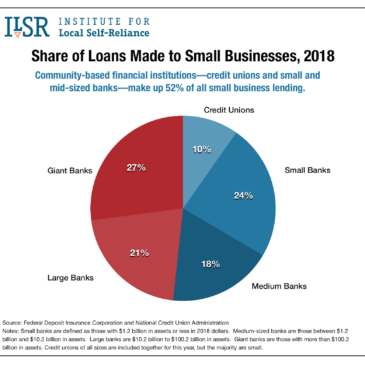

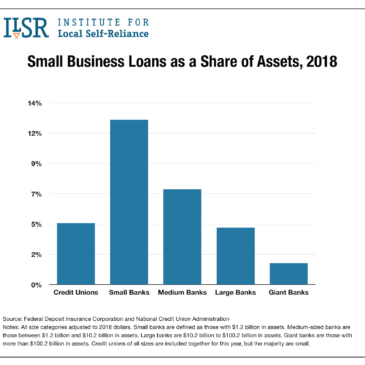

Helping Lending Programs Reach Underserved Small Business Owners

For the past year, ILSR and Recast City have collaborated on bringing Equitable Lending Leaders, a program to help small business lending programs reach more underserved entrepreneurs and small business owners, particularly owners of color. Now that more than 120 RLFs have participated in Equitable Lending Leaders, we have identified several best practices.… Read More