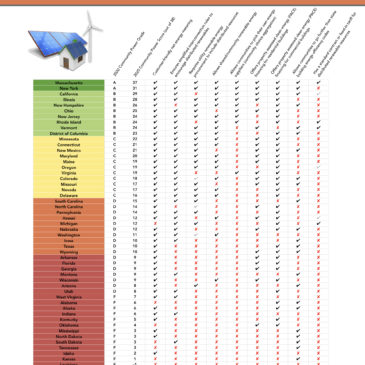

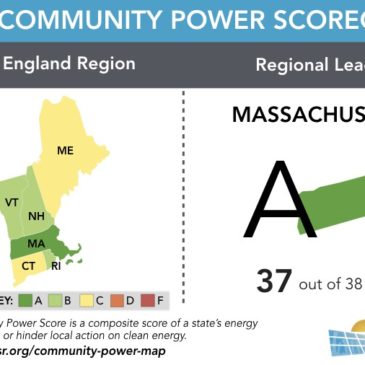

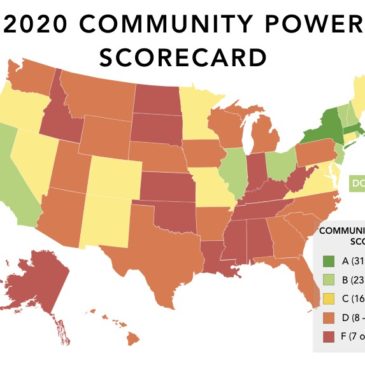

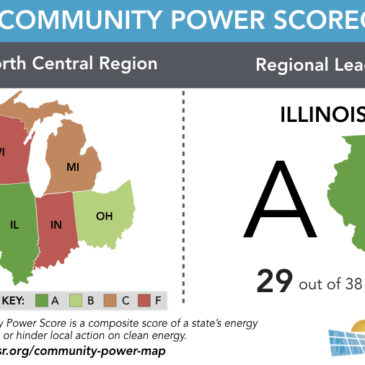

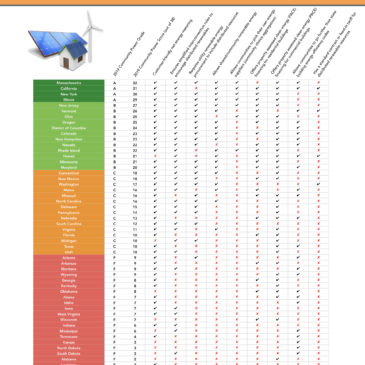

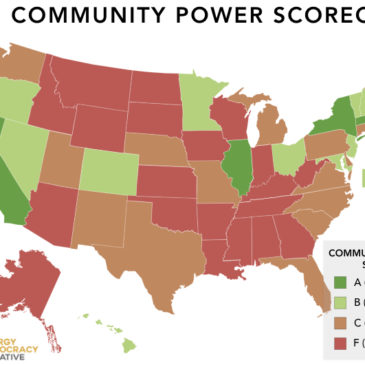

How Can Your State Get an “A” Community Power Score?

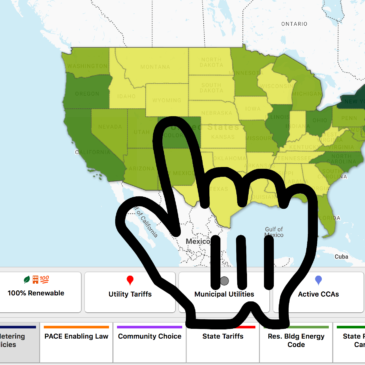

What policies make a state a champion of local, renewable energy? This post walks through models of the best policies in each of the eight areas covered in the Community Power Scorecard.… Read More