Last Updated: March 23, 2023 (First Published: Oct. 2018)

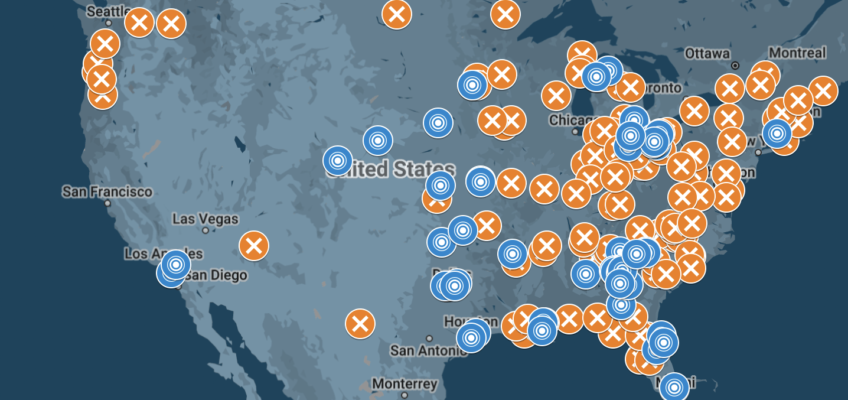

Chain dollar stores are multiplying rapidly. Since 2011, the two dominant chains — Dollar General and Dollar Tree (which owns Family Dollar) — have grown from about 20,000 locations to more than 35,000 total. Both plan to expand even further. In 2023, the two chains indicated that they have plans to expand to a combined total of 51,000 outlets.

Chain dollar stores can create many problems for communities, from crime to traffic congestion. But one of the most serious problems is their impact on existing businesses and, in particular, on grocery stores. Most chain dollar stores stock only a limited selection of fresh or frozen vegetables, fruits, or meats. Even those that offer an expanded selection of fresh food, like DG Market and Dollar Tree Plus!, still provide only a fraction of the fresh food that a grocery store of comparable size offers. Yet, in urban neighborhoods and small towns alike, the dollar chains are opening stores at such a density that they crowd out full-service grocery stores and make it nearly impossible for new businesses to start and grow. This has exacerbated the problem of food deserts and further eroded the economic prospects of vulnerable communities.

As we noted in our 2023 report: “One might assume that the dollar chains are simply filling a need, providing basic retail options in cash-strapped communities. But the evidence shows something else. These stores aren’t merely a byproduct of economic distress; they are a cause of it.”

A growing number of cities are now responding to the influx of these stores by enacting policies that limit new dollar store development. Two approaches in particular are being used across the country — formula business restrictions, which place limits on chain stores generally, and ordinances that specifically target dollar stores.

Formula Business Restrictions

Formula business restrictions are one option for restricting the development of chain stores — including dollar stores — while fostering a balanced mix of businesses. These policies limit formula or chain retailers that have standardized services, methods of operation, and other features. Find examples and learn more about formula business policies here.

Dollar Store Dispersal Ordinances

A growing number of cities and counties are developing dollar store-specific policies. One approach, known as a “dispersal restriction,” sets limits on how close new dollar stores can be to existing ones (typically between 1-5 miles). Such policies take into consideration the existing concentration of dollar stores within a neighborhood or city and help ensure that these chains cannot be developed at such a density that they impede opportunities for grocery stores and other businesses to take root and grow.

In 2018, for example, the city of Tulsa, Okla., drawing on ILSR’s Policy Tools, amended its zoning code by passing an ordinance that restricts new dollar store development in north Tulsa, a predominantly Black area on the city’s north side. North Tulsa is home to many dollar stores, some just blocks apart. “That proliferation makes it more difficult for the full-service, healthy stores to set up shop, and operate successfully,” notes Tulsa City Councilor Vanessa Hall-Harper, who led the effort to pass the ordinance. Similar policies have now been adopted in dozens of other cities, and many other cities are studying the issue.

In addition to enacting a dispersal rule, some cities have also made dollar stores a “conditional use,” requiring them to meet certain conditions, such as not having a negative impact on existing food stores, in order to receive a permit to open.

Considerations in Drafting an Ordinance to Limit Dollar Store Development

Articulate a Clear Purpose

Cities enacting dollar store policies should articulate a clear purpose and tie the policy to a broader public goal. For example, the Tulsa City Council outlines its desire for “greater diversity in retail options and convenient access to fresh meats, fruits and vegetables.” Kansas City says the purpose of its ordinance is to “better regulate the total number and proximity of small box retail stores to assure the best possible opportunity to provide fresh fruits and vegetables to the community.” Mesquite’s ordinance addresses the concern that “residents typically have more access to convenience stores and fast food than to nutritious food.”

Define “Dollar Store”

Cities need to define which stores are subject to the policy. Tulsa’s ordinance defines “dollar stores” as those with “retail sales uses with floor area less than 12,000 square feet that offer for sale a combination and variety of convenience shopping goods and consumer shopping goods; and continuously offer a majority of the items in their inventory for sale at a price less than $10.00 per item.”

Kansas City adopted a more generalized definition of a “small box variety store,” which is a store of “15,000 square feet or less which sells at retail an assortment of physical goods, products, or merchandise directly to the consumer.”

Limits on Dollar Store Density

Most dollar store ordinances regulate these developments by limiting their density, setting distance limits between existing and new dollar stores. The Tulsa ordinance creates a “dispersal standard” requiring a new store to be a minimum of 5,280 feet (one-mile) from an existing dollar store. Stockbridge, Ga. initially required one mile of distance from an existing discount store, then later increased the required distance to five miles. In Kansas City, Kan., the ordinance included both a separation requirement of 10,000 feet from an existing store and 200 feet from residentially zoned property.

Some ordinances define an overlay district or area where the density limits go into effect, while others apply citywide or countywide.

Supporting Alternatives to Dollar Stores

In addition to the dollar store density requirements, these policies can also include incentives to foster better alternatives. To encourage the development of stores that sell fresh meat and produce, Tulsa’s policy reduces parking requirements for grocery stores by 50 percent in the overlay district covered by the ordinance. Kansas City’s policy exempts stores that dedicate at least 15 percent of shelf space to fresh and frozen food or those that contain a prescription pharmacy from the required special use permit process.

Public Participation

As dollar store policies are crafted, cities can gather community input through hearings and public comment periods. These are important ways to develop policies that respond to local needs and goals. For example, Tulsa’s ordinance grew out of a community-driven effort to stop new dollar stores from opening in the neighborhood. This led the city to adopt a temporary moratorium on dollar stores, during which the city council held hearings to better understand the issue and develop its policy.

You can find more information on restricting dollar store development in Stop Dollar Store Proliferation in Your Community: A Strategy Guide.

Examples

- Birmingham, Ala. — In 2019, Birmingham City Council approved a healthy food overlay district, which included a dollar store dispersal policy.

- Apopka, Fla. — Enacted a moratorium on new dollar store development in August 2021 to provide time to study the issue.

- Lauderhill, Fla. — Adopted a dollar store dispersal ordinance in 2019, with a one-mile separation requirement.

- Atlanta, Ga. — Adopted a dollar store dispersal ordinance in December 2019 for most of the city’s neighborhoods, with a one-mile separation requirement.

- Riverdale, Ga. —Adopted a dollar store dispersal ordinance, with a one-mile separation requirement. The ordinance also requires that at least 500 square feet of store space must be devoted to fresh produce, dairy products, and meat products.

- Palm Coast, Fla. — Requires a special use permit if located within 500 feet of a residential property.

- East Point, Ga. — Adopted a dollar store dispersal ordinance in 2020, with a two-mile separation requirement (can be reduced by 50 percent if 10 percent of a store’s parking spaces or interior space is donated to farm stands for fresh produce).

- Henry County, Ga. — Adopted a dollar store dispersal ordinance in 2020.

- Forest Park, Ga. — Adopted an ordinance in 2021 limiting the number of business licenses given to dollar stores to three, with one additional license for every 5,000 new residents beyond 30,000.

- South Fulton, Ga. — Adopted a dollar store dispersal ordinance, with a one-mile separation requirement.

- Stockbridge, Ga. — Adopted a dollar store dispersal ordinance in July 2019, with a one-mile separation requirement. In July 2021, the City amended the ordinance to require five miles of separation from any similar store within or outside the city limits.

- Stonecrest, Ga. — Adopted a total ban on new dollar stores in 2019.

- Kansas City, Kans. — Adopted an updated dollar store dispersal policy in 2019.

- Roeland Park, Kans. — Adopted a dollar store dispersal ordinance in 2016, with a 5,000-foot separation requirement.

- New Orleans, La. — Adopted a dollar store dispersal policy in 2019, along with a number of other food-related policies recommended in a 2018 study of dollar store impacts on food access.

- Melvindale, Mich. — Adopted a dollar store dispersal ordinance in November 2019, with a half-mile separation requirement; the ordinance also requires that 15 percent of the floor area must be dedicated to fresh produce, dairy, and meat products, and it makes dollar store development a conditional use, dependent on whether the proposed store is likely to have a detrimental impact on the development of grocery stores and other stores offering healthy food.

- Plainview, Neb. — Adopted a dollar store dispersal ordinance in 2021, with a one-mile separation requirement.

- Akron, Ohio — Adopted a dollar store dispersal ordinance in September 2019, with a 2,500-foot separation requirement.

- Brunswick, Ohio — Adopted an ordinance in January 2022 that prohibits a new dollar store from locating within two miles of an existing dollar store and requires new dollar stores to devote a certain minimum percentage of shelf space to fresh food.

- Oklahoma City, Okla. — Enacted a moratorium on new dollar store development in 2019, while the city considered other dollar store restrictions.

- Tulsa, Okla. — Adopted a dollar store dispersal policy in 2018.

- Mauldin, S.C. — Adopted a dollar store dispersal ordinance in 2020, with a one-mile separation requirement.

- Fate, Texas — Adopted an ordinance in 2021 that requires proposed dollar stores to obtain a special use permit, dependent on whether the proposed store is likely to have a detrimental impact on the development of grocery stores or other stores offering healthy food; whether it is within one-half mile of an existing grocery store; and whether it would be located within a food desert, as defined by the US Department of Agriculture.

- Fort Worth, Texas — Adopted an ordinance in December 2019 that prohibits a new dollar store from locating within two miles of an existing discount store and requires new dollar stores to devote at least 15 percent of the floor area to fresh produce, meat, and dairy products.

- Manvel, Texas — Adopted an ordinance in 2020 that requires a two-mile separation from other dollar stores, convenience stores, and gas stations.

- Mesquite, Texas — Adopted a dollar store restriction policy that makes dollar stores a “conditional use” and imposes a dispersal standard in 2018.

- Oshkosh, Wisc. — Adopted an ordinance in 2021 that makes large or small discount stores, chains, and franchises conditional uses.

More:

- The Dollar Store Invasion — ILSR’s 2023 report on how misguided policies, particularly those governing antitrust and finance, are fueling the destructive proliferation of dollar stores.

- Stop Dollar Store Proliferation in Your Community: A Strategy Guide — a step-by-step toolkit for local advocates, officials, and organizers.

- 17 Problems: How Dollar Store Chains Hurt Communities — a comprehensive accounting of these dollar stores’ economic and social impact.

- Toledo Takes Dollar Stores to Church, on ILSR’s Building Local Power Podcast

- More Cities Pass Laws to Block Dollar Store Chains — A September 2019 legislative update.

- “Dollar Stores Are Targeting Struggling Urban Neighborhoods and Small Towns. One Community Is Showing How to Fight Back.” — ILSR’s in-depth 2018 report exploring the impact and growth of dollar chains, and what cities are doing about them.

- New Maps Show Alarming Pattern of Dollar Stores’ Spread in U.S. Cities (2019)

- Reining in Dollar Stores: Episode 59 of ILSR’s Building Local Power Podcast

If you like this post, be sure to sign up for the monthly Hometown Advantage newsletter for our latest reporting and research.