Banking Resources – Search Results

Page 3 of 7

Small Businesses Figure Heavily in Goldman Sachs’ PR, But Not its Portfolio

By Stacy Mitchell and David Morris For years Goldman Sachs gave only a tiny fraction of its profits, less than 1 percent, to charity. Then the depression hit and the huge bank was in the public’s crosshairs for its role in that collapse and the billions it continued to give out in bonuses. Even as millions … Read More

Free Checking is Rare at Big Banks, Common at Small

While just 24 percent of big banks offer totally free checking, more than 60 percent of credit unions and small banks do, according to a new report from the U.S. Public Interest Research Group. The report also found that credit unions and small banks have lower fees on average and do a better job of disclosing fees to prospective customers.… Read More

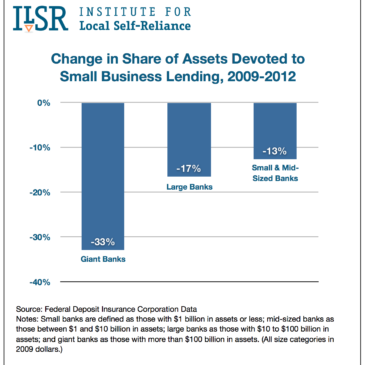

Too Big to Lend

A critical function of our banking system is financing small businesses. But big banks are doing a rotten job of it. At the nation’s largest banks, small business lending has plunged 33% since 2009. Trying to cajole or compel them to do more won’t make much difference because the problem is largely inherent to their scale.… Read More

Change in Share of Assets Devoted to Small Business Lending, 2009-2012

As a share of their total assets, small business lending at the nation’s largest banks fell by 33% in three years. … Read More

Local and Responsible Banking Resolution — Portland, OR

This resolution directs the City Treasurer to shift up to $2.5 million in city funds to local financial institutions.… Read More

Responsible Banking Act — Los Angeles

Banks that wish to do business with the City of Los Angeles must annually submit information on their lending and investments in each of the city’s census tracts. … Read More

Market Share Cap — SAFE Banking Act (Proposed)

Introduced by Senator Sherrod Brown on May 9, 2012, the following bill would place size and leverage limits on big banks, forcing the largest four banks in the country to downsize. … Read More

Market Share Caps

In 1994, Congress adopted a policy that bars a bank from buying another bank if the combined entity would hold more than 10 percent of the country’s deposits, but the policy has several flaws that have allowed at least two banks to exceed the cap.… Read More

Banking For the Rest of Us

In this cover story for Sojourners Magazine, Stacy Mitchell writes that there is remarkably little evidence to support the idea that bigger banks are superior. They have come to dominate, not because they are more efficient or offer better services, but because they have rigged government policy in their own favor. It’s time for a new set of rules—banking policies for the 99 percent.… Read More

How State Banks Bring the Money Home

One of the most significant consequences of the consolidation of banking over the last decade is how much it has hindered the economy’s ability to create jobs. There’s no single solution to this problem, but one of the most promising strategies involves creating state-owned banks that can bolster the lending capacity of local banks, helping them grow and multiply.… Read More

Depositing Public Funds in Local Banks – Massachusetts

Just 18 months after establishing the Massachusetts Small Business Banking Partnership, the state treasurer has moved over $270 million in state funds to 50 local banks. These 50 banks in turn have made over 2,500 new small business loans, many directly attributable to the state’s deposits. … Read More

Why Republicans Hate Warren’s CFPB But Love Another Bank Regulator

What’s really at issue in the fight over the CFPB is not how the agency is structured or how much power it will have, but whose interests it serves.… Read More

And The Academy Award for Cowardice Goes To….

After winning an Oscar for Best Documentary for Inside Job, Charles Ferguson injected some much-needed real world relevance amidst the fabulously glitzy proceedings. … Read More

Depositing Public Funds in Local Banks – Multnomah County, Oregon

On November 18, 2010, the Multnomah County Board of Commissioners approved a measure that creates a Community Advantage Banking Program, under which the county will invest $10 million of its funds with qualifying local community banks and local credit unions. The investment is expected to expand local lending, particularly to small businesses.… Read More

Glass-Steagall Act & the Volcker Rule

The Glass-Steagall Act created federal deposit insurance and erected a strict barrier between commercial and investment banking activities. It was repealed in 1999. In the aftermath of the financial crisis, many people, including prominent economists, policymakers, and even bankers, have called for restoring Glass-Steagall. The Volcker Rule, a provision in the Dodd-Frank financial reform bill, imposed some limits on the mixing of commercial and investment banking activities, but not the firm wall that Glass-Steagall had provided. … Read More