ILSR’s Minnesota Carbon Tax Shift Archives

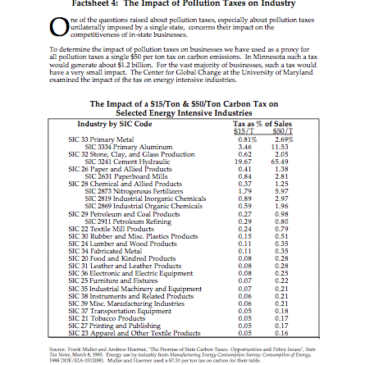

In the 1990s, the Institute for Local Self-Reliance and other energy activists in Minnesota undertook an effort to get Minnesota to adopt a billion dollar "tax shift" that would have raised the cost of energy while reducing taxes on income and/or property. ILSR was integrally involved in the design of the legislative proposal and examined the impacts on various sectors of Minnesota’s economy. Below you will find the archive of the materials that were prepared to support the initiative. Over several years, the proposal was debated extensively but never enacted into law. … Read More