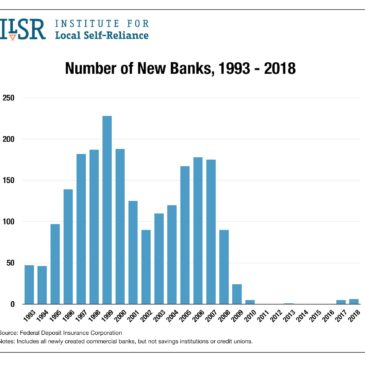

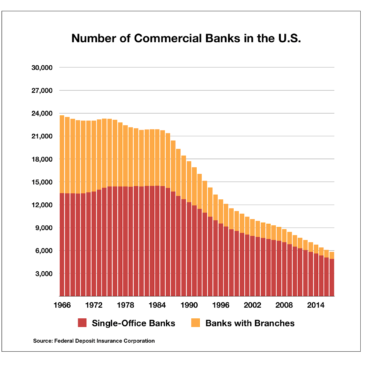

Community is Central to Building a Post-Neoliberal Future

Stacy Mitchell spoke at “Rethinking Globalization, Intermediation, and Efficiency,” on exploring new paradigms for a post-neoliberal world. Community, Stacy argued, is the foundational basis for this paradigm shift.… Read More