We’ve talked previously about the perversity of using tax credits to incentivize renewable energy production, increasing transaction costs and reducing participation in renewable energy development. But there are other perversities in U.S. state and utility renewable energy policies, especially with upfront rebates and net metering.

Let’s start with rebates. Many states and utilities offer upfront rebates for the development of solar PV projects (in dollars per Watt) and many of these rebates have a dollar value cap (e.g. $50,000). There’s a good illustration in a recent New York Times story:

“We could fit more on the roof, but we’ll max it out at 50 kilowatts,” said Mr. Ragozine, whose solar installation will cost about $275,000. “That’s a maximum rebate of $87,500.”

While the cap on rebate values can help stretch limited funds to more participants, it can also perversely increase the cost of solar to ratepayers. That’s because about half the cost of a solar installation is the labor cost to put up the array. It’s expensive to bring an installation team out to the job site, but once the solar installer is on-site, the marginal cost of adding more modules is a fraction of the cost to have a return visit.

It’s like having a plumbing problem – it’s $150 to get the plumber to your house, and then he’ll look at the leaky pipe. You might as well wait until all your faucets are leaking.

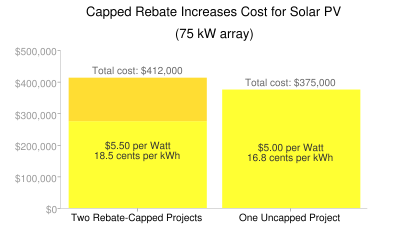

What difference do rebate caps make in solar costs? Let’s consider the 50 kW solar array being installed by Mr. Ragozine. If he were to install a 75 kW system instead, his material cost would likely scale up proportionately, but his labor costs would not. Instead, the total installed cost per Watt might drop from $5.50 to $5.00. The rebate cap is effectively increasing the price of solar, because rather than letting Mr. Ragozine maximize his solar production at a lower price, the rebate will subsidize a more expensive second installation.

What difference do rebate caps make in solar costs? Let’s consider the 50 kW solar array being installed by Mr. Ragozine. If he were to install a 75 kW system instead, his material cost would likely scale up proportionately, but his labor costs would not. Instead, the total installed cost per Watt might drop from $5.50 to $5.00. The rebate cap is effectively increasing the price of solar, because rather than letting Mr. Ragozine maximize his solar production at a lower price, the rebate will subsidize a more expensive second installation.

Net metering provides the same perverse incentive. In most cases, an individual whose solar array produces more than they consume in a year ends up giving that power to the utility for free. Thus, solar installations in the U.S. are carefully crafted to produce less than on-site consumption. The quote from Mr. Ragozine could just as easily have read:

“We could fit more on the roof, but we’ll max it out at 50 kilowatts,” said Mr. Ragozine, whose solar installation will cost about $275,000. “Any larger and we’d exceed net metering limits and be giving free power to the utility.” [quote made up]

What’s the answer? Paying for production.

In the U.S., we already use production payments instead of upfront payments to provide incentives for wind and other renewable energies, via the Production Tax Credit. However, being a tax credit rather than a cash payment, it has all the liabilities we’ve previously mentioned. It also means that while a renewable energy producer has a predictable partial revenue stream from the government, they still have significant uncertainty about their remaining revenue because they must negotiate a power purchase agreement with a utility or sell their power on the wholesale market.

A better strategy is to eschew both the tax code and upfront payments with a policy like the feed-in tariff. It’s an all-in payment to producers that reflects the cost of generation. It provides a guaranteed grid connection and a long-term contract, simplifying and lowering the cost of getting financing for renewable energy projects. And it removes the perverse incentive to cap renewable energy production (and thus increase the cost to ratepayers) because it pays the same price per kilowatt-hour regardless of system size or on-site consumption.

This policy in Germany has meant that most rooftop solar PV installations maximize the size of the system based on roofspace, not on-site consumption. It means that Germany gets more solar for less dollar (or euro), as well as far outstripping U.S. solar installations (installing more solar in early 2010 than the U.S. did in all of 2008).

U.S. state and federal energy policies help craft a market for renewable energy, but they fail to maximize the cost-effectiveness of renewable energy generation.