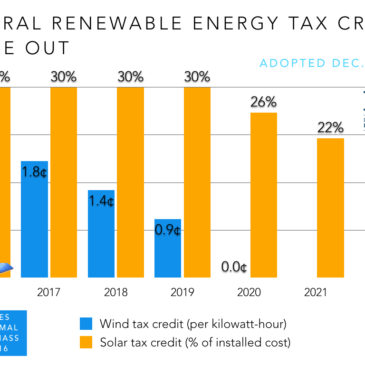

Further Thoughts on the Economics of Losing the Federal Solar Tax Credit

Amid the discussion over ending the federal solar tax credit in 2015, I published an analysis of the less-than-expected hit to residential solar costs. I made a big mistake. Instead of a 2.5% cost increase, the impact of the expired tax credit would be closer to 13.3%. But a revised and deeper investigation also shows our … Read More