-country travel may still require fewer stops with a gas-powered car in 2020, but too few Americans routinely travel long distance to sufficiently affect the overall adoption of electric vehicles in the near term.

The following graphic (taken from this Vox piece) illustrates the evolution in the next two to three years.

Falling Cost of Ownership

With operational differences diminishing, electric vehicles are also approaching price parity with gasoline cars. The trend is driven by falling component and total vehicle costs, in addition to lower operations and maintenance costs.

Better Battery Prices Make Electric Cars Competitive

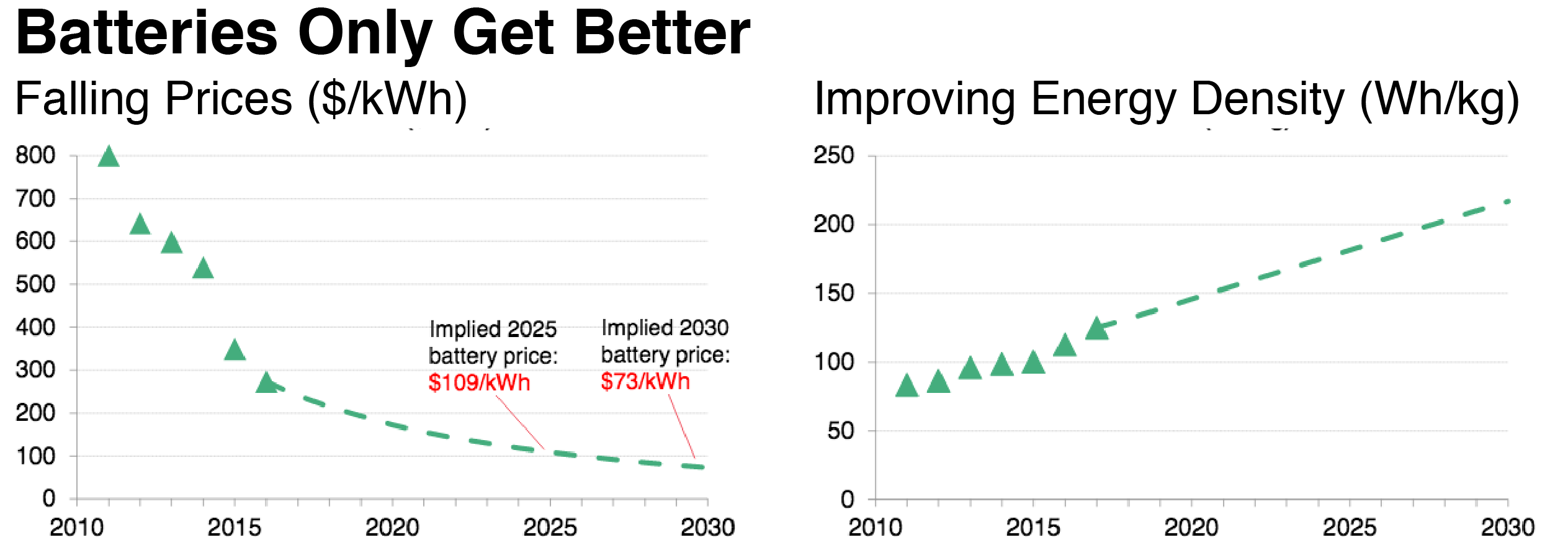

The sunny forecast for electric vehicles comes as the cost of their batteries falls. The price of lithium-ion battery packs — typically comprising one-third of a vehicle’s cost — dipped an average of 8% each year between 2007 and 2017. Battery prices dropped 35% last year alone, compounding steep reductions logged in the previous years.

Battery prices dropped 35 percent last year alone.

The trend is slated to continue, with battery packs expected to cost just one-quarter of their 2010 price by 2022, a shift that by itself reduces the price of electric vehicles by about 25%. The following chart shows the forecast steep declines in battery costs, albeit at a slower pace than the previous five years.

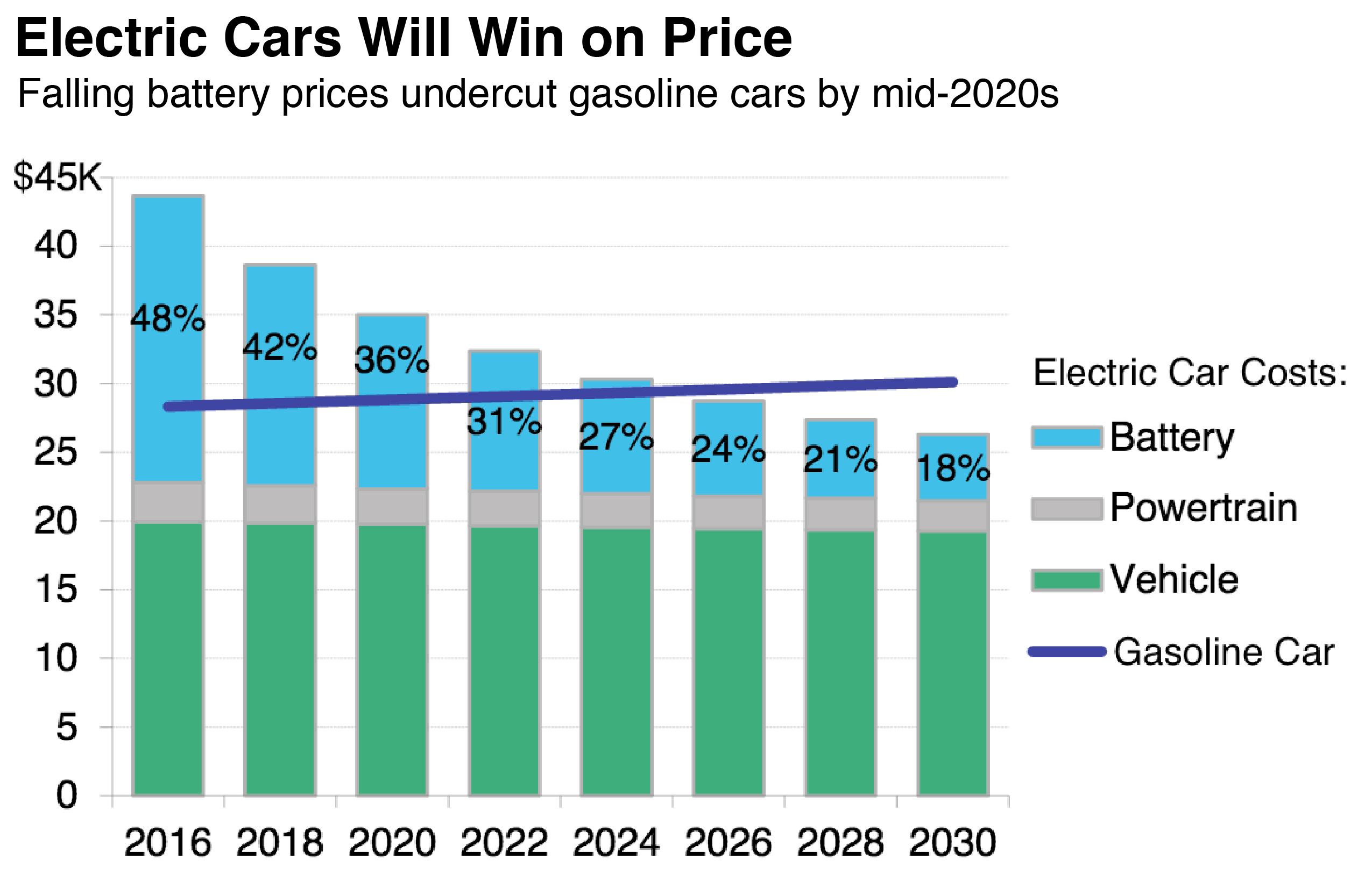

The shrinking battery costs lead Bloomberg to forecast that electric cars will undercut gasoline cars on price by the mid-2020s.

Tesla’s Supercharged Role

As the sole electric-only car company, Tesla leads electric car manufacturing and is in hot pursuit of less expensive batteries for its models. Based on research conducted at its first-of-its-kind Gigafactory, Tesla aims to maximize efficiency in battery production to shave down costs. From 2008 to 2015, Tesla halved the cost of its battery packs despite expanding energy capacity by roughly 60 percent in the same span. This combination of lower costs and significantly more capacity means the relative cost savings on a kilowatt-hour basis are greater than if the company’s battery innovation either reduced costs or increased capacity alone.

Tesla’s scale makes it an outsized player in battery development. Because Tesla holds a larger share of the U.S. electric vehicle market than any other company — 20 percent in 2016, in addition to supplying batteries for other automakers (including for Toyota’s RAV4) — its battery costs likely influence the overall marketplace in a significant way. With increasing scale for Tesla, and other car manufacturers, battery costs are expected to continue falling rapidly.

Sticker Price v. Cost of Ownership

By the 2020s, electric vehicles may be more economical than gasoline or diesel cars in many countries. But the purchasing shift may come even sooner.

A study from the International Energy Agency in 2013 suggested that the ownership cost of an electric vehicle (including fuel and maintenance, not just the sticker price) would break even with ownership expenses for traditional cars when battery cost dropped to $300 per kWh of storage capacity. Top battery manufacturers had already hit that mark by 2016.

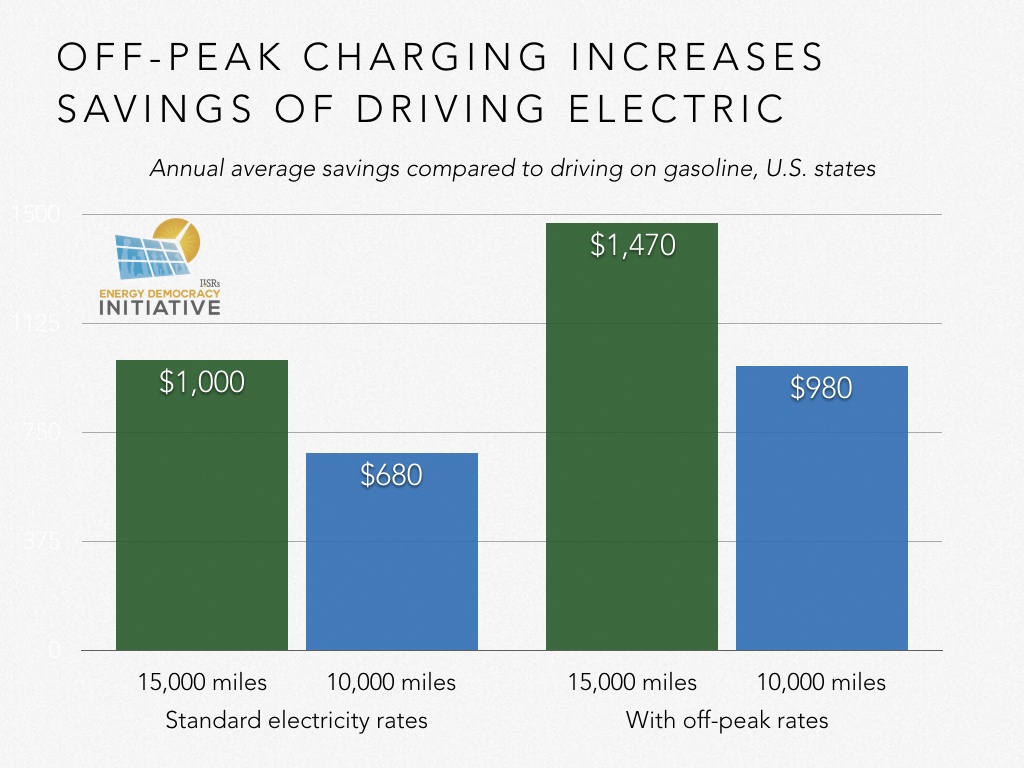

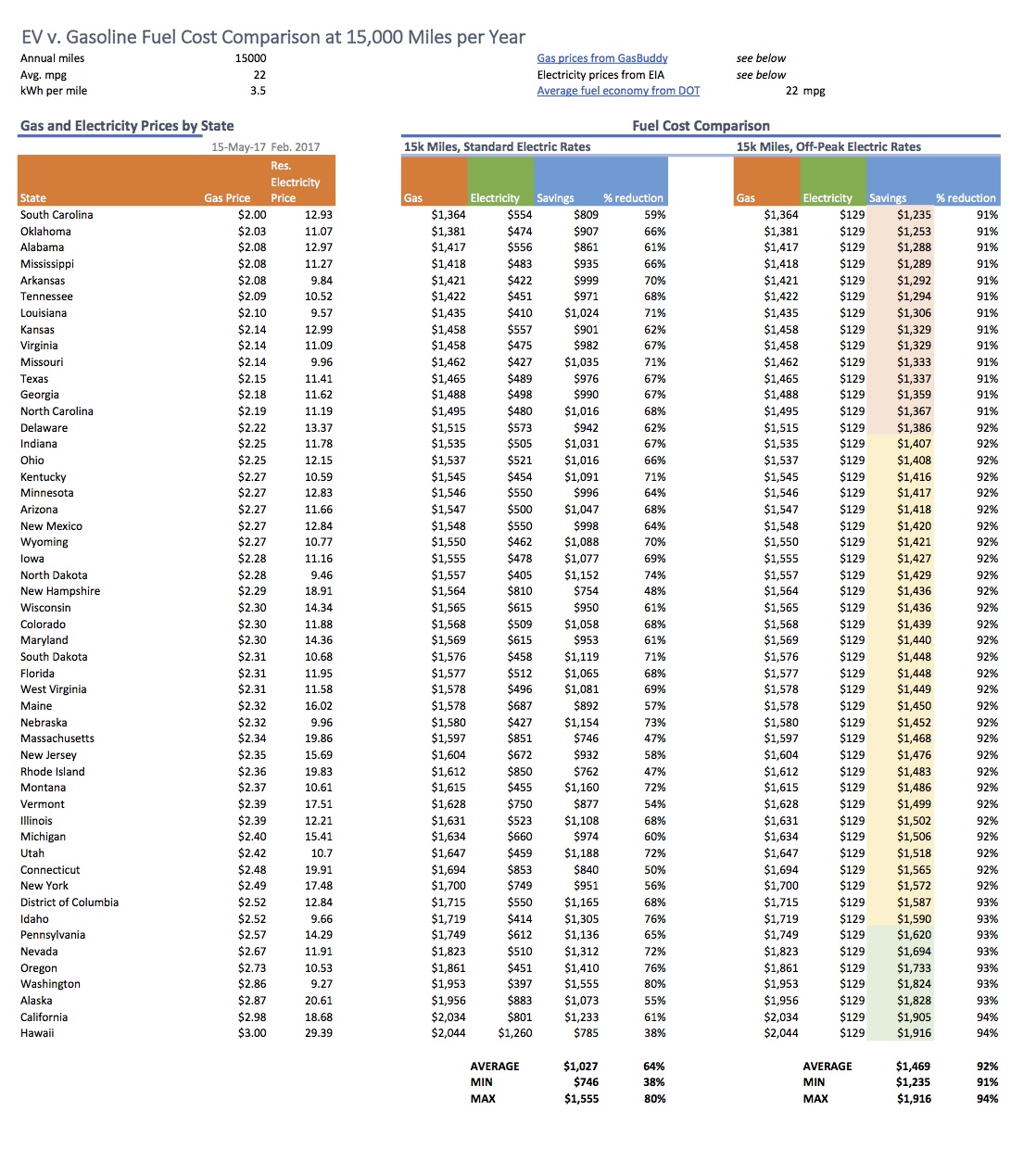

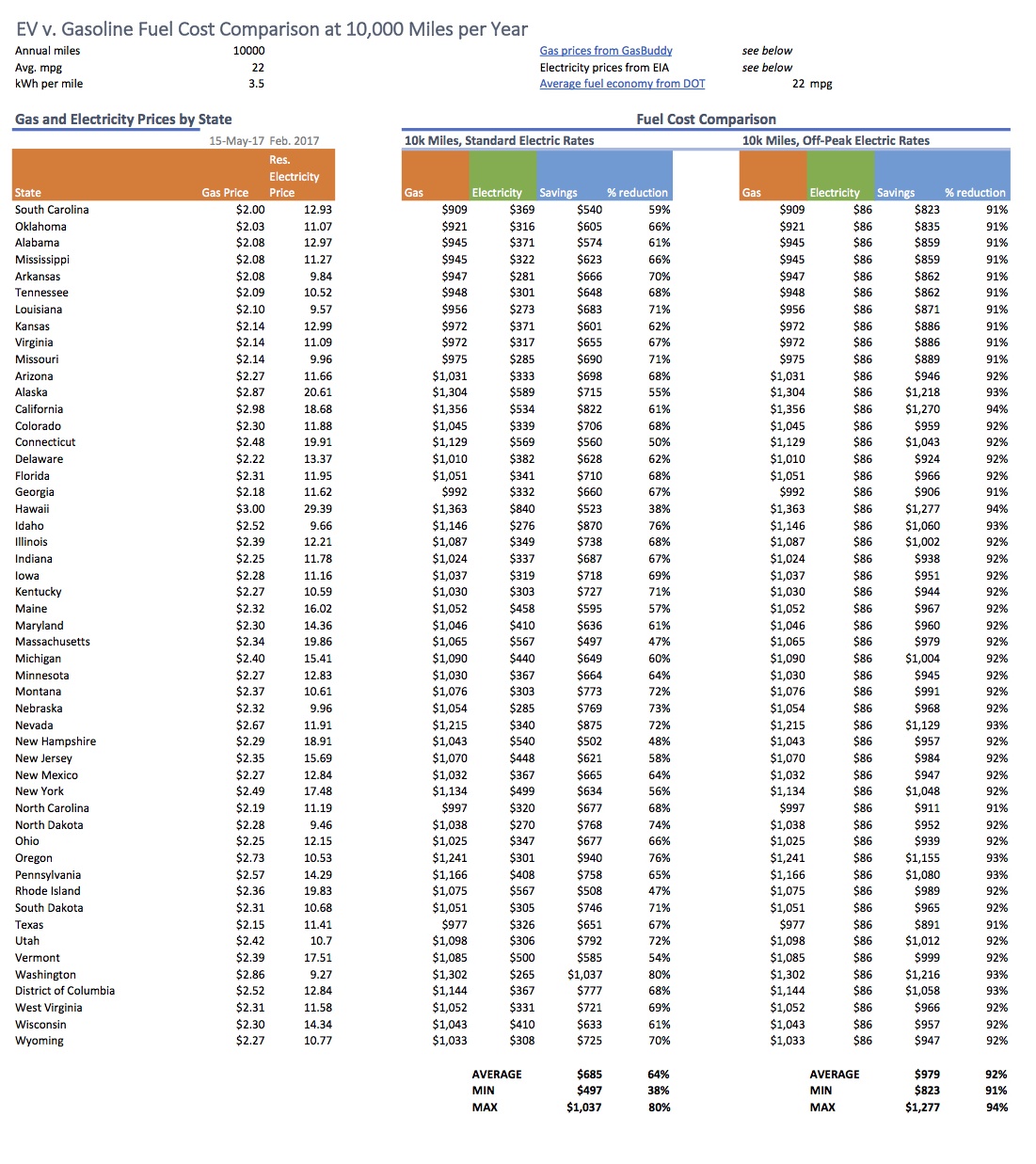

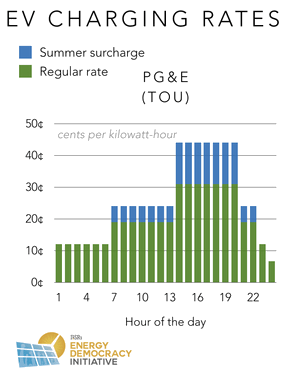

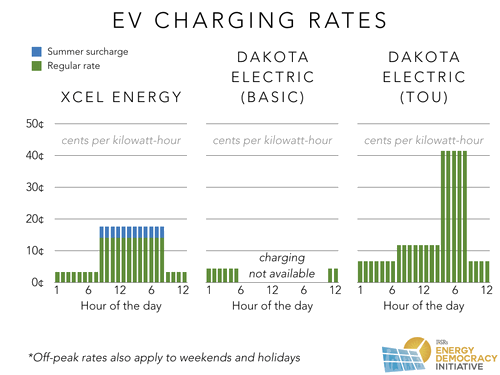

Fuel cost savings are a good illustration of the ownership benefits of electric cars. Without any special charging rate, drivers in all 50 states would save a minimum of $740 per year and up to $1,500, a discount ranging from 38% to 80% of the cost of driving 15,000 miles. With special rates for overnight (“off-peak”) charging — already available from several utilities for around $0.03 per kilowatt-hour — the average savings of driving electric rise from $1,000 to nearly $1,500 per year. The savings remain significant even when a driver covers only 10,000 miles per year (see Appendix C for more on the calculations).

With special rates for overnight (“off-peak”) charging — already available from several utilities for around $0.03 per kilowatt-hour — the average savings of driving electric rise from $1,000 to nearly $1,500 per year.

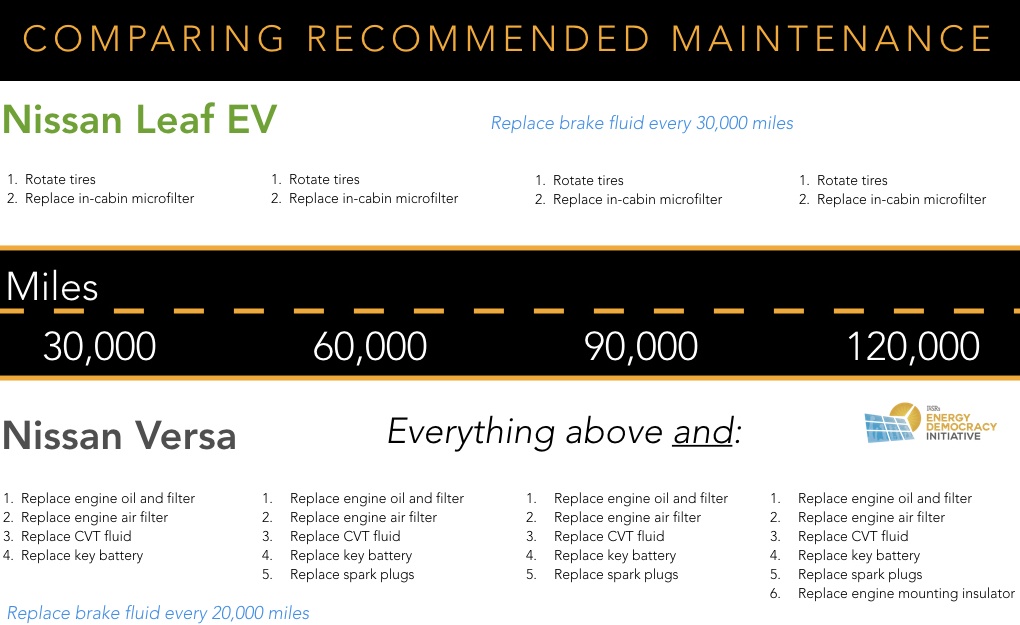

Maintenance costs are also lower for electric vehicles. Clean Disruption author Tony Seba notes that electric vehicles have 100 times fewer moving parts in the drivetrain than cars powered by internal combustion engines. They do not require oil changes, transmission fluid, or timing belt replacements. Electric vehicles’ regenerative braking reduces brake wear. Edmunds estimates a 2017 Nissan Leaf will have five-year scheduled maintenance costs of about 15% less than the gasoline-powered Nissan Versa, for example (other sources suggest the advantage lands closer to 25%). The infographic below compares the Nissan maintenance schedules for a Versa with the all-electric Leaf.

Though they require less scheduled maintenance, electric vehicles may need battery replacement. A Nissan Leaf can be expected to lose approximately one-third of its range in the first 10 years of driving (if the car averages 12,500 miles per year). However, the 30-kilowatt-hour battery originally priced near $10,000 in 2016 is likely to cost $3,000 or less to replace in 2026 — less than the accumulated scheduled maintenance savings.

The following chart combines expected fuel and maintenance savings of electric vehicle ownership over 10 years and deducts the expected battery replacement cost. It is likely conservative, as it does not factor in unscheduled or common repairs unique to gasoline-powered cars including belts, pumps, gaskets, or hoses.

Policy and Pride at Play

Electric vehicles sales are also aided by federal and state policy, and a desire for individuals, governments, and agencies to be perceived as leaders.

Policy Aids

A $7,500 federal tax credit reduces the cost of an electric vehicle by 10% or more, and is available for each auto manufacturer until they sell 200,000 plug-in hybrid and battery-powered vehicles (a few automakers are at least halfway to the cap). Several states chip in rebates or credits of their own. In California, whose policies seeded the national electric vehicle boom, qualifying drivers can unlock benefits worth up to $12,000 when they buy or lease an electric vehicle.

Some states offer a non-monetary incentive that may be even more attractive than cash. Ten states allow electric vehicle drivers unrestricted access to high-occupancy vehicle (HOV) or carpool lanes. In California, according to surveys, the right to drive in the carpool lane has been a compelling benefit. In a 2013 survey, when vehicle buyers were asked about their primary motivation to buy a plug-in car, 57% of plug-in Toyota Prius, 34% of Chevy Volt and 38% of Nissan Leaf owners singled out t free access to carpool lanes. The benefit expires in 2019.

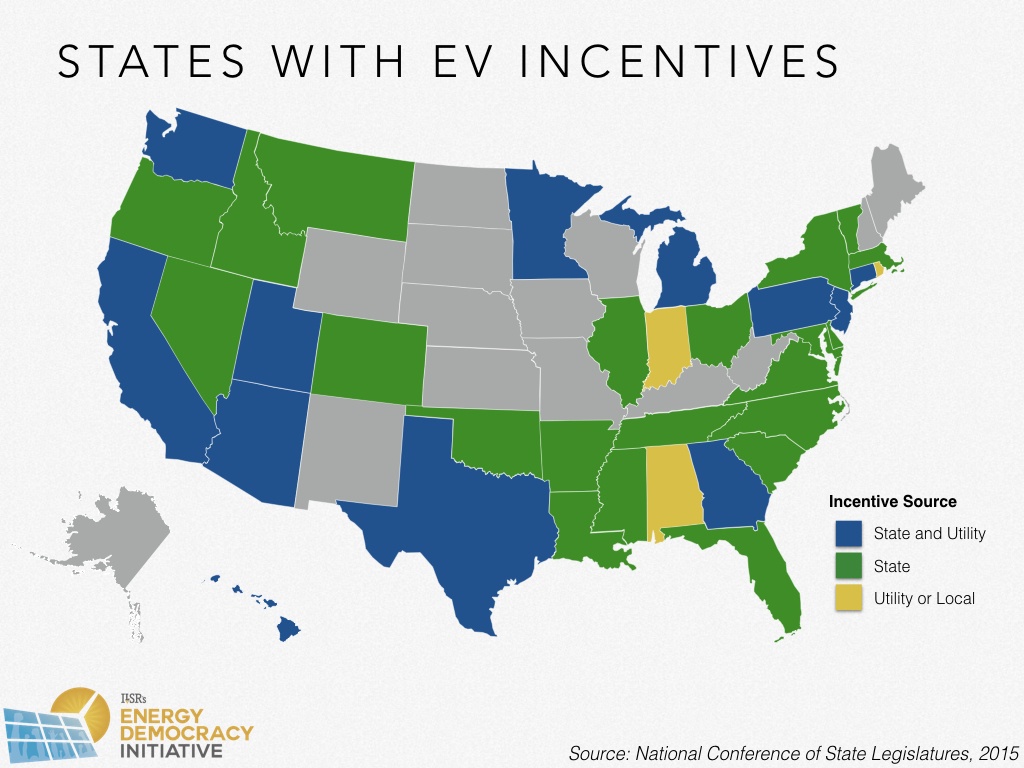

Seven states, including California, require their combined zero-emission vehicle sales to rise to 3.3 million by 2025 (in many states, including California, this includes a combination of all-electric and plug-in hybrid electric cars). In California, each automaker must amass a certain number of credits each year, with companies like Tesla selling millions of dollars in credits to rivals without robust zero-emission offerings. Many states also provide rebates or tax credits for electric vehicle purchases or home charging installation. The following map, based on data from the National Conference of State Legislatures, summarizes these policies.

In a decisive victory for public policy, as incentives begin phasing out, the underlying economics of electric vehicles render these benefits less necessary.

‘Conspicuous Conservation’ or Sex Appeal

The Toyota Prius, a hybrid vehicle powered by a mix of gas and electricity, generated plenty of buzz when it made its worldwide debut in 2000. About a decade later, the automaker had sold 1 million of them in the U.S. alone, earning it repeat appearances on car bestseller lists. The Prius is considered reliable and is affordable, but other factors amplify its appeal.

In an oft-cited 2011 paper, Sexton and Sexton found that “conspicuous conservation” — the idea that our society prizes environmentalism and rewards a lack of consumption — motivated many drivers to choose the Prius. Electric vehicle ownership is one of the most visible consumption decisions a household can make, they argue. That goes double for the Prius, whose distinctive design separates it from other hybrid and plug-in vehicles that look much more like traditional gas-powered cars.

“The status conferred upon demonstration of environmental friendliness is sufficiently prized that homeowners are known to install solar panels on the shaded sides of houses so that their costly investments are visible from the street.”

-

Sexton and Sexton, Conspicuous Conservation: The Prius Effect and Willingness to Pay for Environmental Bona Fides

The cultural emphasis on eco-conscious thinking has deepened since Prius sales took off. Now, it is bolstering cachet for manufacturers like Tesla and others carving out slices of the fast-expanding electric vehicle market.

Tesla has proved to have its own sex appeal, beyond eco-consciousness. Tesla CEO Elon Musk reported in April 2016 that his company’s forthcoming Model 3, priced at $35,000, had garnered about 400,000 reservations. The vehicle wouldn’t go into production until at least 2017, and each reservation required a $1,000 deposit. A Jefferies analyst surveyed 145 Tesla owners in June 2015, when the least-expensive Tesla model available had a $58,000 sticker price and most of Tesla’s vehicles cost substantially more. About 70% of respondents said they switched to Tesla from cars that cost less than $60,000. Overall, they were willing to pay an average of 60% more than their previous car to own a Tesla.

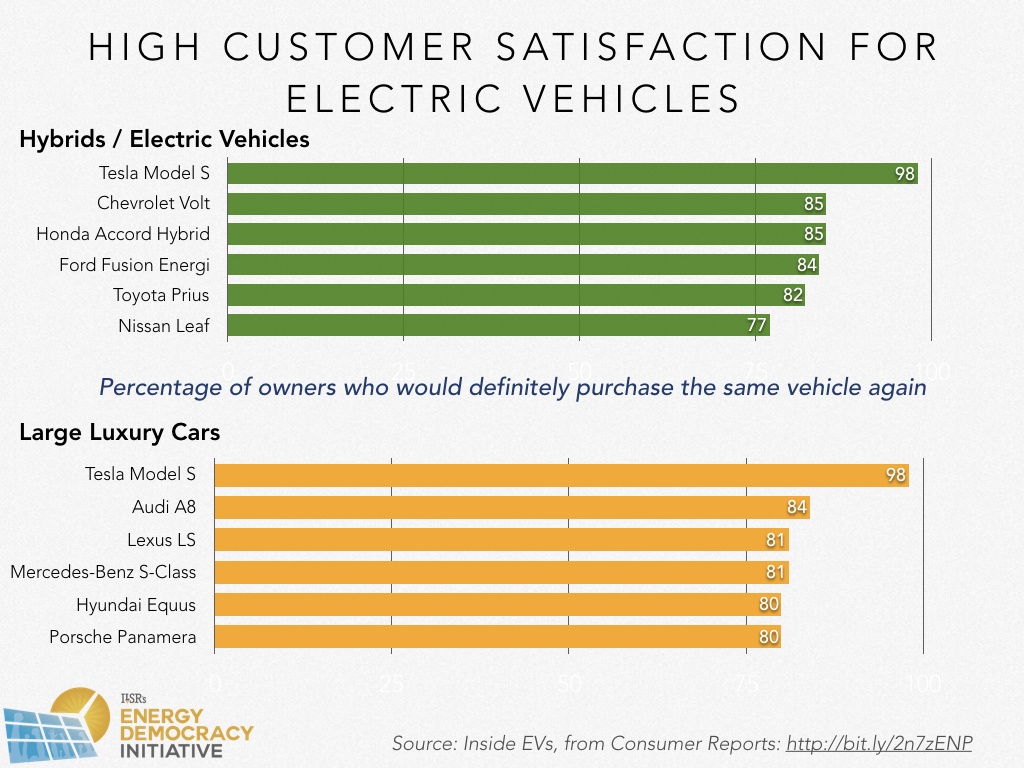

The automaker also ranks first in customer satisfaction surveys, with 91% of owners saying they would buy the same car if they were repeating their shopping process, 7 percentage points more than the next car company, Porsche. Speaking of sports cars, the Tesla Model S is among the top three fastest accelerating cars in the world, the P100D model is the world’s fastest production car. Plus, it still earned a top safety rating from the National Highway Traffic Safety Administration and narrowly missed a superior mark from the Insurance Institute for Highway Safety. It also has ranks highly for cargo space.

Tesla aside, many other hybrid and electric cars rank as high as luxury cars in customer satisfaction.

In other words, hybrid and all-electric vehicles boast a unique appeal that car shoppers consider alongside performance, cargo space, and other common characteristics.

Leading by Example with EV Fleets

Utilities and local governments have also helped spur electric vehicle adoption by procuring them for municipal official business, as “fleet” vehicles. The Sacramento municipal electric utility, for example, has over 20 electric vehicles in its current fleet and plans to increase that number five-fold in the next five years.

The New York Power Authority has pumped $8 million into an initiative to help municipalities and rural electric cooperatives transition their fleets to electric vehicles. The program’s first $5 million allowed 24 towns and villages across New York to buy 61 electric vehicles, aligning with a state goal to cut greenhouse gas emissions by 40 percent by 2030 (compared with 1990 levels).

Separately, New York City is beating expectations for integrating 2,000 electric vehicles to its fleet — among them battery-powered sedans and ambulances — by 2025. The fleet is on track to have 1,000 electric vehicles by the end of 2017, with ample time to double that figure. In addition, Mayor Bill De Blasio has committed $10 million to build out charging infrastructure across the city, part of a plan to encourage private electric vehicle ownership.

Adding just 27 Nissan Leafs to the fleet saves the city $110,000 per year, compared with gas-powered vehicles.

Perhaps a more unexpected leader in municipal fleet conversion is Houston. A city at the center of the U.S. oil industry, it began examining “green transportation” in 2002. With more than 9,200 vehicles, Houston’s fleet is among the nation’s largest. As of 2013, more than half of its light-duty vehicles were hybrids, and the city had begun to add more plug-in cars (including by converting some of its hybrid vehicles). A study revealed that adding just 27 Nissan Leafs to the fleet saves the city $110,000 per year, compared with gas-powered vehicles.

[RETURN TO TOP]

Impact: Improving the Grid

Electric vehicles boost demand for electricity.

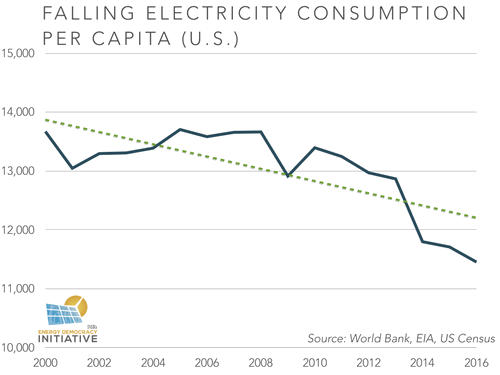

On one hand, that’s great news for utilities. The average electric-powered car driver covers 12,000 miles annually, and one study calculated that the additional 4,000 kilowatt-hours used by an electric vehicle would increase a typical household’s yearly energy need by 33 percent (without adoption of energy efficiency measures). In small numbers, electric cars will change little, but in large numbers they could reverse the stagnant growth in electricity use, which has dropped in five of the last eight years and affected the bottom line of many electric utilities.

On the other hand, could this increased demand also increase the cost of operating the electric grid (and costs for electric customers) by shortening the life of grid components, requiring replacement or upgraded infrastructure such as transformers and capacitors, or even building new fossil fuel power plants?

Fortunately, the evidence suggests that electric vehicle expansion will reward, not ruin, the grid and its customers.

A rigorous analysis spearheaded by the California Public Utilities Commission in 2016 found substantial net benefits in electric vehicle adoption for the state’s electric grid and customers: worth $3.1 billion by 2030, even without smart charging policies and with vehicle adoption clustering in particular areas of the grid. This included the benefits of capturing federal tax credits, gasoline savings, and carbon credits in California’s greenhouse gas allowance transportation market plus all of the associated costs to the customer and grid.

The study also found surprisingly low costs for upgrading the local distribution grid. Even with a much higher vehicle adoption assumption of 7 million cars by 2030 (one-quarter of all registered vehicles), annual distribution infrastructure costs would be just 1% of the annual utility distribution budget.

A rigorous analysis by the California Public Utilities Commission found substantial net benefits in electric vehicle adoption: $3.1 billion by 2030, even without smart charging policies and with vehicle adoption clustering in particular areas of the grid.

A set of studies for northeastern states found a similar net benefit, even without smart charging policies, for vehicle owners, utilities, and society.

Relatively simple policy changes can enhance the payoff of adding thousands or millions of electric vehicles to the grid. California’s study suggests that the most potent and simplest tool to smoothly integrate electric vehicles is controlling when they charge. This can be done with special rates that give customers a discount for charging at grid-friendly times, or even using special chargers that disallow charging when grid demand is at its highest. These tools increase the efficiency of the electricity system, but also mean lower-cost fuel for electric vehicle owners, a win-win.

Relatively simple policy changes can enhance the payoff of adding thousands or millions of electric vehicles to the grid. California’s study suggests that the most potent and simplest tool to smoothly integrate electric vehicles is controlling when they charge.

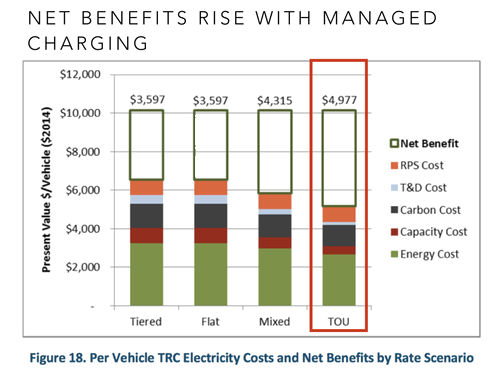

In an exhaustive analysis using time-of-use (TOU) pricing to strongly incentivize nighttime charging, the California Public Utilities Commission found that shifting from flat-rate to time-of-use charging increased net benefits from $3,600 to $5,000 per vehicle through significant reductions in the energy and infrastructure costs of charging.

While the California calculation includes the federal tax credit, the benefits are expected to persist even when that incentive expires because of falling electric vehicle and battery costs.

This following sections explore pricing tools that allow utilities and regulators to better manage grid supply and demand, rather than building new power infrastructure that could be obsolete early in its decades-long life.

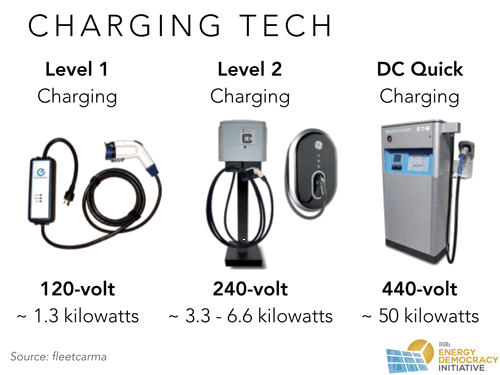

EV Charging Terminology

A quick note on charging before we dive in. Electric vehicles can be charged at different speeds by using different voltages. A standard 120-volt outlet can deliver about 1.3 kilowatts per hour but may take 12 or more hours to fully charge a vehicle. A 240-volt circuit can deliver a substantially faster charge and can be wired in a typical home or business. Direct current (DC) fast charging uses 440-volt charging that can “refuel” an electric vehicle battery in less than an hour. The following graphic from FleetCarma illustrates.

Managing Demand

With proper price incentives, grid managers can motivate electric vehicle users to avoid charging during periods of peak demand, to instead charge when demand is otherwise low, and to help smooth out large increases or decreases in demand.

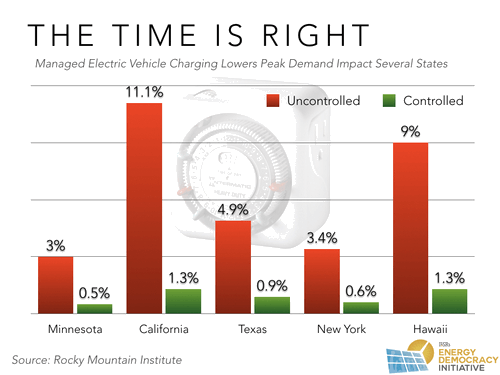

The electric grid is designed around periods of peak energy use, with requirements for significant energy reserves dictated by the single-most congested hour of the year. By raising electricity prices at times of peak energy use (and reducing them elsewhere), utilities can largely minimize electric cars’ contribution to peak energy demand. Recent modeling by the Rocky Mountain Institute suggests optimized charging rates would limit Minnesota’s peak demand increase, for example, to just 0.5 percent when electric vehicles hit 23 percent penetration, compared with an increase of more than 3 percent without charging controls.

Minnesota wasn’t alone. In the four other states modeled, the Rocky Mountain Institute found peak demand impacts of widespread electric vehicle adoption could be significantly reduced with controlled charging. The following graphic illustrates.

Utilities can also leverage electric vehicles to manage rapid changes in electricity demand. Historically, these ramps up or down have been driven by a morning surge in demand as people wake up and turn on lights and appliances, and another in the evening when stores remain open and residents return home. In some cases, these ramps are also influenced by rooftop solar generation, which sharply reduces demand from solar-powered neighborhoods in the daytime but spurs a sharp increase in local demand in the evening when residential demand increases as the sun sets.

Utilities typically prepare for these surges by activating gas power plants that can be put on standby or ramped up quickly. However, because these plants are relatively under-utilized, the electricity provided at peak periods is expensive. An August heat wave in Texas, for example, sent hourly electricity prices on the grid well over $1 per kilowatt hour on several occasions, more than ten times the usual price.

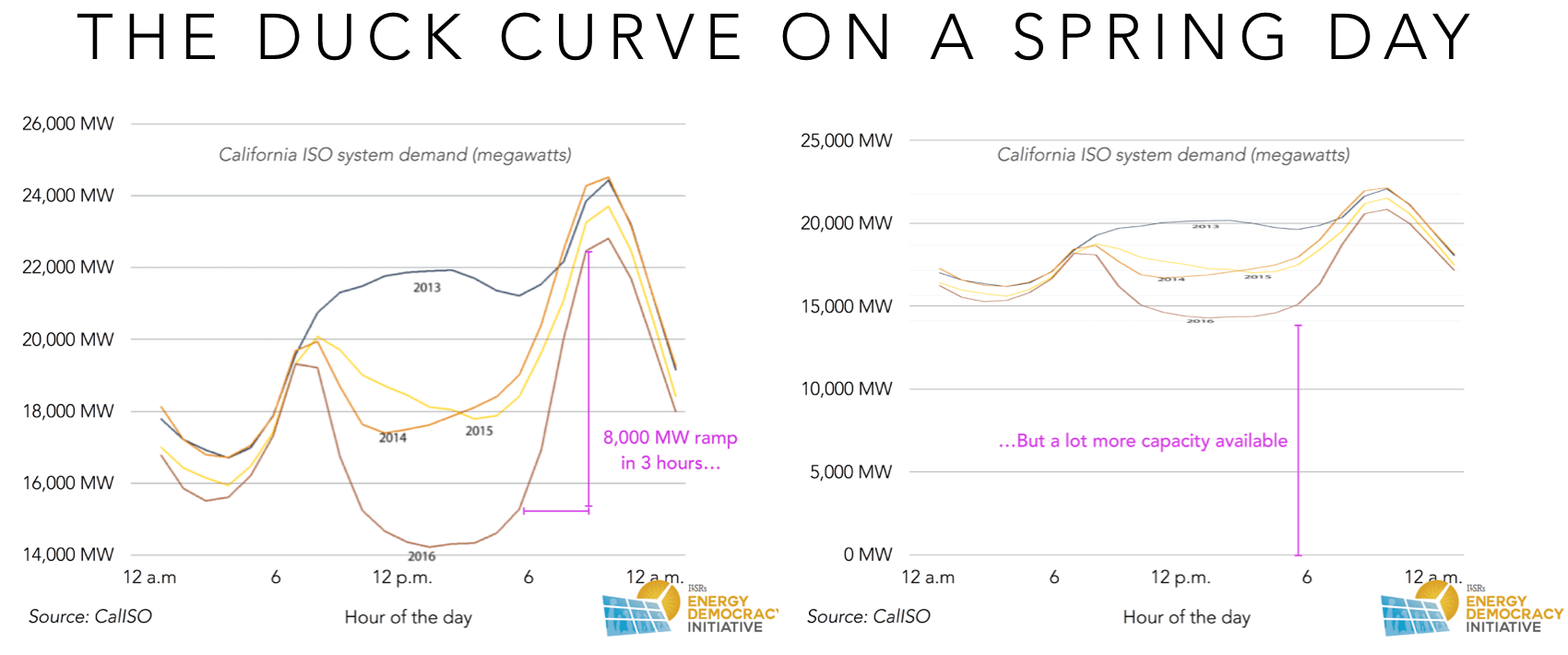

Utility wonks illustrate this challenge with the “duck curve,” shown below for the California Independent System Operator (CAISO). The issue is the steep curve starting around 4 p.m. and peaking around 8 p.m., driven largely by adoption of rooftop solar that drives down daytime electricity demand. One caveat: the deep dip is sometimes called “overgeneration” — implying that there’s too much solar energy production — an issue enhanced when the bottom axis reflects a minimum of 14,000 megawatts. One German observer notes that this issue (as opposed to the ramp) is exaggerated. For context, the chart is also shown with a zero axis.

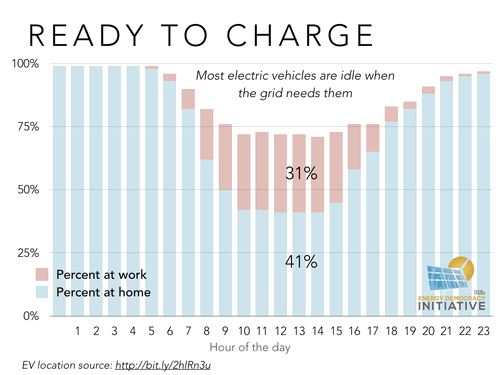

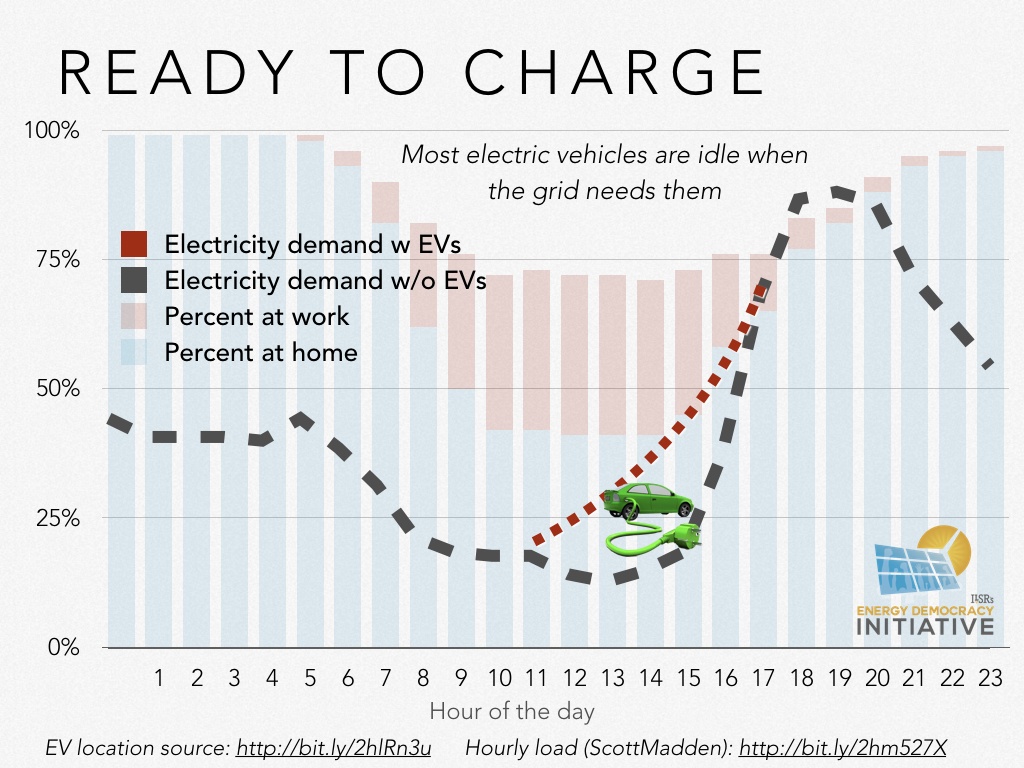

Although there are many potential solutions (the linked report from the Regulatory Assistance Project is particularly thorough), electric vehicles can help smooth the curve. By drawing power from the grid during the midday hours when solar output is greatest, electric vehicles can soak up the sun-generated power and in turn reduce the evening ramp-up. Fortunately, data from California suggests that 40% of electric vehicles remain at home even through the midday hours. If vehicle owners have access to charging at home and at work, over 70% of vehicles are available to absorb excess daytime electricity generation.

Although there are many potential solutions (the linked report from the Regulatory Assistance Project is particularly thorough), electric vehicles can help smooth the curve. By drawing power from the grid during the midday hours when solar output is greatest, electric vehicles can soak up the sun-generated power and in turn reduce the evening ramp-up. Fortunately, data from California suggests that 40% of electric vehicles remain at home even through the midday hours. If vehicle owners have access to charging at home and at work, over 70% of vehicles are available to absorb excess daytime electricity generation.

By charging these idle electric vehicles during daytime hours, grid operators could reduce the steep afternoon ramp-up in electricity demand. The chart below illustrates how charging these vehicles between 11 a.m. and 4 p.m. would help smooth the rise in demand, giving grid managers more time to accommodate increasing electricity consumption.

The amount of additional demand needed from electric vehicles to achieve this outcome is well within projected capacity. The 1.5 million electric cars California expects by 2025 would have a maximum energy demand of about 7,000 megawatts, more than double the capacity needed to substantially smooth the current afternoon rise in peak energy demand.

As discussed later, widely distributed charging infrastructure will be key to accessing this resource, as few homes or businesses currently have car chargers. Furthermore, the amount and availability of bill credits or compensation for grid exports (or in the case of Hawaii, a tariff that provides no payment for excess solar production) will strongly impact customer behavior.

Soaking Up Supply

Charging controls or pricing incentives can also motivate electric vehicle drivers to charge overnight, or whenever clean energy production is strongest.

In markets like the Midwest that have abundant wind power, clean energy production often peaks overnight when demand is lowest. The chart below shows the daily demand curve for the Midwest Independent System Operator, which serves a number of states in the Midwest. The 50,000 megawatt-hour gap between daytime and nighttime demand (in July, when the grid is built to accommodate daytime load boosted by air conditioning) could accommodate over 7.5 million electric vehicles on Level 2 (240-volt) chargers without building a single new power plant. That’s almost 2 million more cars than the total number registered in the entire state of Illinois.

The 50,000 megawatt-hour gap between daytime and nighttime demand could accommodate over 7.5 million electric vehicles on Level 2 (240-volt) chargers without building a single new power plant.

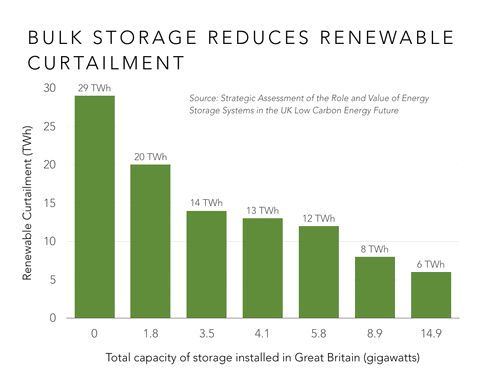

The hungry batteries of electric vehicles can also be coordinated to improve the capture of wind and solar power.

The most common constraint in a grid with high levels of renewable energy (over 30%) is overgeneration. This happens when there’s so much renewable energy available that making room for it would mean ramping down or turning off inflexible power plants (coal, nuclear, hydro). In electricity markets, renewables tend to undercut any other resource because — having no fuel — they have almost no marginal cost to produce electricity.

Electric vehicles represent a new source of electricity demand that can absorb this excess production.

Charging electric cars during nighttime low-demand periods, for example, means increasing the use of wind energy. A 2006 study from the National Renewable Energy Lab found that electric vehicle deployment “results in vastly increased use of wind” because overnight vehicle charging overlaps with windier nighttime conditions. A 2011 study from the Pacific Northwest National Laboratories found that if one in eight cars were electric, the additional storage capacity would allow the Northwest grid to handle 12% more wind energy.

Electric vehicles can also help grids put more solar power to use. The illustration in the previous section — Ready to Charge — illustrates how most electric cars could be available to charge during afternoon hours to absorb solar energy output, although it requires daytime charging (and potentially non-home charging infrastructure) that nighttime charging does not.

Portuguese researchers found that growth in both solar generation and electric vehicles maximizes the grid benefits of each. Portugal’s heavy emphasis on solar generation means that, as time goes on, it will build up a “substantial amount” of excess daytime solar energy. Because neighboring countries are also building out their solar portfolios, Portugal’s exports would yield low prices, suggesting that solar power might be curtailed (or lost) instead. But researchers found that an expanded electric vehicle fleet — and a preference for midday workplace charging — could decrease the midday solar surplus by 50%.

A separate Portuguese study includes analysis of simulated solar production during a given week in April. With no electric vehicles, 202 gigawatt-hours — or 48% of solar production — was curtailed during that span. With electric vehicles added to the mix, curtailment fell to 123 gigawatt-hours, or 29% of solar production.

Together, solar and electric vehicles can do more to smooth the demand curve than either technology could on its own. The following chart, from the Rocky Mountain Institute, shows how optimized electric vehicle charging increases daytime electricity demand by over 200 megawatts (nearly 14% of peak demand) in Hawaii, allowing for more solar production.

Other studies confirm this potential. A 2012 study by the Imperial College of London, for example, suggests that energy storage, including electric vehicles, can reduce curtailment of renewables by more than half.

Providing Ancillary Services to the Grid

By starting, stopping, or varying the level of charge, electric vehicle batteries can provide two crucial “ancillary” services to the grid: helping maintain a consistent voltage (120 volts) and frequency (60 Hertz). These services are provided by short bursts of “reactive” power: either drawing power from the grid or putting it back in. Since nearly all commercially available electric vehicles lack the ability to send power to the grid, car batteries would provide reactive power today only by drawing power (charging).

By starting, stopping, or varying the level of charge, electric vehicle batteries can provide two crucial “ancillary” services to the grid: helping maintain a consistent voltage (120 volts) and frequency (60 Hertz). These services are provided by short bursts of “reactive” power: either drawing power from the grid or putting it back in. Since nearly all commercially available electric vehicles lack the ability to send power to the grid, car batteries would provide reactive power today only by drawing power (charging).

The vehicle’s ability to aid the grid also hinges on the power of its charger and the ability to aggregate with other vehicles. On a typical home 120-volt outlet allowing up to 1.3 kilowatts of power per vehicle, it would take over 250 vehicles to reach the minimum threshold to provide ancillary services in energy markets run by regional grid operators PJM or MISO, which cover a substantial portion of the U.S. A 240-volt Level 2 charger with a capacity as high as 6.6 kilowatts per car significantly reduces the number of vehicles needed (as few as 27) to join the market.

Electric vehicles can provide substantial value to the grid as they charge (and in the future, perhaps by supplying power back to the grid, see Appendix A — The Vehicle-to-Grid Future).

[RETURN TO TOP]

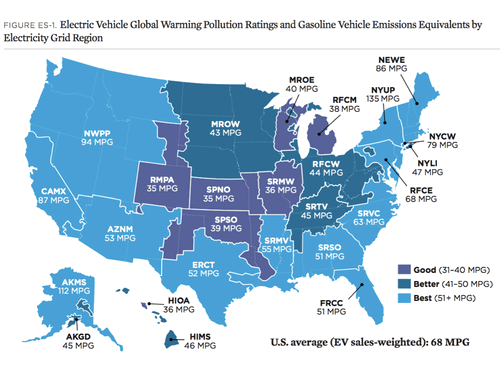

Impact: Cutting Pollution

One major benefit of electric vehicles is reducing pollution impacts of driving. The following chart shows the greenhouse gas emissions from electric vehicles based on the grid electricity supply in 2015. The numbers on the chart are the miles per gallon required from a gasoline-fueled vehicle to have the same greenhouse gas emissions impact as an electric vehicle. The numbers will have risen since 2015, as additional coal plants have been retired.

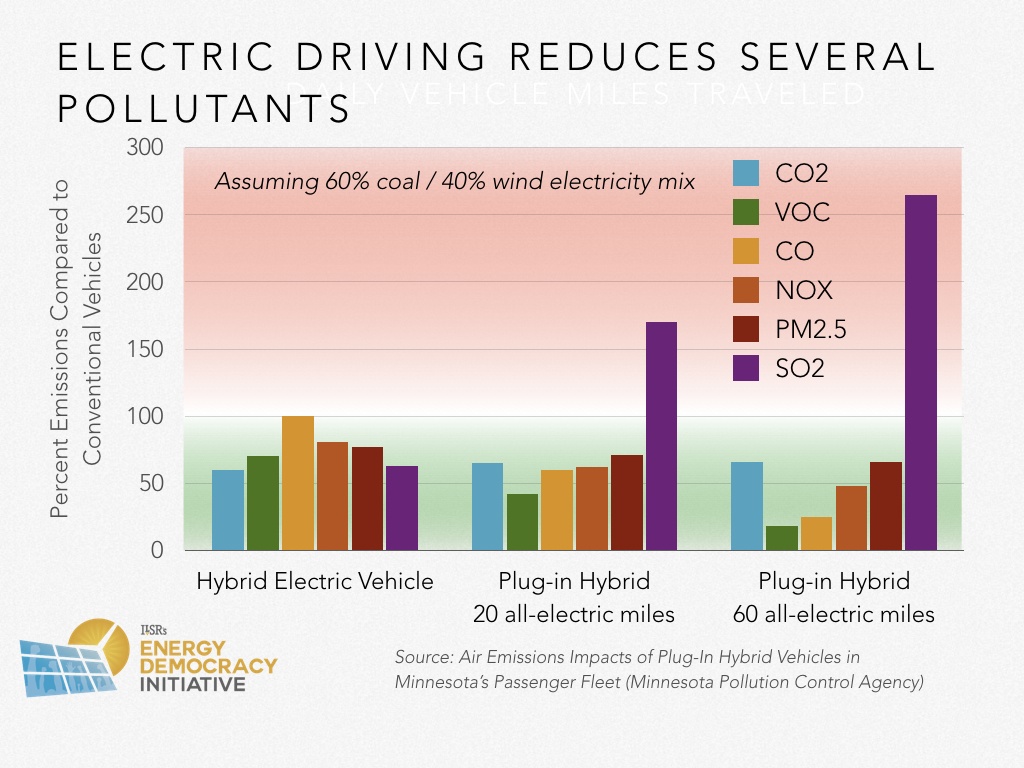

Driving electric also significantly reduces other pollutants. The adjacent chart is from a 2007 study of the pollutant impact of hybrid and plug-in hybrid cars in Minnesota. It assumes a grid with a mix of 40% wind power and 60% coal power. The former is likely in the next decade, the latter is laughable in the face of a massive switch from coal to gas and renewables. With that context in mind, the bar representing sulfur dioxide should be ignored as the emissions rate of sulfur dioxides is 99% lower with natural gas, and 100% lower with more wind or solar power.

[RETURN TO TOP]

Impact: Readying Energy Democracy

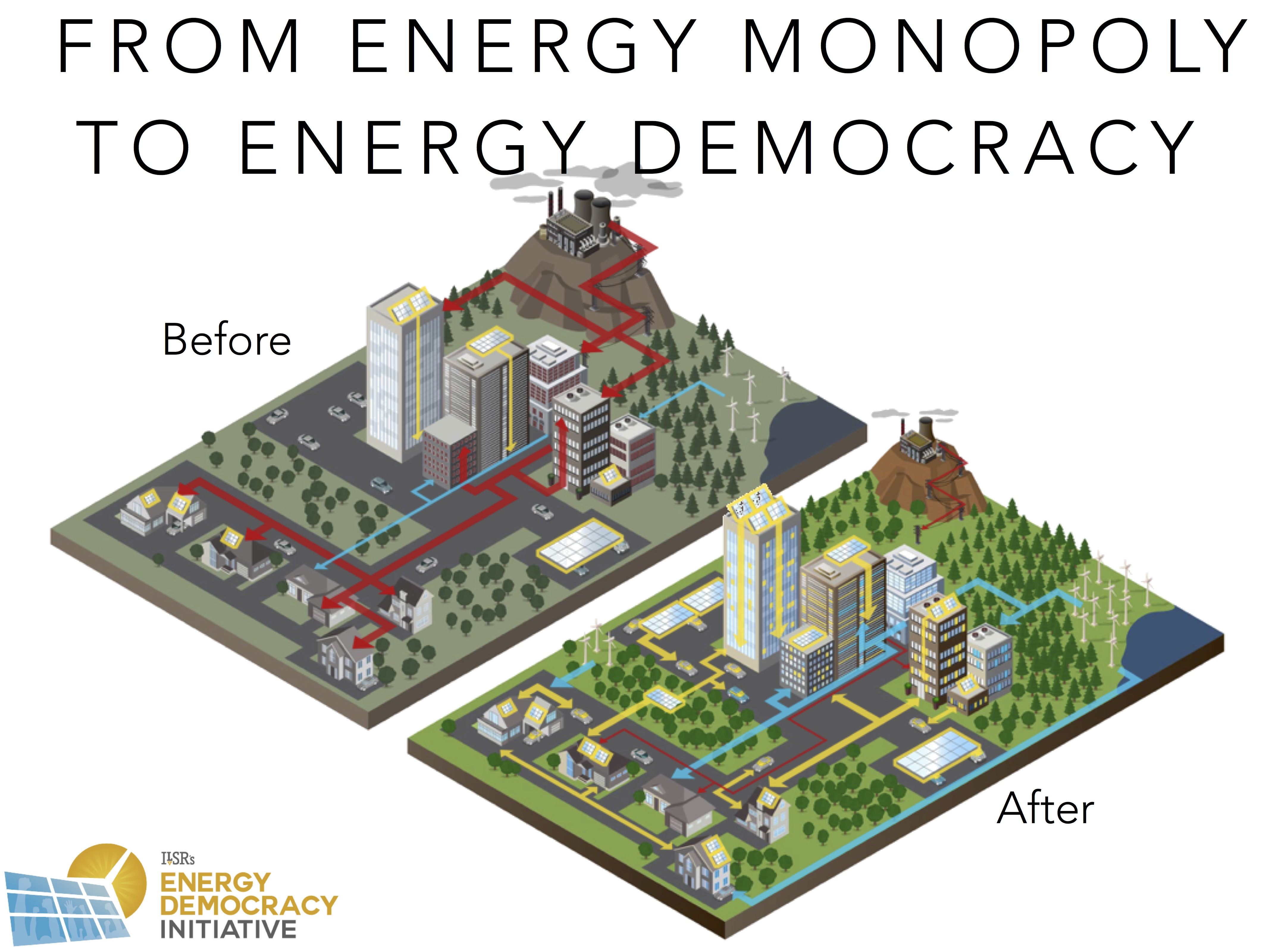

The cumulative power of electric vehicles goes beyond stabilizing the larger electricity system; it offers an opportunity to draw more power from the local economy. Electric vehicles operate in a distinct geography (near the owner) and therefore their benefits are localized. This makes electric vehicles part of a larger transition from energy monopoly to energy democracy, as distributed technology from solar to smartphones localizes everything — production, consumption, and decision making — on the electric grid.

The following graphic illustrates the shift from energy monopoly to energy democracy. The flow of electricity changes from one-way to two-way as many customers install rooftop solar and purchase electric vehicles. The share of renewable energy grows and that of fossil fuel power shrinks. In general, the community sources more of its energy locally.

This section details the three key local benefits of electric vehicles: enabling the combination of the “sexy electrics” (solar and electric cars); increasing the capacity for local distributed solar energy production; and providing resilient, local backup power.

Complementary, Sexy Technology

Electric vehicles can encourage increased deployment of distributed solar. The same environmental values and spending habits that helped rocket the Toyota Prius to 1 million sales in a decade propel people to install solar panels. Like the conspicuous sustainability credential provided by the unique Prius, economists have speculated that homeowners invest more in solar panels than more affordable insulation and caulking. As such, it is not surprising that two of the clearest signals of green values — electric vehicle ownership and rooftop solar installation — often go hand-in-hand.

In California, roughly 39% of electric vehicle drivers also owned residential solar in 2013 — far outpacing the general population in the U.S., where less than 1% of all households had rooftop arrays through the second quarter of 2016. Meanwhile, 17% of California electric vehicle drivers expressed “strong interest” in installing solar in the near future. Of those that already had both, 53% said they sized their at-home solar systems with electric vehicle charging in mind, exposing synergies that reduce grid strain and help accommodate higher electricity demand.

Boulder County, CO, captured this complementary relationship by offering a program that promoted bulk buying for electric vehicles and solar. Area residents could opt in to access discounts on their purchase of either upgrade. The initiative provided a significant boost to electric vehicle sales. During the September-to-December promotional period, a local dealership sold 85 Nissan Leafs in 2013 and 2014 before jumping to 173 in the same period in 2015. Boulder County, home to less than one-tenth of 1% of the U.S. population, accounted for 3.5% of all U.S. Leaf sales over that span.

Meanwhile, program participants installed 147 solar arrays totaling 832 kilowatts. At least 19 households (over 10% percent of those participating) purchased both a Leaf and a solar array, and of that group, 11 right-sized their solar project to ensure it could power both their home and their new electric vehicle. By harnessing the federal electric vehicle tax credit alone, participants brought $1.8 million into the local economy — a huge gain, considering Boulder County estimated the program required just 165 hours of staff time and $650 in out-of-pocket expenses. The program was aided by the state electric vehicle tax credit, worth about $3,800 per car or $660,000 altogether.

The relationship between solar and electric vehicles may not remain as tight in the long term. A 2016 survey of plug-in car owners found that the percentage owning a solar array had fallen from 25% in 2012 and prior to 12% in 2015. This could be due to less affluent car owners or vehicle sales in areas with poorer solar resources. On the other hand, it also means that electric vehicles are dispersing beyond the very savvy customers that already own solar.

Either way, electric vehicles and solar arrays are both appealing to consumers, in a way that other energy improvements are not. And fortunately, this marriage of sexy electrics delivers benefits to the grid and local economy.

Electric Vehicles and Community Solar?

As electric vehicle ownership expands, it will reach many Americans who lack a sunny rooftop but may still have interest in solar. Community solar programs allow these customers to invest in or subscribe to solar energy projects, and the revenue from these subscriptions could offset the cost of charging an electric vehicle. It also allows them to, indirectly, charge their car from the sun.

The technical benefits of marrying solar and electric vehicles using community solar would be diminished unless customers subscribed to a community solar array located on the same distribution feeder as their primary place of vehicle charging.

Increasing Local Energy Capacity

Electric vehicles boost electricity demand and expand local storage, increasing capacity to produce more electricity from local, renewable sources.

Electric vehicles boost electricity demand and expand local storage, increasing capacity to produce more electricity from local, renewable sources.

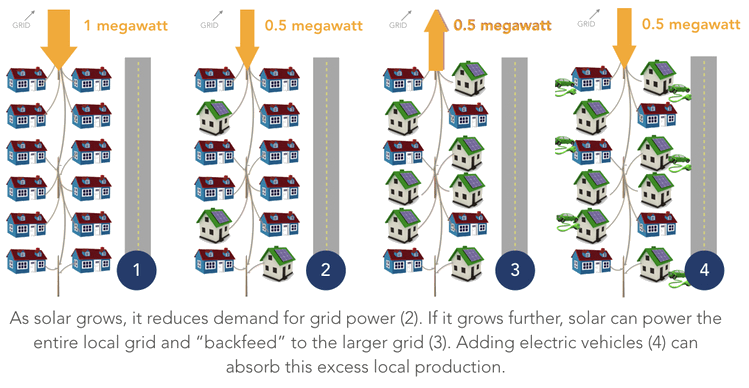

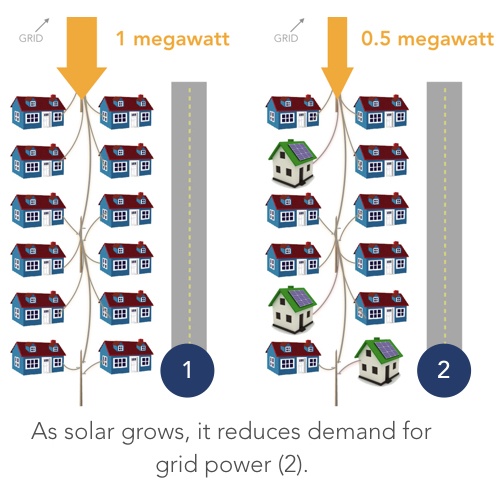

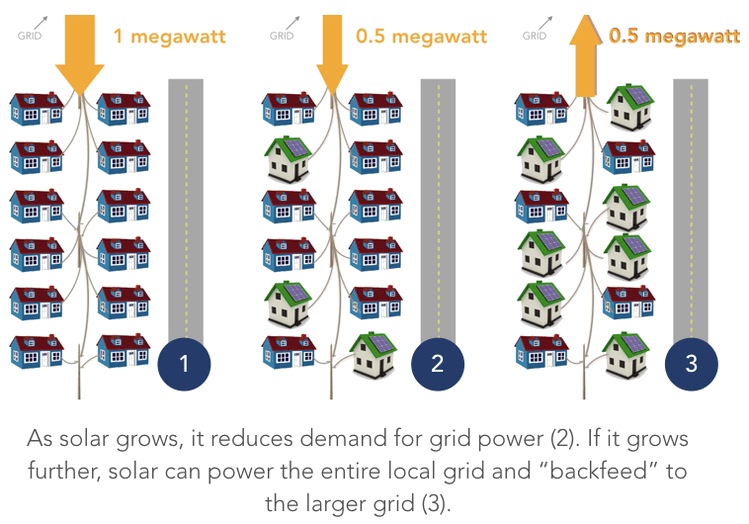

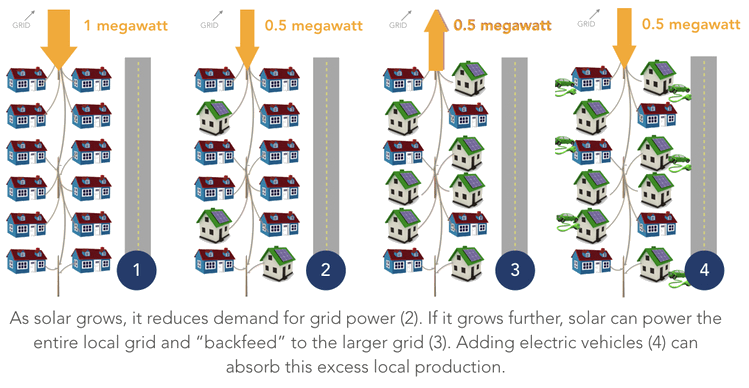

Solar energy, for example, can reduce a neighborhood’s peak energy consumption. If a community is served by a distribution line with a maximum capacity of 1 megawatt and it’s running near that limit, the utility may consider an expensive hardware upgrade. But adding local solar can reduce demand during hot, sunny summer afternoons, potentially allowing the utility to defer that upgrade.

We illustrate the effect in the graphic to the right. If many homes and businesses in a neighborhood add rooftop solar, it supplants power from the grid with local energy to avoid new capacity needs.

As solar continues to proliferate, a second set of issues can arise. Lots of small solar power plants can result in a portion of the local grid remaining energized when there’s a larger blackout. This could cause safety issues for utility workers who would expect power lines they’re repairing to be dead. However, smart inverters for solar arrays can automatically turn off power production when the grid goes dark. An even better solution is to island the home or business with solar, allowing them to have power even when the grid is dark. Newer inverters can supply up to 1500 watts for use during blackouts, even as the solar array stops sending power to the grid.

A second issue is a technical and competitive concern called “backfeed.” Backfeed is what happens when the supply of electricity (including from local solar) exceeds total use on a certain area of the grid. In this case, power flows back onto the grid, as shown in the illustration below.

This may require substation upgrades to mediate power flow from the high-voltage regional grid to the low-voltage local grid, which weren’t designed with this flow in mind. It also allows local solar generation to compete against many other sources of electricity, including traditional fossil fuel power plants. In the many states where the utility company is responsible for grid safety and owns power plants that would be in competition with local solar, this creates a challenging conflict of interest.

Electric vehicles can solve backfeed issues by absorbing more local power generation, in turn enabling it to serve local needs. This also reduces wear and tear on utility hardware, inevitable in longer-distance power distribution. The following illustration shows how increasing electric vehicle ownership can reduce solar energy exports to the larger grid.

Without an additional local source of energy consumption, utilities can “curtail,” or effectively shut off, clean power production from local solar arrays. But a 2016 study in Hawaii confirmed that more electric vehicles on the grid translates to greater potential reductions in curtailed energy. That is especially significant in a rooftop solar stronghold — 17% of utility customers in Hawaii generate their power this way, including at least 32% of single-family homes on Oahu. The study’s authors modeled a scenario where 10% to 30% of Oahu vehicles were electric, and predicted an 18% to 46% reduction in curtailed generation when vehicle charging was controlled to match local power production. In this model, wind and solar provided close to 50% of the island’s total electricity needs.

The authors cautioned that marked day-to-day fluctuations in wind and solar curtailment obscure the precise effects of controlled charging in capturing curtailed energy, but found that using electric vehicles to integrate more storage makes distributed generation more valuable, more effective, and even more pervasive.

It’s a scenario that could play out in markets across the country. For example, the California grid operator CAISO reported 132 megawatt-hours in local curtailments of solar generation between 10 a.m. and 2 p.m. on Sept. 15, 2016. These curtailments were due to a limit on the capacity of the local grid to export. Typically, such curtailments involve utility-scale solar. If the capacity of the average electric car battery is 30 kilowatt-hours (the size of that in the 2017 Nissan Leaf), 8,800 parked electric vehicles needing a 50% charge could collectively offset that day’s curtailment, benefiting those generating solar power and helping to stabilize the grid.

Local Value

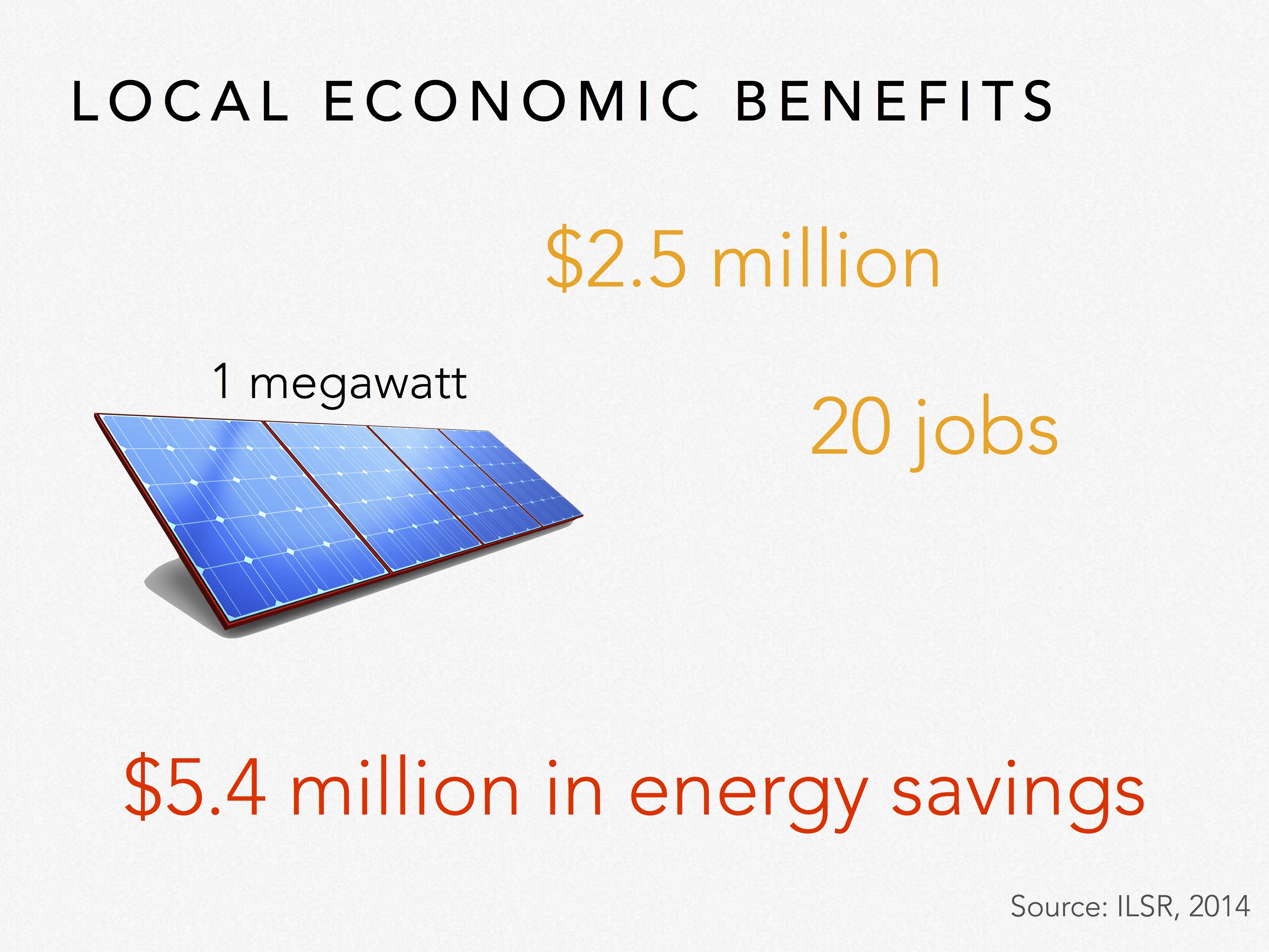

Sourcing power locally has two spillover benefits. First, it keeps more of the economic benefits of power generation within a given community. A typical 1-megawatt solar array creates $2.5 million in local economic activity and 20 jobs. Through its 25-year lifetime, a locally owned solar project will redirect an additional $5.4 million of electricity spending back into local hands.

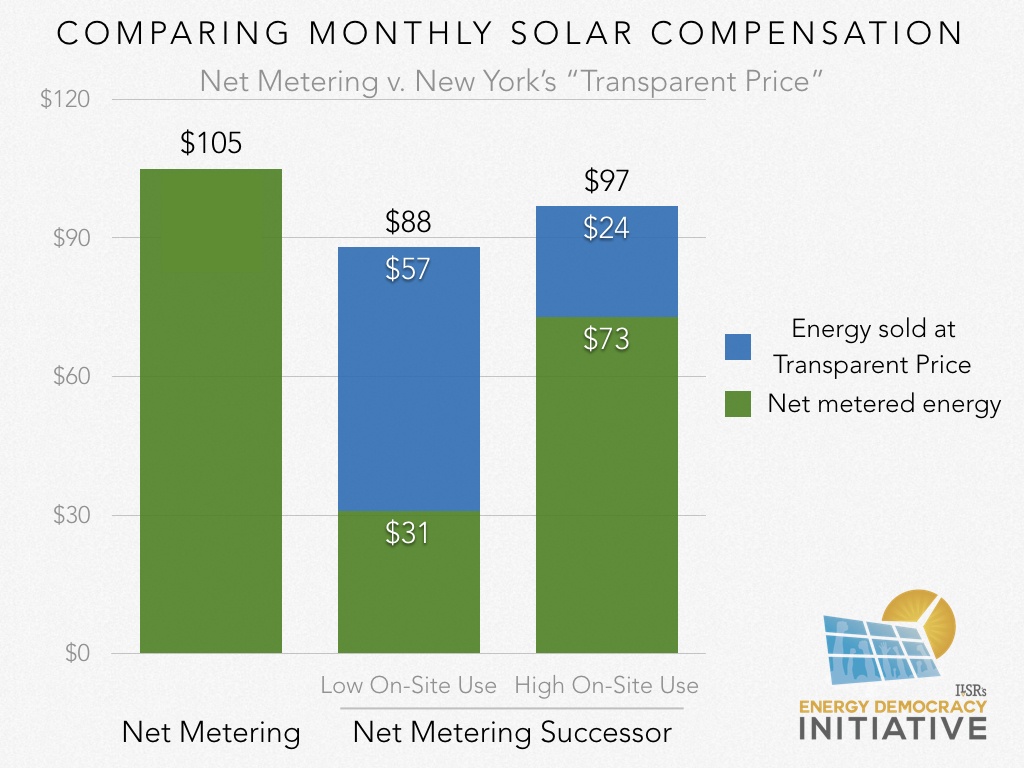

The energy may also be more valuable to the grid if it is consumed locally, as ILSR explains in our 2016 report, Is Bigger Best? In many debates nationwide over the proper valuation of solar, most policy outcomes include a higher value for energy that can be used on-site or locally, rather than exported to the larger grid. Utilities and regulators in Hawaii and New York, for example, have adopted measures for distributed solar that favor on-site consumption.

The energy may also be more valuable to the grid if it is consumed locally, as ILSR explains in our 2016 report, Is Bigger Best? In many debates nationwide over the proper valuation of solar, most policy outcomes include a higher value for energy that can be used on-site or locally, rather than exported to the larger grid. Utilities and regulators in Hawaii and New York, for example, have adopted measures for distributed solar that favor on-site consumption.

Resiliency

Electric vehicles can also provide individuals and communities greater resiliency in the face of natural disaster. In the wake of week-long power outages following Hurricane Sandy, many communities on the East Coast sought ways to reduce their reliance on their (often distantly located) utilities. Many states encourage the installation of solar energy generation and even microgrids, miniature versions of the electric grid that can operate when the larger grid goes dark. Microgrids, typically powered by solar and batteries, could use electric vehicles to soak up excess energy production — and keep it local — to provide power during extended grid outages.

A pilot project at the University of California-San Diego, a campus which supplies more than 90%t of its own energy, equipped its microgrid to host 70 electric vehicle chargers. The microgrid can ramp down charging to reduce campus-wide demand. In turn, drivers who allow flexibility in charging receive compensation when their vehicles perform services like frequency regulation. This symbiosis makes electric vehicle integration a compelling prospect for microgrid operators and vehicle owners.

“The link between a microgrid and an electric vehicle can create a win-win situation wherein the microgrid can reduce utility costs by load shifting while the electric vehicle owner receives revenue that partially offsets his/her expensive mobile storage investment,” researchers wrote in a 2010 study from the Lawrence Berkeley National Laboratory.

While microgrids currently comprise a small portion of the total U.S. electric generation capacity, their numbers are expected to double or triple within a decade — rising in tandem with electric vehicle ownership in the U.S. Particularly as both markets grow, outfitting microgrids with technology to tap into storage and ancillary services from electric vehicles can fortify local power systems. Together, electric vehicles and microgrids promote resiliency.

As noted above, electric vehicles may also offer a resiliency benefit to existing “microgrids” — homes. The typical second-generation electric vehicle battery (such as the Chevrolet Bolt) stores sufficient electricity to power the average American home for two days. This is a powerful secondary benefit for a purchase centered on mobility.

[RETURN TO TOP]The typical 2nd generation electric vehicle battery (such as in the Chevrolet Bolt) stores sufficient electricity to power the average American home for two days.

Rules to Maximize the Electric Vehicle Opportunity

With a virtuous cycle of falling battery costs driving increased electric vehicle deployment, and deployment improving the economics of scale of battery production, the widespread adoption of electric vehicles is likely inevitable. But policies enacted now could influence the timing of widespread use and shape how electric cars benefit the grid. The following section explores how policy can most effectively aid adoption of electric vehicles, in a way that maximizes their economic benefits to the grid and to vehicle owners.

Deploy Charging Infrastructure

Simplifying refueling with widespread vehicle chargers is key to capturing electric vehicle benefits. This means placing chargers strategically and offering sufficient charging speed to match the battery capacity and time available to charge.

For many individual vehicle or even fleet vehicle owners, charging while parked overnight will replace today’s regular visits to the gas station. Typical 120-volt outlets can fully charge cars with a smaller battery (like in the Nissan Leaf), from empty to full, in about 12 hours. However, the next generation of electric vehicles — the ones that will compete directly with internal combustion engines — need more power to refuel completely and quickly.

Charging infrastructure will also need to be available where people park, and not everyone has a handy garage or carport. In a presentation to the California Energy Commission, Nissan noted that fewer than half of today’s 140 million light-duty vehicles have a garage stall available. Over 60% of U.S. residents live in multi-unit housing that may lack charging options, and few workplaces or public spaces today feature vehicle chargers.

The local refueling network for electric vehicles will be substantially different than for gasoline vehicles. Many cars will charge at home overnight, only rarely requiring a public charge. Many more will want access to overnight charging when parked on-street.

This section explores charging infrastructure issues. It begins with long-distance travel, where high-voltage chargers will largely mimic the existing gas station network, then dives into the novel places that will need fueling infrastructure to accommodate a new electric fleet. Finally, it discusses the role of competition, incentives, cities, and autonomous vehicles in building out of electric vehicle charging.

For Long-Distance Travel

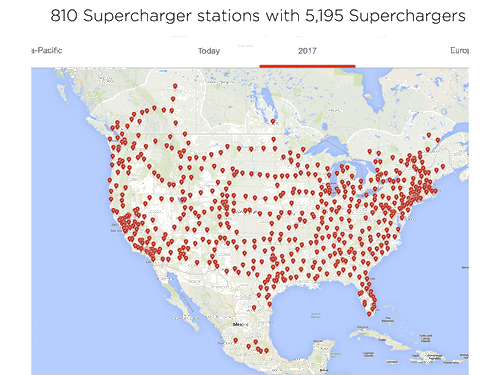

High-capacity charging to support long-distance travel is likely to follow the private market model for fueling gasoline-powered vehicles. Charging locations will be determined by vehicle battery capacity and commonly traveled routes. Already, Tesla has built a national network of 145-kilowatt “Superchargers” for its vehicles (shown below), which provide its vehicles 170 miles of range in about 30 minutes. Private company ChargePoint also provides high-voltage 50- to 400-kilowatt “Express Plus” chargers that offer fast charging for all electric vehicle models and are designed with future, higher capacity batteries in mind.

At Homes and Businesses

Placement of chargers in cities may follow different development models, and there’s a compelling case for utilities to be more heavily involved. While typical 120-volt outlets are ubiquitous in homes and businesses, they have two major drawbacks. First, they charge car batteries in hours, not minutes. Second, they tend to be in or attached to buildings, limiting charging options for those who park on the street or away from buildings in parking lots. The solution to both issues is deploying higher-voltage chargers wherever drivers park.

We’ll start with the simplest case: a driver who can park in a garage or driveway close to a building. In a scenario where their car battery has sufficient range and they plug in each night, a typical 120-volt outlet may be sufficient. But for those who want a faster turnaround either for multiple trips in a day, or simply the security of having a full battery sooner, a higher-voltage charger is desirable. For these folks, the barrier is the personal financial cost of such a charger, which usually runs around $1,200 for hardware and installation, split evenly between the charger and the cost to run a higher-amp, 240-volt wire to the charging location.

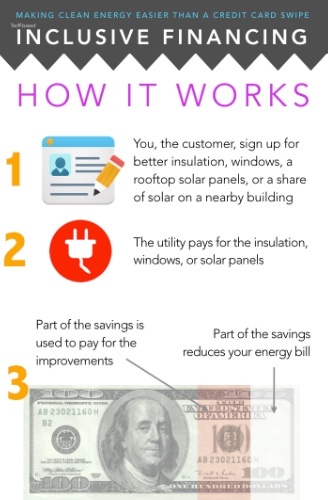

There’s a compelling case for electric utilities to pay for these chargers, and there are a couple of mechanisms for doing so. One is to provide inclusive, tariff-based financing. Under inclusive financing, the utility fronts the money for energy efficiency or renewable energy improvements (including electric vehicle chargers) on a customer’s property, then recovers the cost over time through the customer’s electricity bills. The timeline for cost recovery provides the customer positive cash flow from day one, but caps repayment costs at 80 percent of the total cost reduction. In this case, since there are no attributable energy savings (on the electric bill, though there are substantial savings at the gas pump), the term could correspond instead with the typical ownership period of a car, about six years.

A second financing option is traditional cost recovery, where the utility pays for the chargers but spreads the cost over the entire customer rate base.

In either case, the long-term revenue stream from electric vehicle charging justifies utility-managed financing. This is a similar approach to giving away light bulbs to drive sales in the early years of electrification. Utilities will see significantly greater revenue from electric vehicle charging. With typical driving patterns, the average household consumes an additional 4,000 kilowatt-hours per year after buying an electric vehicle. The incremental cost to the utility for delivery that energy is minimal, especially if charging plans reward the car owner for avoiding peak energy periods.

If a customer charges their car at the average retail rate of $0.10 per kilowatt-hour (assuming 30%, or $0.03, covers the fuel costs for generation), the utility would recoup the $1,200 cost of a home charger in a little over 4 years, less than the typical six years duration of vehicle ownership. Even at a discounted charging rate of $0.03 per kilowatt-hour for off-peak charging, the utility would recover the charger cost within 10 years. This may suffice, as it seems unlikely that customers will transition away from electric cars after owning one.

In Public Places Near Residences

Placing public charging stations near multi-family buildings or other residences lacking off-street parking is more complicated. For one, how can parking spots adjacent tor chargers be reserved for electric vehicles, especially in neighborhoods where parking spaces come at a premium? For another, how each charger support multiple vehicles if the tendency is to park the cars and leave them charging all night? The economic case for installing public on-street charging is strong if they are well-utilized.

If a pair of electric vehicles with 30 kilowatt-hour batteries were to park and completely refuel at a dual charger 300 nights per year at a cost of $0.05 per kilowatt-hour, the utility would recoup a total of $900 per year. That translates to a seven-year payback on the $6,000 public charger.

Chargers at businesses, built to serve customers or employees, might be simpler to integrate than on-street public chargers. Utilities may find an advantage in having these charging stations available to absorb daytime solar production, or for providing ancillary services to the larger grid. Businesses may simply offer charging as a convenience to attract customers, a benefit for employees, or as a tool to tap potential energy savings. In the latter case, customers could agree to make their batteries available briefly to help reduce the building owner’s peak energy use (perhaps in exchange for a discount in store).

No matter the method, private charging infrastructure will likely expand quickly as home or business owners purchase electric vehicles. Still, the charging logistics for those without off-street parking remains a challenge.

In Commercial and Other Spaces

Charging in public spaces (apart from residential locations) offers a less compelling economic case, but it may also prove less necessary in the long run. While existing electric vehicle owners may target a midday charge for evening errands or longer commutes, the next generation(s) of drivers are unlikely to need refueling beyond overnight charging. In the near term, however, there’s an opportunity to use public charging stations to encourage electric vehicle adoption and a craft a compelling economic case to finance them.

At a cost of about $6,000 per public charger (for dual charging stations), the utility would have to spread the cost over more customers than they would for home chargers.

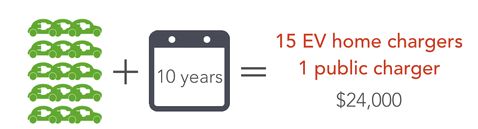

Aiming for a 10-year payback on public charging, the utility could finance a public dual charger for every 15 electric vehicle drivers. This assumes about $450 per year in revenue from each public charger (charging 25 kilowatt-hours per day at $0.05 per kilowatt-hour, and that the home customers are providing $120 per year each charging at $0.03 per kilowatt-hour). The utility uses the revenue to cover the cost of a Level 2 charger for each customer, plus the public station.

Deploying new public infrastructure is important. Nissan notes the number of public chargers per electric vehicle has slipped significantly in the last two years, from four cars per charger to over 14 cars per charger. This framework would reduce number of vehicles per public charger to 7.5 and remove the home charger cost barrier from electric vehicle ownership.

Utilities theoretically have the reach and scale to build out comprehensive networks across their service areas. At least one — California’s largest, Pacific Gas & Electric Co. (PG&E) — received regulatory approval for a proposal to add up to 7,600 charging stations across its 70,000-square-mile territory, at a total cost of up to $130 million.

A more expansive public charger network, like the one originally proposed by PG&E in California (with 25,000 Level 2 chargers and 10 fast chargers), would likely encourage electric vehicle ownership. But the larger PG&E proposal spotlighted questions about who bears the cost, and why it’s relatively high. Under PG&E’s plan, customers would cover the project’s $130 million price tag for charging stations (at a cost well over $15,000 per station). Consumer advocates raised concerns about the size and price tag of the project, and suggested a smaller pilot program to gauge benefits that come with more widely available charging stations. Although utility costs can be recouped by higher electricity sales, it’s important to get the price right, too.

Two other large utilities in California received approval for smaller charging station rollouts, at a smaller per-station price. San Diego Gas & Electric Co. will install 10 chargers each at 350 locations — including businesses and multifamily housing complexes — and implement special rates that reward drivers who plug in when solar generation is most abundant. The project will cost $45 million. Southern California Edison, meanwhile, plans to add 1,500 charging stations in a $22 million project. It will prioritize locations like workplaces and campuses, where drivers typically park for longer periods of time.

Public charging infrastructure can also be deployed with an eye toward equitable access. San Diego Gas & Electric Co., for example, plans to install 3,500 total public chargers and place 10 percent of them in disadvantaged communities. These chargers are a crucial complement to state incentives designed to increase ownership among lower-income Californians.

Charging “Depots”

Charging “depots,” where a fleet of electric vehicles can charge simultaneously in a single location, can provide a ready-made demand response resource.

These facilities could serve battery-powered taxis and commercial vehicles, as well as accommodate vehicles parked at workplaces. Solar panels atop charging depots could provide power, while locating them near substations could minimize power delivery costs. This system follows a method tested by Nissan at a Japanese office building, where the battery power held by six plugged-in Nissan Leafs enabled the automaker accommodate high demand and avoid peak charges.

The key for public depots is providing an incentive for fleet vehicles to stay plugged in. A taxi driver, for example, is unlikely to wait around longer than is necessary to fuel up for their next fare. On the other hand, autonomous vehicles (discussed later) may be the perfect match for these facilities.

Competitive Issues

Despite the logical overlap between electric vehicle charging and utilities, some private charging network operators have decried the use of ratepayer funds to support charging infrastructure, citing fair competition. It’s a challenging policy question in an era in which most technology lends itself to decentralization and greater competition. However, adding electric vehicle chargers is much like stringing the first wires — there’s a reason to avoid unnecessary duplication. One possible remedy is to prohibit monopoly utilities from installing chargers. This would require significant development of policies and protocols to ensure that private stations could interface with utility systems and allow for managed charging, but it may follow the direction of decentralization of energy generation already in motion.

Another option is to allow utilities to manage and finance a charging station rollout, but have regulators set competitive requirements. For example, regulators should require the utility to buy and install a variety of charging hardware, to test out different technologies. This method was recently proposed in comments filed in relation to an electric vehicle tariff program pilot in Minnesota. Another key element is “rolling qualifications,” or flexible purchasing standards that allow new charging hardware to qualify for build-outs that have already received approval, without having a second comprehensive regulatory review.

Incentives and Financing

Incentives and Financing

There are a range of incentives and financing tools for deploying charging infrastructure. State and federal incentives (the latter now expired) to subsidize at-home charger installations defray the cost for individuals, or could be passed directly to the utility to support greater deployment of public charging infrastructure. Some utilities offer rebates for chargers — the Los Angeles public utility, for example, offers a $500 rebate for a Level 2 charger and an additional $250 for those that install a second meter to access the time-of-use rate.

In California, property owners can tap into Property-Assessed Clean Energy (PACE) financing to pay for charging hardware and installation. In general, the program allows them to borrow funds for efficiency and renewable energy-focused upgrades, repaid through city-managed property tax assessments. Local governments in Florida, for example, have leeway to provide drivers with financing for eligible costs. Massachusetts, on the other hand, set aside grants to finance the equipment.

Utilities have also introduced tariff-based inclusive financing to pay the upfront cost of energy saving investments on private property, with costs recovered similar to how costs for power plants are recovered. This tool could similarly be used for electric vehicle chargers, given that the improvements in both cases provide a revenue stream for repayment — for efficiency or solar, from the improvement itself, and for chargers from electricity sales revenue increased by vehicle charging.

Role of Cities

Cities can lead on installation of public charging infrastructure, as a part of fleet transformation or emissions-reduction goals. For example, if cities adopt electric vehicles for fleet use, they can set up chargers that private drivers can access in the daytime, but are used for fleet vehicles at night. Cities can also work with utilities to ensure an equitable distribution of public charging infrastructure, to accommodate drivers who may not have access to off-street parking (or an at-home charger).

Los Angeles is a leader in charging station deployment, with 724 Level 2 charging stations and 16 DC fast charging stations available for public use (the latter available for free), in service of 13,000 vehicles, as of June 2015. The city expanded charging options through a multimillion-dollar rebate program that provides free equipment to residential and commercial properties.

Electric vehicle infrastructure can provide a springboard for cities to advance overarching clean energy goals. In 2012, St. Paul, MN, became one of the first U.S. cities to debut its own charging infrastructure. Two publicly accessible solar-powered chargers marked the beginning of a bigger network build-out, anchored in a park seen as a “regional destination” for electric vehicle drivers. Federal stimulus dollars covered about 60% of total project costs, while the city and utility Xcel Energy split the rest.

An Eye Toward Autonomy

Autonomous vehicles, typically using an electric drivetrain, present a potential complication for planning charging infrastructure. If these cars become ubiquitous, they may substantially alter vehicle ownership and use patterns. For example, if autonomous vehicles could be easily and inexpensively summoned on short notice, they could spur a sharp decrease in vehicle ownership, especially for households owning second (or third) cars. This shift would have substantial implications for charging infrastructure because instead of a large vehicle fleet that’s idle for over 90% of each day, we would have thousands of vehicles in near-constant use, requiring very fast refueling. Rather than heading to home garages with 6- to 8-kilowatt chargers, these vehicles might cluster at charging depots near utility substations, where they could access a charge at 100-kilowatts or more.

Tesla, the maker of the most highly touted battery-powered cars on the market, has said all of its vehicles will be equipped with hardware needed to enable self-driving technology. In addition, the company plans to roll out its own fleet of self-driving cars and a ride-hailing service, both under the banner of the Tesla Network. In particular, the ride-hailing element (similar to Uber and Lyft) would allow Tesla drivers to rent out their vehicles and capture a piece of the ride-hailing revenue. Through an app, Tesla owners could open their self-driving vehicles at any time to people seeking rides through the forthcoming network.

Unlike the existing Uber and Lyft models, Tesla owners would not need to actually drive their cars to pick up fares. In fact, they would not even need to be in them. The model potentially opens an ample value stream for vehicle owners to financially justify Tesla ownership.

Writing to Tesla owners in a “master plan” drafted in July 2016, Tesla CEO Elon Musk said, “You will be able to add your car to the Tesla shared fleet just by tapping a button on the Tesla phone app and have it generate income for you while you’re at work or on vacation, significantly offsetting and at times potentially exceeding the monthly loan or lease cost.”

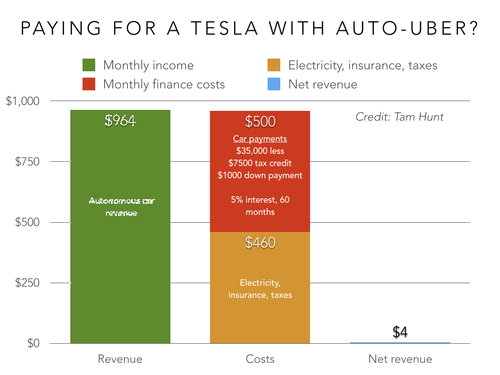

Writing in Greentech Media, Tam Hunt tabulated the possible payoff for the owners of automated Teslas, based on the $15 average hourly income for a part-time Uber driver in Santa Barbara, CA. If a Tesla owner rented their vehicle on the Tesla Network at that hourly rate for 15 hours per week, they would see $225 in weekly income, or about $964 per month.

Even subtracting $80 per month in electricity and insurance costs, plus 35% in taxes, the monthly takeaway is $504. That narrowly outstrips monthly loan payments for a Tesla Model 3 priced at $27,500 (after a $7,500 federal tax credit), with $1,000 down and a five-year loan with a 5% interest rate. Under those circumstances, Hunt estimates the “cost” of ownership is a net positive $4 per month.

Following Hunt’s logic, and assuming regulators sign off on both the introduction of automated vehicles and Tesla’s rideshare plan, a driver with good enough credit to access favorable financing could essentially own their Tesla for free (minus a $1,000 down payment).

Will this model actually emerge? It’s unclear, but we acknowledge this complication in electric vehicle infrastructure planning and suggest policy makers remain flexible as the technology is commercially deployed.

Providing Rates to Guide Charging

Providing Rates to Guide Charging

Low-cost charging rates represent the second major policy initiative for expanding electric vehicles. There’s ample evidence that utilities can use low rates to enhance grid benefits of, and customer savings from, electric vehicle charging.

Thus far, infrastructure has been a barrier.