Pennsylvania is a pioneer in using State-imposed surcharges on top of existing tipping fees to fund state and municipal recycling and local land conservation programs. Revenues come from a $6.25-per-ton surcharge on top of municipal waste disposal fees.

Of the $6.25-per-ton surcharge, $4.25 finances the Environmental Stewardship Fund (ESF) and its Growing Greener Plus grants program, which supports watershed restoration and protection. The $4.25 is made up of $4.00-per-ton and $0.25-per-ton fees, established by Act 90 of 2002 and Act 68 of 1999 respectively. The remaining $2 per ton, as established by Act 101 of 1988, finances the Recycling Fund, which allocates money toward municipal grants for recycling collection, education, training, processing facilities and equipment. See the table below for a breakdown of the fees.

|

Fee Name |

Fee ($ per ton) |

Revenue (millions)* |

Purpose |

| Act 101 Recycling Fee | $2.00 | $39 | Recycling Fund |

| Act 68 Environmental Stewardship | $0.25 | $6-8 | Environmental Stewardship Fund |

| Act 90 Disposal Fee | $4.00 | $60-65 |

Annual Revenue Generated by Pennsylvania Tipping Fees

(Adapted from PA TPL Tipping Fee Memo)

*Latest annual revenue data as of 2021

The $0.25-per-ton Environmental Stewardship Fee and the $4.00-per-ton Disposal Fee apply only at municipal waste landfills. The $2.00-per-ton Recycling Fee applies to waste disposal at both landfills and resource recovery facilities, as defined below.

“Resource recovery facility.” A processing facility that provides for the extraction and utilization of materials or energy from municipal waste that is generated offsite, including, but not limited to, a facility that mechanically extracts materials from municipal waste, a combustion facility that converts the organic fraction of municipal waste to usable energy, and any chemical and biological process that converts municipal waste into a fuel product. The term also includes any facility for the combustion of municipal waste that is generated offsite, whether or not the facility is operated to recover energy. The term does not include:

(1) Any composting facility.

(2) Methane gas extraction from a municipal waste landfill.

(3) Any separation and collection center, drop-off point or collection center for recycling, or any source separation or collection center for composting leaf waste.

(4) Any facility, including all units in the facility, with a total processing capacity of less than 50 tons per day.”

Environmental Stewardship Fund

The Growing Greener Plus grants program was established by Act 68 of 1999, which created the Environmental Stewardship Fund (ESF), established a $0.25-per-ton surcharge, and committed to investments in preserving farmland, conserving open space, restoring water quality, promoting outdoor recreation, and revitalizing communities. The $0.25-per-ton disposal fee generates $6-8 million annually. In 2002, Act 90 authorized an additional waste disposal surcharge as a dedicated source of revenue for the ESF. This additional $4.00-per-ton disposal fee generates $60-65 million for the ESF annually.

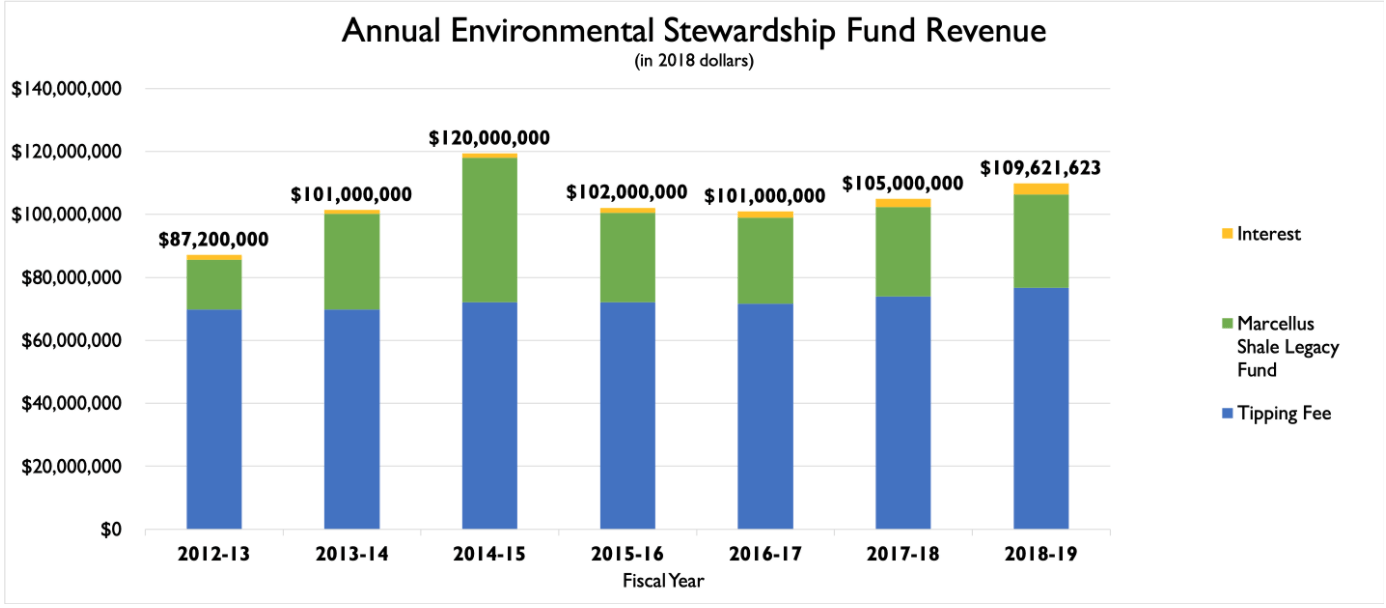

Between 2012-2020, ESF revenue was supplemented by fund transfers from the Marcellus Shale Legacy Fund (MSLF), which allowed funds to flow from oil and gas leasing and drilling fees into the ESF, via the MSLF. Fund transfers from the MSLF into the ESF began in 2012, at $20 million, and continued at $35 million annually until 2020, when the fund transfers ceased. The ESF also earns a portion of its revenue on interest.

ESF Revenue & Legislative History (ESF website)

The Environmental Stewardship Fund’s Growing Greener Plus grant program continues to support conservation, restoration, and community building in Pennsylvania’s public lands. Eligible applicants for the grant programs include incorporated watershed associations, county or municipal governments, county conservation districts, councils of governments, nonprofit charities, educational institutions, and municipal authorities. In 2020, more than $34 million was awarded to fund 149 projects engaged in watershed restoration and protection. Local projects have included implementation of agricultural best management practices on farms in McKean County and Lycoming County, improvement of water health in the Canestoga watershed, reducing farm costs and runoff, and the building of community recreational spaces using sustainable techniques, including amending the soil with compost from local school districts.

Recycling Fee

The 1988 Municipal Waste Planning, Recycling and Waste Reduction Act (Act 101 Chapter 7) established the Recycling Fee of $2 per ton of solid waste processed or disposed at resource recovery facilities and landfills, paid quarterly by the waste facility operator and accompanied by a tonnage report. This fee, however, excludes disposal of incinerator ash, given that the fee is already paid on the tonnage of solid waste sent to incinerators pre-incineration.

This Act also established the Recycling Fund, financed by the aforementioned $2-per-ton tipping fee, which allocates money toward municipal grants for local collection programs, public education, materials processing and composting facilities, equipment, and technical training (Act 101 Section 706).

“(a) Establishment.–All fees received by the department pursuant to section 701 shall be paid into the State Treasury into a special fund to be known as the Recycling Fund, which is hereby established.”

Of the Recycling Fund, at least 70% will be allocated as grants for local government recycling, planning, and environmental protection programs. Up to 30% of this fund shall be used for public information, education, and technical assistance programs on recycling and waste reduction. And up to 10% of the fund may be extended as grants not restricted to municipalities.

Recycling Fund Grants

The minimum of 70% of Recycling Fund money that is allocated as grants to local governments, as established in Act 101, Chapter 9. The majority of funds go toward Recycling Performance Grants (Act 101 Section 904), which are available to any and all local governments in Pennsylvania with a recycling program. The Recycling Performance Grants are awarded based on total tons recycled and recycling rate, to fund local recycling program development, implementation, grants, and research. Other programs funded by the Recycling Fund include the following:

- County Planning and Hazardous Household Waste Education Grants (Act 101, Section 901)

- Reimburses up to 80% of County costs in preparing their waste management plans and pollution prevention activities. Counties must submit applications with costs incurred in order to receive funding.

- Recycling Program Development and Implementation Grants (Act 101, Section 902)

- Reimburses up to 90% of county and municipal expenses on eligible recycling program development and implementation. Annual applications are required.

- County Recycling Coordinator Grants (Act 101, Section 903)

- Provide up to 50% reimbursement for County Recycling Coordinator salaries and expenses. Annual applications are available only to county governments.

Up to 10% of Recycling Fund money may be allocated as grants not restricted to municipalities. For example, in 2020, the Division of Waste Management and Planning launched the Food Recovery Infrastructure Grant, a competitive grant which provided assistance to non-profit organizations for the proper management of food to reduce waste. The grant program provided $9.6 million to 145 projects focused on diverting edible food waste from landfills. For example, Central Pennsylvania Food Bank received $200,000 that supported the purchase of three refrigeration trucks and enhancement of their food recovery work in 2020.

Post-program survey results show that this program rescued almost 1 million pounds of food from landfills, distributing edible food to over 25,000 Pennsylvania residents over the course of the year. Although the first year of these grants was supported by funds from the Recycling Fund, the Fund has since been depleted and can no longer support this program. The Division hopes to recommend continued support of this vital program through a $10 million appropriation in FY 22/23.1

Fund Diversions

In 2005, a six-year $625 million bond referendum was approved by Pennsylvania voters, establishing the Growing Greener Bond Fund (Act 45) and the Growing Greener II program. The bond was introduced in order to accelerate the ESF’s popular work. However, later legislation enabled the bond program’s debt service to be paid out of the ESF instead of just Pennsylvania’s general funds. This resulted in the diversion of tens of millions of ESF funds annually toward the repayment of these bonds. This bond repayment diversion continues to this day, funneling money away from environmental conservation and restoration work that the Fund would have otherwise supported

In fiscal year 2019–20, $16 million from the ESF was diverted from spending on local projects to pay operating expenses for the Department of Environmental Protection, diverting money away from the original purpose of the fund, which is to invest in farmland, conserve Pennsylvania’s public lands and water, and revitalize communities. And, in 2019, the Recycling Fund took a $50 million hit when the money was redirected into the general fund.

These diversions exhibit how funds designated for conservation activities can be easily redirected. Lawrence Holley, Pennsylvania DEP’s Waste Management and Planning division chief, noted the critical role of legislative language in setting up the ESF and Recycling Fund, and suggested that similar funds, in order to be effective, should include statutory parameters on how the money can be used as well as protections against moving money out of the fund.2

More Information

- Recycling in Pennsylvania – Pennsylvania DEP

- Composting in Pennsylvania – Pennsylvania DEP

- Pennsylvania Environmental Stewardship Fund

- Environmental Stewardship Fund – Revenue and Legislative History

- White paper: Report on Act 101 Recycling Requirements – Pennsylvania DEP

1 Personal Communication. Lawrence Holley. Waste Management and Planning Division Chief, Pennsylvania DEP. Call. September 28, 2021.

2 Personal Communication. Lawrence Holley. Waste Management and Planning Division Chief, Pennsylvania DEP. Call. September 28, 2021.

—————————————

Original post from November 2, 2021