Podcast (buildinglocalpower): Play in new window | Download | Embed Subscribe: RSS

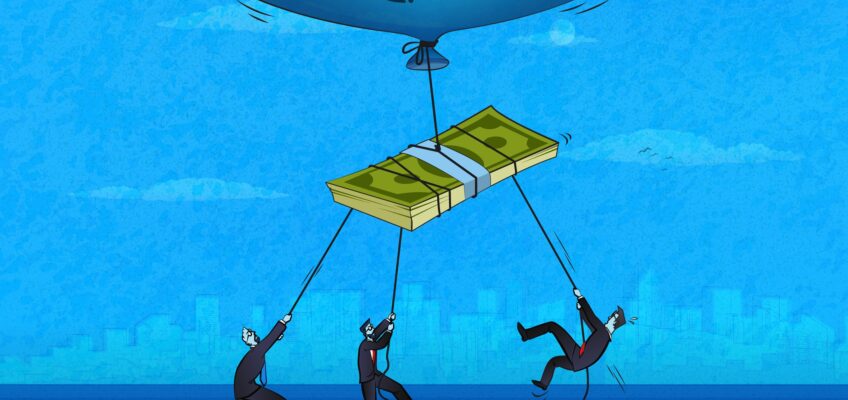

“For every crime, you need means, motive, and opportunity,” Rakeen Mabud explained on the Building Local Power podcast. Executives at some of the largest monopolies in our economy are using their market power to jack up prices on consumers. Their means is market power. Their motive is profit. What is the opportunity? The opportunity is for CEOs to pocket the revenue from price hikes while blaming inflation for the increases.

On this episode of Building Local Power, Rakeen Mabud the Chief Economist at Groundwork Collaborative and Ron Knox, Senior Researcher and Writer at the Institute for Local Self-Reliance, take us on a riveting journey exposing the story of inflation that most economists don’t want to tell.

As workers, citizens, and small businesses are made increasingly vulnerable in the face of rising prices, corporate profit margins are hitting a 70-year high. So, despite real issues with a broken infrastructure, the war against Ukraine, and a fragile supply chain, the recent history of unchecked mergers and corporate greed underlies much of what has left the majority of Americans so vulnerable in our economy today.

“The price hikes that we’re seeing now are building on decades and decades of disinvestment, corporate consolidation, and deep deregulation.” – Rakeen Mabud

“The history of unchecked mergers and acquisitions in this country has really contributed to the loss of our productive capacity. – Ron Knox

Groundwork’s Dossier of Earnings Calls Research

Work from Rakeen Mabud on the Supply Chain Debacle

Prices, Profits, and Power: An Analysis of 2021 Firm-Level Markups from the Roosevelt Institute

Thinking like an Economist by Elizabeth Popp Berman

Economics for Everyone by Jim Stanford

| Rakeen Mabud: | The price hikes that we’re seeing now were really brought to life and are building on decades and decades of disinvestment, corporate consolidation, deep deregulation. Which has paved the way in this moment, where we do have the excuse of inflation or the excuse of a war in Ukraine or the excuse of a COVID shutdown along our supply chain, for mega corporations to corner markets and increase prices on consumers, who have nowhere else to turn. |

| Reggie Rucker: | Hello and welcome to Building Local Power, a podcast from the Institute for Local Self-Reliance, dedicated to challenging corporate monopolies and expanding the power of people to shape their own future. I’m Reggie Rucker and I cannot wait to get into this discussion. In this episode, we’re talking about how corporate profit sharing and monopolistic tactics are contributing to record high inflation, not just harming individual consumers, but putting small and independent businesses at risk. But before we get into all that, let me introduce you to my co-host Luke Gannon. |

| Luke Gannon: | Thank you, Reggie. I am Luke Gannon and today we are welcoming a seasoned expert on the inflation debate, a nationally respected policy professional and the chief economist at Groundwork Collaborative, Rakeen Mabud. We are so delighted to have her on the show, along with anti-trust aficionado and phenomenal storyteller, Ron Knox, who is the senior researcher and writer on the independent business team at the Institute for Local Self-Reliance. Welcome Rakeen and Ron. |

| Rakeen Mabud: | It’s great to be here. |

| Ron Knox: | Hey Luke. Yeah, thanks for having me. |

| Luke Gannon: | Of course. |

| Reggie Rucker: | Inflation is obviously dominating the headlines. |

| Speaker 5: | Gas prices, soaring to the highest average ever recorded. |

| Speaker 6: | The price of ground beef and chicken have reached an all time high. |

| Speaker 7: | Inflation is taking a big bite out of Americans everyday budgets and savings. |

| Reggie Rucker: | Wages are going up, now we have this Inflation Reduction Act. Question is as we think about on one side of the ledger, the cost of living is going up, but then on the other side of the ledger wages are also going up. Don’t these things just cancel each other out? What’s the deal with inflation? What does it matter? Rakeen, do you want to take that one first? |

| Rakeen Mabud: | Yeah, I can definitely jump in. And it’s such an important question, right? Because I think when we talk about inflation, it often gets couched in these intangible economic terms, like interest rate hikes. What does that even mean? How does it affect real people’s lives, right? At the end of the day, we care about inflation, because we care about how it affects people and their ability to thrive. Inflation means rising prices for goods and services people need on a day to day basis, whether that’s gas to drive yourself to work, so you can participate in the labor market, food for your children, diapers for your kids, right? All of these costs are absolutely essential. And I think oftentimes we lose the human aspect of inflation. The other thing I’ll note here, is wages are rising, but wage growth is slowing. So we’re starting to see some tempering in terms of wage growth. It’s certainly the case that wages are not driving inflation, that’s pretty crystal clear at this point. |

| And at Groundwork, we often say we are the economy and that’s this idea that all of us create the economy, right? When all of us do well, that’s when the economy does well. And that’s particularly true for those who are most marginalized in our economy. And economic crises and inflation really hits folks who have always been at the margins of our economy the hardest. Black and brown communities are routinely left behind in recovery periods and because of the racism that is so deeply inbuilt into our economy, also tend to have lower incomes. So that means when prices rise, especially for big ticket and essential items, like rent, families who are already marginalized in our economy are pushed into crisis. And coming on the heels of two years of absolute chaos in our economy due to the pandemic, folks are already struggling and these rising prices are really taking a toll. | |

| Luke Gannon: | Awesome Rakeen, thank you. And I want to pass that over to you, Ron, for a minute. How is increasing inflation affecting small businesses? In what ways? |

| Ron Knox: | Probably the main way that I see rising inflation rates affecting small business, is simply the Fed’s response to inflation. I mean, you think about the way that policy makers respond when prices go up across the economy. They respond by raising interest rates. And that has outsized impacts on everyone in the economy, but in large part, that impact falls onto businesses that they find it more expensive to borrow and to get credit and to do the things that they need to do to run their business. So the knock on effect there, right? Is that credit’s more expensive, it’s harder to retain workers and pay workers a living wage, so what happens? When employment goes up, you evolve those effects across the economy for small businesses. |

| Often small businesses, especially thinking about bars and restaurants. You think about small businesses like that, right? They rely on easy access to credit in order to stock their kitchens and to stock their bars and to pay their workers and to do all those things they need to do to survive. When the Fed makes that harder by using this hammer of a solution, which is to raise borrowing rates, that’s going to hurt small businesses across the economy. Meanwhile, you have monopolists who have occupied almost every corner of the economy. Most big corporations are sitting on absolute piles of cash after the pandemic. They’re not having these same issues, they’re simply not. They’re able to use their market power just to raise prices, increase their margins, and all of those kinds of things. | |

| Luke Gannon: | Thank you, Ron. You made that transition for me. I think it’s so important to talk about who is hurting from rising inflation. And what I want to get at next is, what is driving inflation? You’re talking about these monopolistic corporations. So Rakeen, and I want to turn that over to you. |

| Rakeen Mabud: | Yeah, absolutely. And it’s a complicated story, because there are lots of different factors driving inflation right now. We have the pandemic, we have supply chain issues, we have the war in Ukraine, we have shifting demand, right? People are wanting different things after two years of quarantine in their homes and the list really goes on. But taking advantage, and Ron really set this up beautifully, I mean, taking advantage of all of these factors are mega corporations, right? They are using these crises to charge customers more and to pad their profits. And so ultimately, the story that we’re seeing in our economy today around inflation, is one about power, right? A lot of it boils down to market power. And I think it’s important, because I think as we’re going to get to later in the conversation, how we understand what’s driving rising prices also has deep implications for what our solutions set is, right? |

| And so let’s talk about market power. So big companies that dominate sectors are taking advantage of the fact that consumers have nowhere else to go. They have pricing power, I mean, literally companies get to set their prices, believe it or not. That’s somewhat controversial amongst economists, but it’s pretty obvious. It’s they have huge dominance in the industries where they can exert their market power and customers have nowhere to go. And one good example of that is the diaper sector. It’s an essential item for all new parents. And the world’s most popular are diaper brands. Huggies, Luvs, Pampers Pullups, we’ve heard of all of these. They’re all made by two companies, Kimberly-Clark and Proctor and Gamble. These two companies account for 70% of the US diaper market and both have increased prices sharply over the last year. So one thing that we’ve been doing at Groundwork is really digging into earnings calls, which is where corporate executives tell their shareholders and their investors, what happened last quarter and what’s going to happen in the next quarter. | |

| And on these earnings calls, these executives are not shy about the fact that they’re using their market power to jack up prices on consumers. So Kimberly-Clark, which is part of this big diaper duopoly was well aware that higher prices would, “Create stress on the consumer.” But that didn’t stop the company from implementing, “Multiple rounds of pricing on essential products families can’t do without.” Proctor and Gamble also planned to raise prices across most categories in the last couple of months. And you know who won from that? Shareholders. Shareholders got billions and billions and billions of dollars. And executives told analysts that consumers were responding well to price hikes, noting that they, “Don’t deselect their daily use of products like diapers.” Well yeah, they don’t deselect, because you have to put a diaper on your baby. | |

| I think it’s really important to note that this is the exertion of market power. The way I often talk about it is for every crime you need means, motive and opportunity. The means is that market power, these companies have had the power to set prices or go for market share for a really long time. The motive is the profit motive, these companies are trying to make many bucks, billions of bucks, and they’ve been doing that for a really long time. What’s changed and the reason we’re starting to see profiteering taking a little bit more that are justified by your higher input costs and then adding a couple of extra dollars on top or adding a couple of extra percentage points on top. The reason we’re seeing that gilding the lily, is because the opportunity to do so has changed. In this environment where prices are going up generally, consumers are not aware how much of the price hike they’re seeing, is because the input costs went up versus how much of it is that CEO just taking a little bit more to feed to their shareholders. | |

| And over and over again, as we look at these earnings calls, what we see is that it’s the latter, right? These executives are really taking advantage of these crisis to raise prices on consumers. And the last thing I’ll say, and I’m sure we’re going to get into this, is this is not a new problem. The price hikes that we’re seeing now, we’re really brought to life and are building on decades and decades of disinvestment, corporate consolidation, deep deregulation. Which has paved the way in this moment, where we do have the excuse of inflation or the excuse of a war in Ukraine or the excuse of a COVID shutdown along our supply chain, for mega corporations to corner markets and increase prices on consumers, who have nowhere else to turn. | |

| Ron Knox: | I just want to underline that, because all of that is exactly right. And I think that we’re seeing the exact same issues in the economy, in so far as the vast predominance of monopoly power and the long history of outsized corporate concentration in every part of the economy. And you see a through line from those issues to the issues that we’re seeing today around inflation. I just want to put a period under that, because I think that there is this information asymmetry, right? Where your average consumer goes to the store, they don’t know why they’re paying these prices. They say, “Oh, geez. Look how much the cost of chicken has gone up. It’s crazy.” Okay, here we go, I’m either going to get your money out of your wallet or you’re not. But the consumers don’t understand what’s behind that. |

| So it’s very easy to shift the blame, whether it’s in the media, whether it’s what the corporations themselves are saying. It’s easy to shift the blame on these price hikes to the cost of inputs, right? That’s the cost of workers, the cost of getting your supplies to market, the cost of shipping, all these things. Look, there is a truth behind a little bit of that, right? There have been price shocks. The nice thing is that we now have data and we actually know what’s going on in the economy. We can get a pretty clear picture of it. And what’s going on, is an issue that’s called markups. We know that in highly concentrated industries throughout the economy, there’s been a slow and steady climb in markups. That is what a corporation can charge their customers beyond the cost of actually making or obtaining a thing that they’re selling, right? So these markups have gone up since essentially the mid-eighties. And then the horizon markups really has started to accelerate over the last 20 years or so as the economy has become far more concentrated. | |

| So then you look at what happened in 2021, we see that these markups skyrocketed way beyond the cost of whatever a company might need to acquire in order to sell a thing, whether that’s workers, whether that’s diapers, whether that’s chicken, whatever the case might be. It’s the highest level on record and the largest one year increase on record, more than two and a half times any other annual increase in history. This is straight corporate profiteering, right? So these questions about what’s causing this inflation? What’s behind it? It is now very clear. The sledgehammer that the Fed uses to try to get inflation under control, which is to raise interest rates, it’s intended to bring wages down. But workers have already taken a bath in this economy with disinflation, right? Nominal wages have increased 5%. Inflation is at 9%, that means almost every worker in America’s taking a 4% pay cut during this economy. | |

| This isn’t workers that are driving the cost of goods and services going up across the economy. This is concentrated market power everywhere you look. I do also find it absolutely outlandish when you hear the CEOs of these monopolistic companies in earnings calls or wherever, talking about all of these record profits that they’re being able to rake in. I remember reading the transcript of an earnings call from Tyson Chicken, one of the monopolistic chicken producers and processors in America. And the CEO of Tyson Chicken used this code work. He said, “Actually, this is a way more inelastic market than we ever thought it would be.” What does the word inelastic means? It means that no matter where these corporations put their prices, they figured out that consumers are still going to buy the chicken. Unbelievable. So then you can see how these cost increases become dehinged from any other cost to the company. That’s just the exercise of this market power throughout the economy. | |

| Rakeen Mabud: | Ron, there’s so much to dig into what you just said, I don’t even know where to start. But I think where I’ll start is picking up where you left off. It will never not be surprising to me how obvious and blatant these CEOs are on their earnings calls. I mean, they’re not trying to hide it. They’re just saying the quiet part out loud, over and over and over again. And sometimes you read these quotes and you’re like, “Did you just really say that out loud? Like in a public record?” I mean, this is incredible, right? So just to give a couple of examples, one of the moments that really stands out is this brand called Constellation Brands. And it’s a beer, wine and liquor distributor that owns brands like Corona and Modelo. And this CFO on an earnings call told investors in one of the recent calls, that their company’s strategy was to, “Take as much as we can from our primarily Hispanic consumer base, as much pricing as we think the consumer will absorb.” And, “Make sure that we’re not leaving any pricing on the table.” |

| Meanwhile, the company also talked about how it had funneled over $1 billion to Wall Street through stock buybacks in 2021 alone. And then they subsequently beat expectations on earnings per share performance by over 12% in the latest quarterly earnings. So this is very clear, they know what their strategy is, they’re executing on that strategy. But that strategy is not just making a bunch of people rich, it’s not just making consumers poor. It is also really resulting in some deep harms. And I think an example that really sticks out to me, is the baby formula crisis. This is an incredibly concentrated industry. It’s a complicated industry, because of the way that baby formula interacts with WIC. But aside from that, it’s a pretty concentrated industry. | |

| Abbott, their product killed two children, made many children sick. And we only know that they had actually known about the problems in their production, because of a whistleblower. But at the same time, as they chose, actively chose not to invest in making their products safer and making their factory cleaner and coming up with baby formula that was safe, an essential nutrient that was safe for babies, they were funneling billions of dollars to their shareholders, right? So this is not just a fairness question, it’s a real question of harm. How much harm these companies are doing to our economy, to our trust in our economy and our trust in each other, it’s just really important to name. | |

| And then to Ron’s Fed point, when you start to really focus on the corporate profiteering piece of inflation, and it is a piece, I don’t think anyone’s trying to say it’s the whole story, but when you start to focus on that piece, you realize that your tool set for addressing rising prices is totally different than what most people think of when they think of inflation. I mean, to Ron’s point, when people think of inflation, they think, “Okay, the federal reserve is going to come in, they’re going to raise interest rates.” And the way interest rates work is by pushing down demand, making the cost of borrowing higher, pushing down demand, increasing unemployment and slowing down wage growth. So it’s just basically saying, “Let’s make people so poor that they can’t buy anything. And that’s how we’re going to solve the problem with rising prices.” But as we’ve just been talking about prices, aren’t rising because people have too much money in their pockets or are demanding higher wages, prices are rising, because these companies are using their market power and the cover of inflation and the cover of a war, to jack up prices. | |

| And so the tools look very different. The tools are no longer about the Fed they become about, what are the regulatory tools that we can use to crack down on profiteers and price gouging? What are the anti-monopoly and ant-trust tools that we can use to break up big businesses that are exploiting their market share? What are the critical investments that we need in our supply chains to make sure that we actually have something that’s built to deliver goods rather than built to deliver short term returns to mega corporations, who’ve already made a ton of money? So I think the story underlying price increases is just so important in part, because we can do a whole lot of harm if we let the Fed try to take this on. The Fed has acted really aggressively over the past couple of months and has had really limited impact. And I think it’s pretty clear and Jerome Powell himself has said, “Yeah, I can’t do anything about supply issues.” Right? And part of the reason we’re facing these supply issues, is because of all the things that we’ve just been talking about. | |

| Reggie Rucker: | We will be right back after a very short break. As an organization seeking the end of corporate control in local communities, you’ll understand why our commercial break sounds a little different. There’s no corporation selling you something in an ad, just me thanking you for listening to our show. And if you’re enjoying this episode, which if you’ve made it this far, I’m assuming you are, I definitely encourage you to go check out more of our work to build local power and support independent businesses at ilsr.org. Recently, we published a report on how new federal anti-merger guidelines can challenge corporate power. This is the type of work that your donations support, so that’s ilsr.org/donate to make contribution. Any amount is deeply, deeply appreciated. And if you’re looking for additional ways to support, please rate or leave a review of this show, wherever you listen to your podcast. These reviews make a huge difference in helping us reach a wider audience. Okay, that’s our break, thanks for listening and now, back to the show. |

| Ron Knox: | There hasn’t been a real increase in wages in 30 plus years in America. So what are the policy solutions? You look at the Inflation Reduction Act, as you mentioned, Luke. It’s trying to push some prices down, it’s trying to push the price, in particular of healthcare, down in America. But I always question whether those types of policy solutions are actually getting at the underlying problem that I see, which is highly concentrated markets all across the economy. You think about insulin, right? |

| Speaker 8: | While the skyrocketing cost of insulin is impacting millions of Americans who depend on it. |

| Ron Knox: | It didn’t get into the Inflation Reduction Act, unfortunately, but there was a push to try to cap the cost of insulin for private insurers at $35. That would’ve been great. But to me, it’s a bandaid, because the sale of insulin is highly monopolized. There are three drug makers that make insulin in America. This is an oligopoly market and they have unbelievable pricing power and they clearly use it and they clearly abuse it to the detriment of people, to the detriment of public health. So yes, you can cap these prices, that’s one thing you can do, but you’re dealing with a symptom and not the disease. And I think if you really want to try to deal with the disease in America, as Rakeen said, you have to get to some of these other real policy solutions, which are policy solutions that are going to both regulate and deconcentrate these parts of the economy. |

| Luke Gannon: | Yeah. Thank you for jumping in there, Ron. I think that was a really important point. And before we get to policy solutions for the future, I want to go back. Rakeen, you bring up this point, which is this question I have asked for many years, why do people so desperately want to make money at the expense of others? I’ll start with you, Rakeen. Can you talk about the policy choices, the historical policy choices that have led us to this point? |

| Rakeen Mabud: | Yeah, absolutely. And it’s worth noting that corporate profit margins are at a 70 year record high right now. So there are a lot of people making a lot of money off of people’s pain at the moment. I think your question is a really good one, because we have to go a little bit deeper, right? And as I laid out before, there’s means, there’s motive, there’s opportunity, but that means comes from somewhere. For half a century policy makers have allowed mega corporations to take over our supply chains. I think supply chains are a really good place to hone in, because they lay out the story really well. Those mega corporations put short-term profits over a functioning system for delivering goods. Corporate America is very good at lobbying. They are ruthlessly pursuing efficiency at all costs, right? And what we’ve seen is a wave of mergers and acquisitions, that consolidated our supply chains deeply and left it deeply brittle. |

| So take ocean shipping, there are three oligopolies that control, I think almost 90% of the ocean shipping market, right? So if anything happens to any one of those three units, global trade just falls apart. So this brittle supply chain that we have, has no backups, has no fail safes. And the reason it has none of that, is because it was built to maximize returns and that means cutting costs, right? That means cutting back on what you hold in the warehouse as a little bit of a backup. That means cutting back on worker wages and that means cutting back on job quality. And frankly, this is part of why we cease the proliferation of independent contract, is because it is cheaper to have an independent contractor than to pay fair wages and to pay benefits. | |

| So when we have such a brittle system, when we see a shock, like an economic shock, whether that’s an increase in demand or a COVID shock or whatever, that system falls apart. And the same companies who spent so many years advocating for this deregulation, advocating for this type of consolidation are now saying, “Oh my gosh, the supply chains, aren’t working, got to jack up my prices, so sorry.” This is a long term problem. And that’s why I said earlier, the inflation that we’re seeing now is just the tip of the iceberg. And so if we are truly to set ourselves up for an economic system that is resilient, that can handle shocks, to build a supply chain that can handle a little bit of different kinds of demand, we can do that. But it requires us to really interrogate what’s underlying a lot of it. | |

| Ron Knox: | I think what I’m hearing, is how our history of unchecked mergers and acquisitions in this country has really contributed to the loss of our productive capacity. The loss of productive capacity here through mergers, those chickens come home to roost when you have these supply shocks. And it’s not just that we have fewer factories making fewer things in fewer places, because that is what’s happening. And that is how you end up with these issues of strip supply when you have these shocks to the system. But you also end up with fewer workers and fewer workers working good paying, union, middle class jobs. I think about here in Illinois, where a merger between Whirlpool and Maytag shuttered one of the biggest washer and dryer plants in the country and led to a thousand layoffs, in what was essentially a company town that was built around this plant. And you layoff a thousand people in a place and the place just never recovers, right? And it hasn’t here in Illinois, still it’s not recovered. |

| You mentioned Constellation Brands earlier. I think about beer and concentration in the beer industry all the time. There are essentially three different companies in America that make beer cans. And two of them merged, a company called Ball and a company called Wrexham. When that happened, you had multiple beer can manufacturing facilities closed around the country. Then suddenly you have these shocks, these supply shocks. All of a sudden, because there is this stripped out capacity to make things in America, suddenly brewers can’t put their beer in cans. They don’t have the right sized cans, for example, in the case of Coors and others. So you see how these things can quickly cascade. | |

| Rakeen Mabud: | Yeah, I feel you Ron. And Luke, I wanted to also just return to a point that you made earlier that we don’t talk about the harms. I think about the trucking industry a lot, especially vis a vis consolidation and deregulation, which writ large across our economy, has left us with a really bare bones workforce, that relies predominantly or excessively certainly, on vulnerable and precarious workers who are often misclassified and exploited. And so truckers are a really good example like that, right? So time is a flat circle, so in the last couple of months, we heard a lot about trucker shortages, right? We heard a lot about, “Oh, there are no truckers, that’s why you’re not getting your goods, that’s why things are so expensive.” Big shipping companies like XPO were all over that story. |

| But the truth of the matter is that as many as 80% of port truckers are misclassified as independent contractors, that means that they don’t receive benefits. They’re not covered by minimum wage statutes. They have to pay for the maintenance of their trucks, their gas, their insurance, their repairs. In many cases, because of this broken supply chain we’ve been talking about, there were backups at the ports and truckers would wait in line for hours and hours, uncompensated by the way, because they’re not paid unless they’re actually driving. They weren’t even allowed to use the bathroom, because ports would only allow “employees” to use the bathroom, not people who are not considered employees. And so this is not an inevitable outcome, this is a set… The thing that got us to this point where big companies can decry trucker shortages, while we are literally not letting people do basic bodily functions have been a set of policy choices. | |

| Luke Gannon: | Yeah. |

| Rakeen Mabud: | It comes down to deregulation. Until the 1980s truckers, especially those on long haul journeys were employed by really regulated companies and were regulated by the Interstate Commerce Commission. Many drivers were unionized, they could expect a comfortable life of benefits and good pay. And the Motor Carrier Act of 1980 really sent us down a race to the bottom by deregulating the industry, by driving down trucker wages, working conditions and unionization rates. So we’ve never faced a trucker shortage, we’ve just faced a shortage of good trucking jobs. And that’s been spurred on by deregulation of this industry. And I say all that, because first of all, I think we often don’t talk about rising prices and the plight of workers in the same breath. And I think it’s important to link those two things. |

| But I also say that, because our economy is built on us. If we have truckers who are struggling to make do, struggling to put food on their table for their kids and struggling to get goods to our shelves, because that’s something we need, all of that makes our economy weaker. And again, this is none of this is inevitable, these are the result of many, many policy choices we’ve made over the course of decades and we can make different ones. And that is, to me, somewhat hopeful. I think the IRA is a good start there, right? We’re making some really critical investments. There are some provisions that really tackle healthcare costs in particular. And it’s an important first start and we need to do more. And there’s lots of other things that we can do to get at the tip of the iceberg that is the current inflation crisis, but really get under the hood, to mix a bunch of metaphors, of what’s gotten us to this point in the first place. | |

| Reggie Rucker: | It’s a great metaphor coming off the trucking example you just gave, so I love it. |

| Rakeen Mabud: | Oh, I appreciate that. |

| Reggie Rucker: | And then so with the little bit of time that we have left, I do actually just want to pick right up where you left off, Rakeen, with an abundance of options of how we could do more than even what this Inflation Reduction Act is bringing to us. And I know that with Groundwork, you do a lot of work, particularly thinking about those communities that are traditionally left behind in times of both economic progress and economic peril. Can you give us a little bit, some of the key priorities that you think we should be considering in terms of the policies to address inflation and make sure that communities aren’t being harmed, both in their access to quality jobs with high wages and consumers’ ability to get goods at prices they can afford? |

| Rakeen Mabud: | Yeah. And I’ll start by saying what we shouldn’t be doing, which is relying on the Federal Reserve to raise interest rates and throw us into a recession and make people so poor that prices come down. Because this is not a demand problem, this is a much more complicated story. Excess demand is not the reason we have high prices today. We absolutely should not be doing that, sadly, we are doing that. I mean, the Fed has raised interest rates several times over the last couple of months, and we’re anticipating seeing more in the coming weeks. And unfortunately, some of the most recent data around the labor market also, it’s great, because it means that we have some big jobs numbers, always mean that people are getting back to work and they’re able to access the labor market in ways they haven’t been able to. And it’s complicated, because I think it adds fuel to the fire that the Federal Reserve is going to raise rates again. So that’s what we shouldn’t be doing. |

| What we should be doing, I mean, we have a vast panoply of tools in our toolbox that we can be using to take on rising prices. That ranges from regulatory actions by the FTC and the DOJ to crack down on corporate profiteering, to start to crack down on excessive market power. It means making really critical investments in our supply chain, actually creating a system that is resilient and can handle some shocks. That’s a policy choice that we’ve built a system that can’t, we can do that. We should tax corporations, right? We should actually make them play their fair share and also decrease their incentives to do this behavior. And there are some provisions in the Inflation Reduction Act that get to that, in particular, the excise tax on stock buybacks, which is a way of funneling money to your shareholders by buying your shares back from the market and artificially raising the value of your firm. | |

| There’s actually a lot that can be done at the state and local level. So three quarters of state attorneys generals have a federal price gouging statute in place. So let’s empower them to go after price gougers, let’s create a federal price gouging statute at the federal level. I can go on and on. But the point is we often think of inflation and the reaction to inflation as solely in the purview of the Fed. That framework is really causing us way more harm than good. We’ve seen in the past what happens when we rely on the Fed, right? The Volcker Shock is a great example of what happens. The Volcker Shock is essentially a rapid rise in interest rates in the seventies and eighties, when it basically threw the economy into recession. | |

| But in particular, through Black communities and brown communities into a devastating crisis. And it’s always the people who are forced to be at the margins of our economy, who are hurt the most. Let’s actually take some proactive steps to take on prices. Let’s take proactive steps that don’t do harm and aggressive interest rates hikes would simply throw millions out of work, push our economy into recession. And in particular, harm the communities who have always taken the biggest brunt. And that’s not good for them, it’s frankly not good for our economy and we are all losers as a result of that. | |

| Ron Knox: | Yeah. I mean, that’s absolutely right. I think at some point, we in America have to get very serious about the structure of our economy. And the ways in which we need to change that structure in order for our economy to function as it was supposed to and function to the benefit of regular working Americans all over the country in every community. I think when you have this outsized monopoly power in industry, after industry, and you have this unrestrained power to set prices as they wish beyond any other economic forces of supply and demand and input costs. When you see this market power that’s being exerted in this way, I think the solution ultimately, has to be to help to change the structure of these industries. Luckily, we have regulators in place at the moment at the Federal Trade Commission and the Department of Justice who are also interested in this project. |

| I think that fingers crossed, over the next few months we’re going to see new merger guidelines that are going to be aimed at both curtailing this current wave of mergers, that as we’ve said, has contributed to this problem of monopoly across the economy. Not only curtailing these future mergers, but casting an eye on these very concentrated markets in a way that promotes deconcentration, promotes new entry, promotes new competition, promotes small businesses and independent businesses coming up and thriving and becoming viable in these markets. I think only through these kinds of forces, are you going to really see the change that we want to see and prevent this inflationary pressure in the future. | |

| Rakeen Mabud: | I just wanted to add to Ron’s point, which is market power is critical and tackling market power in and of itself is absolutely essential to bringing down prices. And I think we have to think about what some of these counterbalancing powers are too. I mean, one of the great ways to tackle market power is to empower workers to have agency in their own lives, to have agency in their workplaces, to have agency against employers. And passing the PRO Act would also be a great way to address the power imbalances that are really at the root of many of the problems we’re talking about. |

| I think we also need more accountable public power. That means investments that are critical, about using our public resources for good, making sure that government is accountable to the people. I totally agree that tackling market power in and of itself is a key part of this. And I think we should make sure we don’t forget that there are other tools there too, like really empowering workers, really empowering the public to take on some of these issues as they should, because they affect all of us, is also a big piece of the puzzle. | |

| Ron Knox: | Amen to all of those things. |

| Luke Gannon: | Yes, absolutely, amen. I’m going to pivot to our last question and that is, what book has made a big impact or has influenced the work that you do today? And I’ll start with you, Rakeen |

| Rakeen Mabud: | I think this book is changing the way I am thinking about these issues. It’s one that I’m reading now, so I will come back on the pod if you’ll have me and give you a full review. But I’ve been reading Elizabeth Popp Berman’s new book, Thinking Like an Economist. And it’s really about how a very new, liberal version of economic thinking has infiltrated the way that we think about policy in our policy choices. And it’s just a fascinating historical account. I think it tells us a lot about the tools that we use to analyze and look at the problems in front of us and how those tools themselves lead to a set of conclusions that are often really misguided and don’t allow us to focus on the right thing. So that’s the book that I’m at least in the middle of right now, and really enjoying and learning a lot from and would recommend. And is I think, changing and reinforcing many of the things that I’ve been thinking about. |

| Reggie Rucker: | So Rakeen, we will definitely have you back on the podcast and would love to hear what the final analysis is once you’re done. But Ron, how about you? |

| Ron Knox: | The first book that jumped to my mind was a book by an Canadian economist named Jim Stanford. He’s the founder of the Progressive Economics Forum and the director of the Center for Future Work up there in Canada. And he wrote a book called Economics For Everyone. It has a subtitle, a short guide to the economics of capitalism. But I was already well into my career writing and thinking about anti-monopoly and anti-trust when I read that book. And when I read that book, I was like, “Oh, this is how it all works.” It unlocked a lot for me about different pressures in the economy and the ways that the market power and the corporate power works, including on inflation. So that’s a good one, I would recommend that to anyone. |

| Luke Gannon: | Awesome. I have a very long list now from doing this podcast of books I need to read, but I love adding to it, so thank you for those recommendations. This has been a brilliant conversation, I’ve learned so much. Thank you so very much, Ron and Rakeen, we so appreciate you being here. |

| Reggie Rucker: | Yeah, this was a great conversation. Thanks both. |

| Ron Knox: | It was a lot of fun guys. Thank you. |

| Rakeen Mabud: | Thanks for having me. |

| Reggie Rucker: | All right, folks. Thank you for tuning in to this episode of the Building Local Power podcast from the Institute for Local Self-Reliance. You can find links to everything discussed today by going to ilsr.org and clicking on the show page for this episode, that is ilsr.org. |

| Luke Gannon: | And we have tons of ways for you to get involved in our work. You can sign up for one of our many newsletters, you can connect with us on social media, or even reach out with a podcast guest. All of your reviews, likes and donations help produce this very podcast and support the research and resources that we make available for free on our website. This show is produced by Reggie Rucker and me Luke Gannon. This podcast is edited by Drew Birschbach. Our theme music is Funk Interlude by Dysfunkshunal. But before we end, you can find more information about why inflation is at a record high at groundworkcollaborative.org. This is Building Local Power. |

Like this episode? Please help us reach a wider audience by rating Building Local Power on Apple Podcasts or wherever you find your podcasts. And please become a subscriber! If you missed our previous episodes make sure to bookmark our Building Local Power Podcast Homepage.

Like this episode? Please help us reach a wider audience by rating Building Local Power on Apple Podcasts or wherever you find your podcasts. And please become a subscriber! If you missed our previous episodes make sure to bookmark our Building Local Power Podcast Homepage.

If you have show ideas or comments, please email us at info@ilsr.org. Also, join the conversation by talking about #BuildingLocalPower on Twitter and Facebook!

Subscribe: Apple Podcasts | Android | RSS

Audio Credit: Funk Interlude by Dysfunction_AL Ft: Fourstones – Scomber (Bonus Track). Copyright 2016 Licensed under a Creative Commons Attribution Noncommercial (3.0) license.

Photo Credit: Worcester Youth Collaboratives

Follow the Institute for Local Self-Reliance on Twitter and Facebook and, for monthly updates on our work, sign-up for our ILSR general newsletter.