In March 2014, Minnesota became the first state to adopt a “value of solar” policy. It may fundamentally change the financial relationship between electric utilities and their energy-producing customers. It may also serve as a precedent for setting a transparent, market-based price for solar energy. This report explains the origins of value of solar, the compromises made to get the policy adopted in Minnesota, and the potential impact on utilities and solar energy producers.

Read our blog series on Minnesota’s value of solar

Get email updates from ILSR’s Democratic Energy program!

The Value Of Solar Concept

The basic concept behind value of solar is that utilities should pay a transparent and market-based price for solar energy. The value of solar energy is based on:

The basic concept behind value of solar is that utilities should pay a transparent and market-based price for solar energy. The value of solar energy is based on:

- Avoiding the purchase of energy from other, polluting sources

- Avoiding the need to build additional power plant capacity to meet peak energy needs

- Providing energy for decades at a fixed price

- Reducing wear and tear on the electric grid, including power lines, substations, and power plants

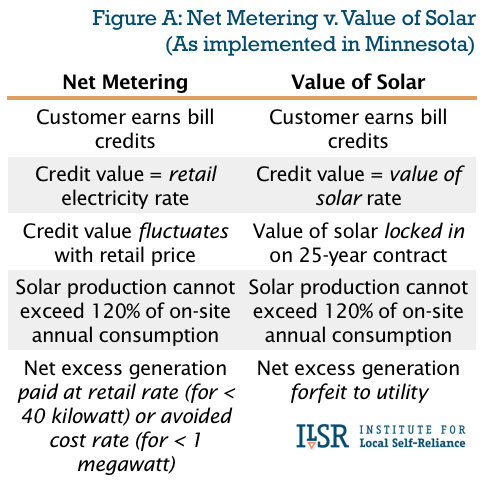

Value of solar is not like net metering, where producing energy reduces your electricity bill just like turning off a light. Fig. A illustrates the difference between net metering and value of solar in Minnesota. It also highlights a few key features of the adopted value of solar policy, including the 25-year contract, and the use of bill credits rather than a separate cash payment.

Minnesota’s Value of Solar

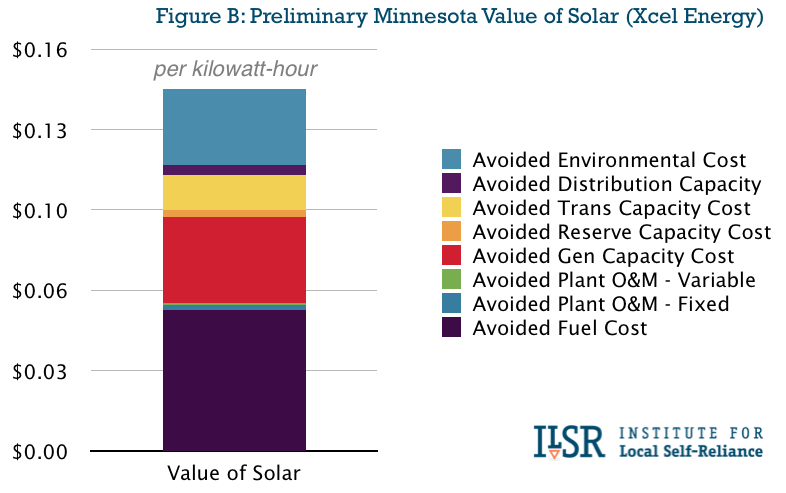

As adopted, Minnesota’s value of solar formula includes all of the basic components of the theoretical policy. The following chart (Fig. B) shows the relative value of the various components, and the total value, based on early estimates filed during the proceedings at the state’s Public Utilities Commission.

A Caution

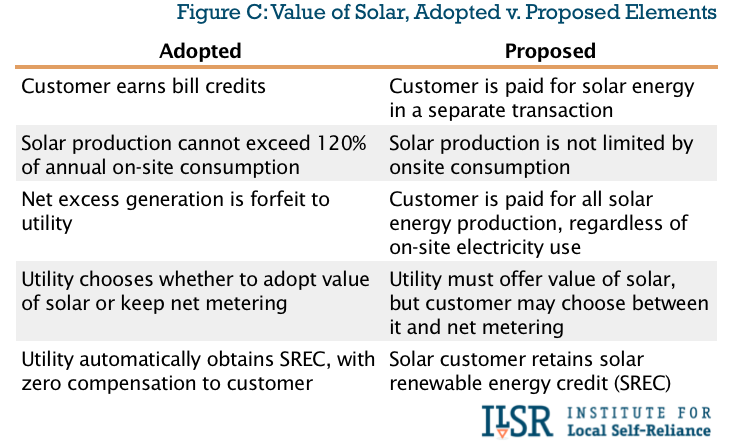

Although Minnesota’s value of solar policy is a national precedent, the adopted policy had some good elements that were lost in the legislative process, elements that other states may want to revive. The following table (Fig. C) illustrates:

The Impact on Utilities and Customers

The environmental value may be the most precedent setting, because it means that when buying solar power under Minnesota’s value of solar tariff, a utility is for the first time paying for the environmental harm of its fossil fuel energy generation.

The environmental value may be the most precedent setting, because it means that when buying solar power under Minnesota’s value of solar tariff, a utility is for the first time paying for the environmental harm of its fossil fuel energy generation.

Value of solar offers something for everyone. For utility customers, a 25-year contract at a fixed price makes solar financing much easier, and as the cost of solar continues to fall, quite lucrative.

For utilities, the transparency of the market price means no concerns about cross-subsidies between solar customers and non-solar customers. It means a payment for solar energy uncoupled from the retail electricity price. It may also mean a potential for cost recovery on payments made to solar producers, something not allowed with net metering. In Minnesota’s case, it also means free access to solar renewable energy credits, at a substantial savings compared to credit prices in states with competitive credit markets, i.e. New Jersey, Pennsylvania, etc.

Will Value of Solar End Battles Over Distributed Generation?

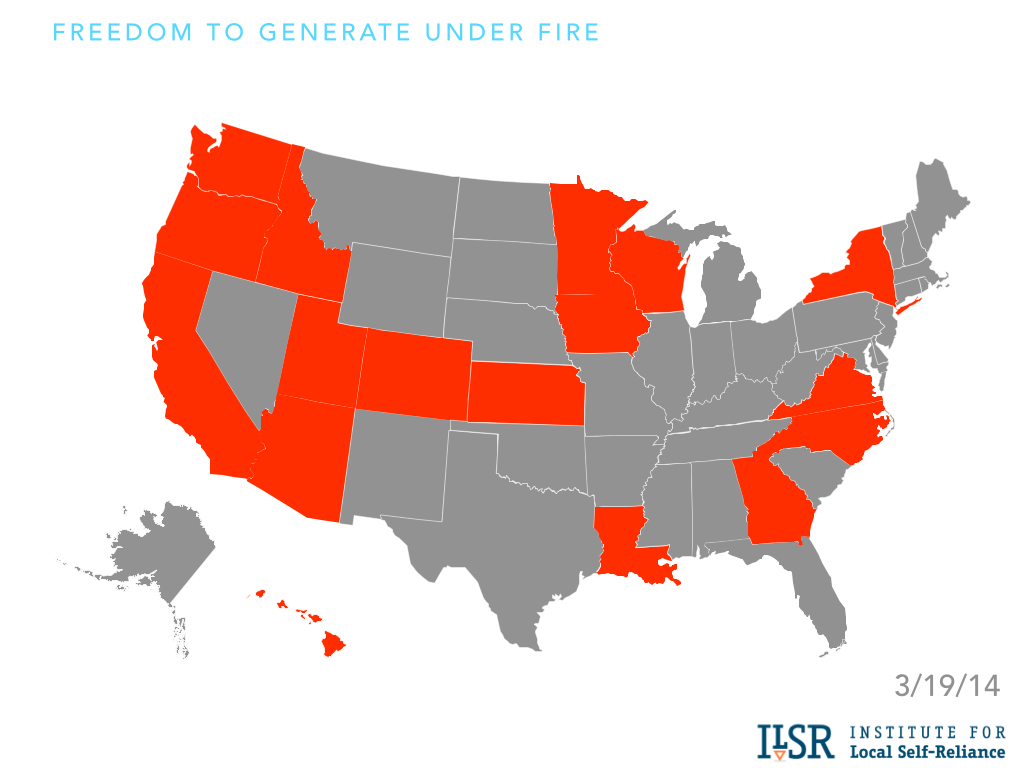

If Minnesota utilities report favorably on the value of solar, it may change the debate in other state battlegrounds over distributed generation.

The value of solar delivers a transparent, market-based price for solar. It solves problems for utilities and for utility customers around compensation for distributed renewable energy generation. But its ultimate success lies in whether electric utilities can be convinced that accommodation of customer-owned power generation is in their best interest, or whether any concession of their market share is a deadly threat to their economic livelihood.