Banking Resources – Search Results

Page 2 of 3

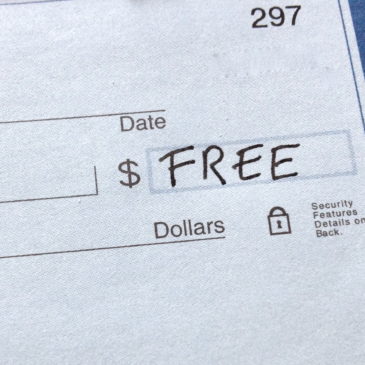

Free Checking is Rare at Big Banks, Common at Small

While just 24 percent of big banks offer totally free checking, more than 60 percent of credit unions and small banks do, according to a new report from the U.S. Public Interest Research Group. The report also found that credit unions and small banks have lower fees on average and do a better job of disclosing fees to prospective customers.… Read More

Too Big to Lend

A critical function of our banking system is financing small businesses. But big banks are doing a rotten job of it. At the nation’s largest banks, small business lending has plunged 33% since 2009. Trying to cajole or compel them to do more won’t make much difference because the problem is largely inherent to their scale.… Read More

Banking For the Rest of Us

In this cover story for Sojourners Magazine, Stacy Mitchell writes that there is remarkably little evidence to support the idea that bigger banks are superior. They have come to dominate, not because they are more efficient or offer better services, but because they have rigged government policy in their own favor. It’s time for a new set of rules—banking policies for the 99 percent.… Read More

How State Banks Bring the Money Home

One of the most significant consequences of the consolidation of banking over the last decade is how much it has hindered the economy’s ability to create jobs. There’s no single solution to this problem, but one of the most promising strategies involves creating state-owned banks that can bolster the lending capacity of local banks, helping them grow and multiply.… Read More

Why Republicans Hate Warren’s CFPB But Love Another Bank Regulator

What’s really at issue in the fight over the CFPB is not how the agency is structured or how much power it will have, but whose interests it serves.… Read More

And The Academy Award for Cowardice Goes To….

After winning an Oscar for Best Documentary for Inside Job, Charles Ferguson injected some much-needed real world relevance amidst the fabulously glitzy proceedings. … Read More

Federal Policy Threatens Local Banks, a Top Fed Official Says

A top Federal Reserve official says that locally owned banks do a better job of serving communities and small businesses, but they are threatened by federal policies that favor their big competitors. … Read More

Taking Financial Reform into Our Own Hands

How do we change course and revive a banking system that is more local and responsive to the needs of communities?… Read More

Credit Unions Hang Tough, See Surge in Deposits

In the perilous aftermath of one of the worst financial disasters in U.S. history, one might expect credit unions — which, after all, are mostly tiny by the standards of the banking industry and operated on a cooperative, not-for-profit basis — to be struggling. But data from the last 18 months show that the country’s 7,600 credit unions are in fact outperforming big banks and rapidly expanding their market share. … Read More

Five Reasons the Carper Amendment Must Be Defeated

One of the more menacing amendments circling the financial reform bill is a proposal by Senator Tom Carper (D-DE) that would bar states from enforcing consumer protection laws against national banks and would make it easier for banks to claim immunity from state laws they don’t like.… Read More

Bank Local: Indie Businesses Embrace Move Your Money

Across the country, independent business groups that have been urging people to "buy local" are now making "bank local" an increasingly prominent part of their message, bringing new grassroots visibility and organizational infrastructure to the Move Your Money movement. … Read More

What Big Banks Fear More than the CFPA

Hanging in the balance of the financial reform debate is an issue that has received far less attention than the Consumer Financial Protection Agency, but is at least as important and probably more so: whether Congress will restore the authority of states to oversee national banks.… Read More

Finally, a Bill to Reinstate Limits on Bank Size

Not one to let a good crisis go to waste, Bank of America managed, in the dark days of 2008, to parlay its own insolvency and near collapse into attaining something it had long dreamed of: federal approval to bypass a national law that says that no bank may acquire another bank if it would end up holding more than 10 percent of the country’s deposits.

Now, at long last, a new Senate proposal calls for reinstating strict size caps. It would mean disassembling at least five big banks.

Big Banks Want You Back

Those who wonder whether public anger at big banks and the Move Your Money sentiment sweeping the country is substantial enough to impact these giants need only look at the banks’ own marketing over the last few weeks to see the proof. … Read More

Move Your Money and Save

The biggest banks impose much higher fees on their customers than small financial institutions do. This is exactly the opposite of what was promised in 1994 and again in 1999, when Congress dismantled laws that had long restricted the size and scope of banks, ushering in a wave of mergers that left the industry dominated by a few financial giants. … Read More