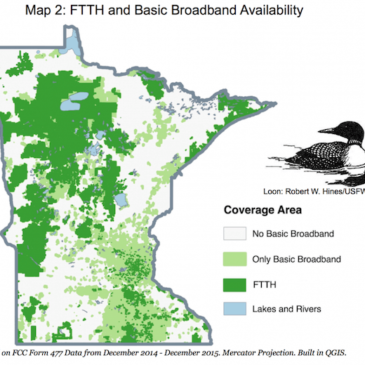

Fact Sheet on Minnesota’s Rural Digital Divide

The fact sheet highlights the great work that Minnesota cooperatives and municipalities have done to bring fast, affordable, reliable Internet service to rural areas throughout the state. They’ve built many Fiber-to-the-Home (FTTH) networks, but there is still much work to do. One in 4 Minnesotans lives in a rural area, and of those rural households, 43 … Read More