This February 1997 report by David Morris, Alyson Schiller, and John Bailey examines the impact of the proposed Economic Efficiency and Pollution Reduction Act (EEPRA). The bill’s introduction in the 1996 Minnesota State Legislature prompted a discussion about its impact on Minnesota businesses. This report addresses this question. It does so by assessing the net impact of several types of tax shifts on 23 Minnesota businesses, ranging from neighborhood coffee shops to equipment manufacturers and farmers and paper mills.

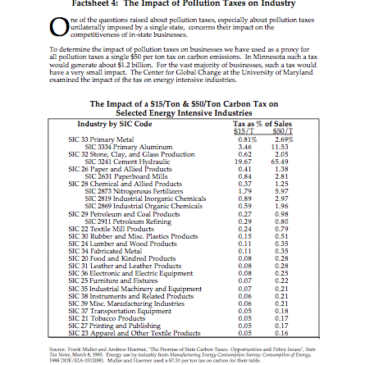

EEPRA imposes a tax on all fossil fuels and nuclear energy and reduces taxes on property and work. The tax in the form of a $50 fee per ton of carbon burned would raise $1.5 billion a year.

… Read More