Featured

ILSR Responds to the CFPB’s Proposed Guardrails for Digital Banking

Katy Milani

January 24, 2024

ILSR supports the Consumer Financial Protection Bureau's proposed “open banking” rule to establish important guardrails for digital banking. But it needs additional provisions to ensure that smaller, relationship-oriented financial institutions can access fair competition. READ MORE

ILSR Comment Letter Raises Concerns about Big Tech’s Expansion into Finance

Katy Milani

December 16, 2021

In a comment letter to the Consumer Finance Protection Bureau, ILSR raised several areas of concern that the agency should examine as part of its inquiry Into Big Tech payment platforms. READ MORE

Senate Testimony: Concentration is at the Root of Rural Distress

Katy Milani

April 27, 2021

The Senate Committee on Banking, Housing, and Urban Affairs invited Co-Director Stacy Mitchell to testify at its April 20th hearing on the state of the rural economy. Stacy spoke on why rural America is in crisis and attributed the widening gap between struggling rural towns and coastal supercities to the concentration of corporate and financial power. READ MORE

Our Guide Gives State and Local Leaders Tools to Fight Corporate Monopolies

Jess Del Fiacco

July 15, 2020

As state and local leaders grapple with how to create a true recovery — one that lifts wages, fosters small businesses, and rebalances power — combating outsized corporate power is a key strategy. Check out ILSR's guide to antimonopoly policies for states and cities. READ MORE

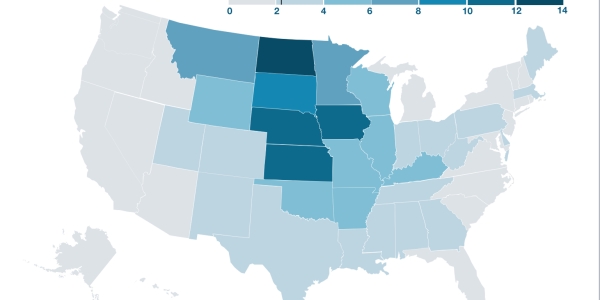

Report: Fewer Small Businesses are Receiving Federal Relief Loans in States Dominated by Big Banks

April 29, 2020

A significantly larger number of federal relief loans are reaching small businesses in states where small, local banks comprise a greater share of the market, compared to states where big banks are more dominant, an ILSR analysis has found. READ MORE

Op-Ed in Fortune: The Hidden Price of Cashless Retail

April 3, 2019

In Fortune, we detail the growing cashless retail trend, steps cities and states are taking to regulate it, and the ultimate effect monopoly credit card companies like Visa and Mastercard have on small businesses and the economy at large. READ MORE

How One State Escaped Wall Street's Rule and Created a Banking System That's 83% Locally Owned

September 1, 2015

North Dakota has a different kind of banking sector than the rest of the country does, with six times as many locally owned financial institutions per person as the rest of the U.S., and local institutions controlling 83 percent of the market. What is North Dakota doing differently? A lot of the answer is the Bank of North Dakota. READ MORE