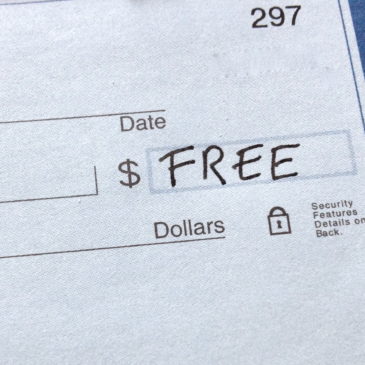

Free Checking is Rare at Big Banks, Common at Small

While just 24 percent of big banks offer totally free checking, more than 60 percent of credit unions and small banks do, according to a new report from the U.S. Public Interest Research Group. The report also found that credit unions and small banks have lower fees on average and do a better job of disclosing fees to prospective customers.… Read More