I took the “no” side in a point/counterpoint in the Wall Street Journal this week on the topic: Will Solar Energy Plummet if the Investment Tax Credit Fades Away? It’s been a great conversation-starter, but also an opportunity to clarify ILSR’s position on the tax credit extension.

In short, while allowing the 30% tax credit to expire is not doomsday for solar, it’s bad policy. Congress should maintain support for a zero-fuel, zero-carbon energy resource that can decentralize the economic benefits of the power system.

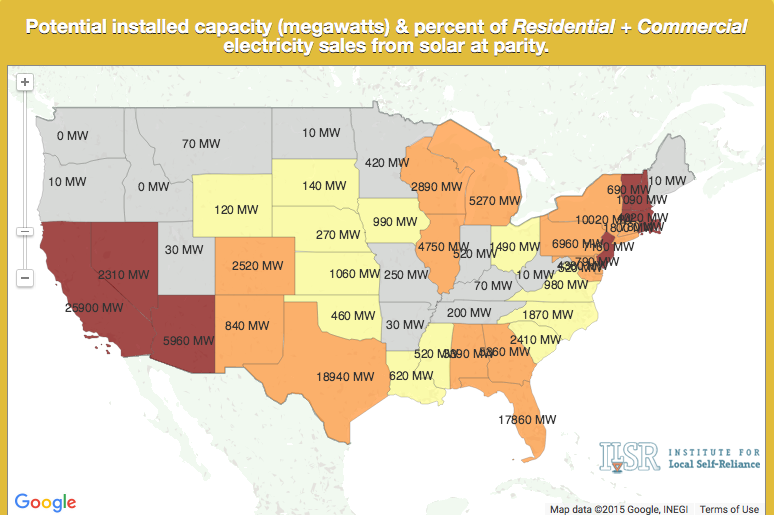

The biggest problem with killing the tax credit is that, as a blunt instrument, the tax credit doesn’t equally affect all communities. A solar array in Missouri or Minnesota, for example, produces 30% less (or more) electricity per year than one in California or Arizona. While the cost of solar electricity will be at parity with (or better than) electricity prices in the Southwest and some Northeast states by 2017, it will take several more years to reach parity elsewhere. Letting the tax credit expire will mire these markets at a crucial opportunity to get them launched. The following screenshot from ILSR’s interactive solar parity map shows the regional disparity in cost-competitive solar with no incentives in 2017.

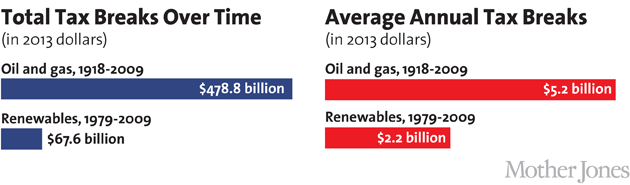

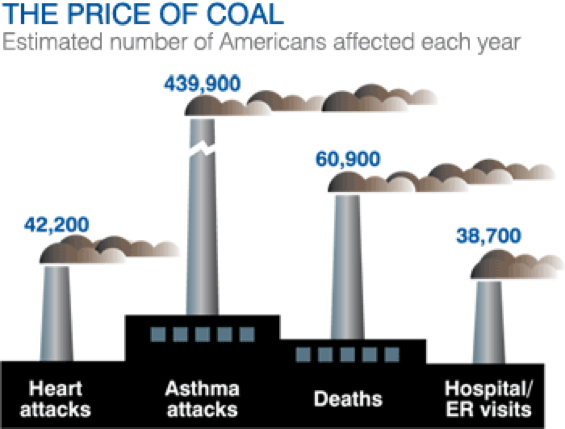

There’s also little point in reducing incentives for clean energy when we continue to subsidize dirty energy. In the last 70 years, the federal Department of Energy has spent twice as much money on fossil energy development as on renewables. And renewable energy has received only 14% of the tax break largess showered on fossil fuels through the last century, and less than half on an annual basis. That’s despite the fact that while solar has no meaningful environmental or health impact from generating electricity, fossil fuel sources like coal continue to socialize their costs.

Finally, solar energy gives most electric customers, for the first time, the power to choose their energy source, often as an alternative to an increasingly expensive product from a monopoly power company. These companies would like nothing better than to cripple competition for their increasingly costly electricity.

While it’s true that there may be some silver lining to the solar tax credit expiration cloud, it would create more harm than good to give coal and natural gas (and electric monopolies) a free pass while roadblocking solar by cutting the Investment Tax Credit.

Opportunities to Improve

Policy-making is rarely perfect, however, so I can’t resist suggesting a few ways Congress could make the solar incentive better rather than killing it.

1. Make it a cash payment. Cities, counties, schools, and other non-profit organizations can’t use tax credits at all, and many Americans lack the tax liability to use it even as new financing tools are allowing more of them to go solar. The result is the rise of middlemen that suck up much of the tax credit’s value.

2. Adjust it to the solar resource. Awarding the same $4,500 to identical 5-kilowatt solar arrays in Minnesota and California makes the former just competitive with retail electricity prices and the latter a windfall investment. In coastal Oregon, the same tax incentives may not be enough to provide any payback at all. Adapting the incentive to the solar resource would focus its power on the regions that need it most to get the solar market running.

3. Pay for performance. How do we make sure solar arrays are installed properly to maximize electricity production? If we pay for output, rather than simply discount the price up front.

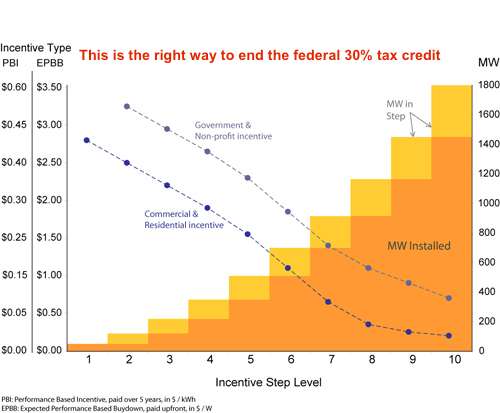

4. Phase out, don’t do lights out. If we truly care about allowing the solar industry to adjust to an incentive-free market, then copy one of the best solar programs out there—the California Solar Initiative. Incentive payments were tied to existing market capacity, stepping down as the market grew. The federal incentive could also be phased out on a predetermined schedule, reducing by 5% per year until it zeroed out in 2022.

The solar tax credit was a blunt instrument for energizing the solar market and it worked. It may be less efficient and less nuanced than it could be, but killing the tax credit isn’t the solution. Instead, ending the credit amounts to unilateral disarmament of solar energy in the face of fossil fuel competition, at an unacceptable cost to the environment, consumer choice, and the coming of energy democracy.

For further reading:

The Federal Solar Tax Credit Extension: Can We Win if We Lose?

Will Solar Energy Plummet if the Investment Tax Credit Fades Away?

This article originally posted at ilsr.org. For timely updates, follow John Farrell on Twitter or get the Democratic Energy weekly update.

Photo credit: 1upLego via Flickr (CC BY-NC-SA 2.0 license)