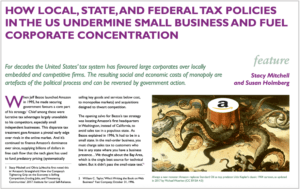

Amazon’ strategy for dominance — which includes securing government favors, particularly tax advantages — offers a road map of how to harness the tax system to build a monopoly.

As Stacy Mitchell and Susan Holmberg explain in a special Tax and Monopoly edition of the UK publication Tax Justice Focus, while Amazon is particularly deft at playing this game, most of the giant corporations that now dominate their industries owe their market power in part to government handouts and tax favors. For decades, local and federal U.S. policymakers have systematically structured the tax system to fuel the concentration of corporate power at the expense of everyone else, including small businesses.

Tax loopholes at every level — from dark store property tax breaks to state and international tax havens — work to build monopolies and disadvantage small businesses. Yet, small businesses prove time and again their value in communities: Small banks are better at making productive community-based loans. Small companies produce more patents per employee. They offer better wages, foster economic vitality, and nurture democracy through community self-determination. Centering small business should be at the center of an antimonopoly tax agenda, Mitchell and Holmberg argue. It’s good politics and good policy.

“If U.S. progressives advance an antimonopoly tax agenda, they can recover a populist politics, which would help them compete in rural areas and swing states, drawing in voters who are yearning for a fairer, more equitable economy. Stronger tax and spending policies, at every level of government, is an essential spoke on the wheel of strong antimonopoly reform. When our tax system is built to foster fairness and justice in addition to vitality and economic growth, it can help to restructure economic power and more broadly distribute and boost prosperity.”

Read the issue here.

If you like this post, be sure to sign up for the monthly Hometown Advantage newsletter for our latest reporting and research.