How States and Cities Can Unlock Local Clean Energy

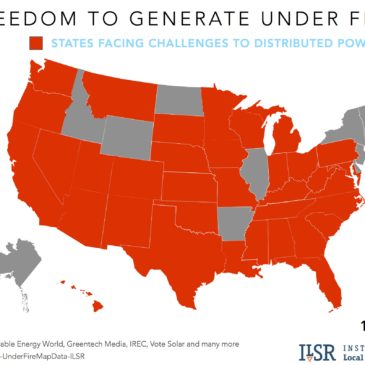

Yesterday’s news about the Paris Climate Accords has provoked a groundswell of commitments for local action on climate change. But what can cities actually do in the absence of federal support? A lot. In fact, with the help of states, cities have many avenues to boost their economies and drive down energy costs with local clean … Read More