The reasons to choose a community bank or credit union range from getting the same services at a lower cost to supporting productive investment instead of speculative trading. But while it’s one thing to think about the qualities that are important in our banks, it’s another to find particular local banks that are enacting them.

A new tool, called Bank Local, aims to make that process easier.

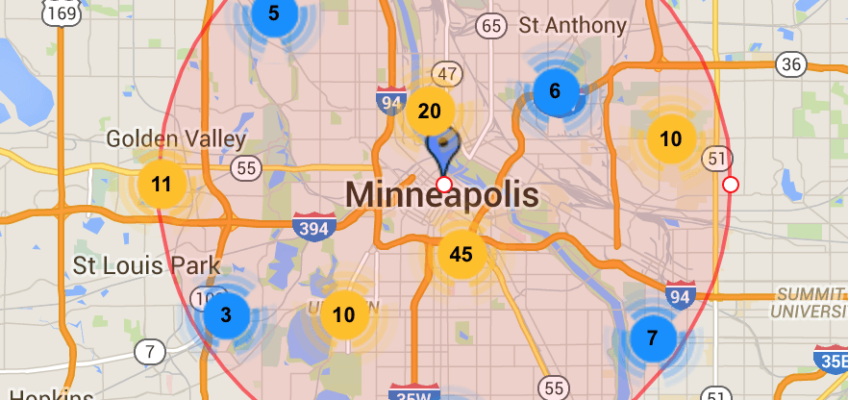

Bank Local maps every banking institution in the U.S., and uses data from three federal agencies, plus its own algorithm, to assign them a Local Impact Rating. Users can type their address into a bar on the site’s homepage, and find a map and list of how nearby financial institutions compare.

The project was created by Bob Marino and Nick Plante, who initially schemed it up as a tool for their own area. Both are board members of Seacoast Local, a local economies non-profit that works in eastern New Hampshire and southern Maine. They wanted to come up with something to help people move their money to a local bank or credit union, and take what they describe in an early post on their website as a “small, pragmatic action” against “the problem of Bigness in banking.”

“We thought that one of the venues for change would be to put that information out there for consumers who care about these issues,” Marino says.

Working with experts, including Stacy Mitchell here at ILSR and the economist Olga Bruslavski with the National Credit Union Administration, they came up with criteria to quantify a bank’s local impact. They decided on seven: Small business lending, location of headquarters, branch concentration, bank ownership, bank size, small farm lending, and speculative trading.

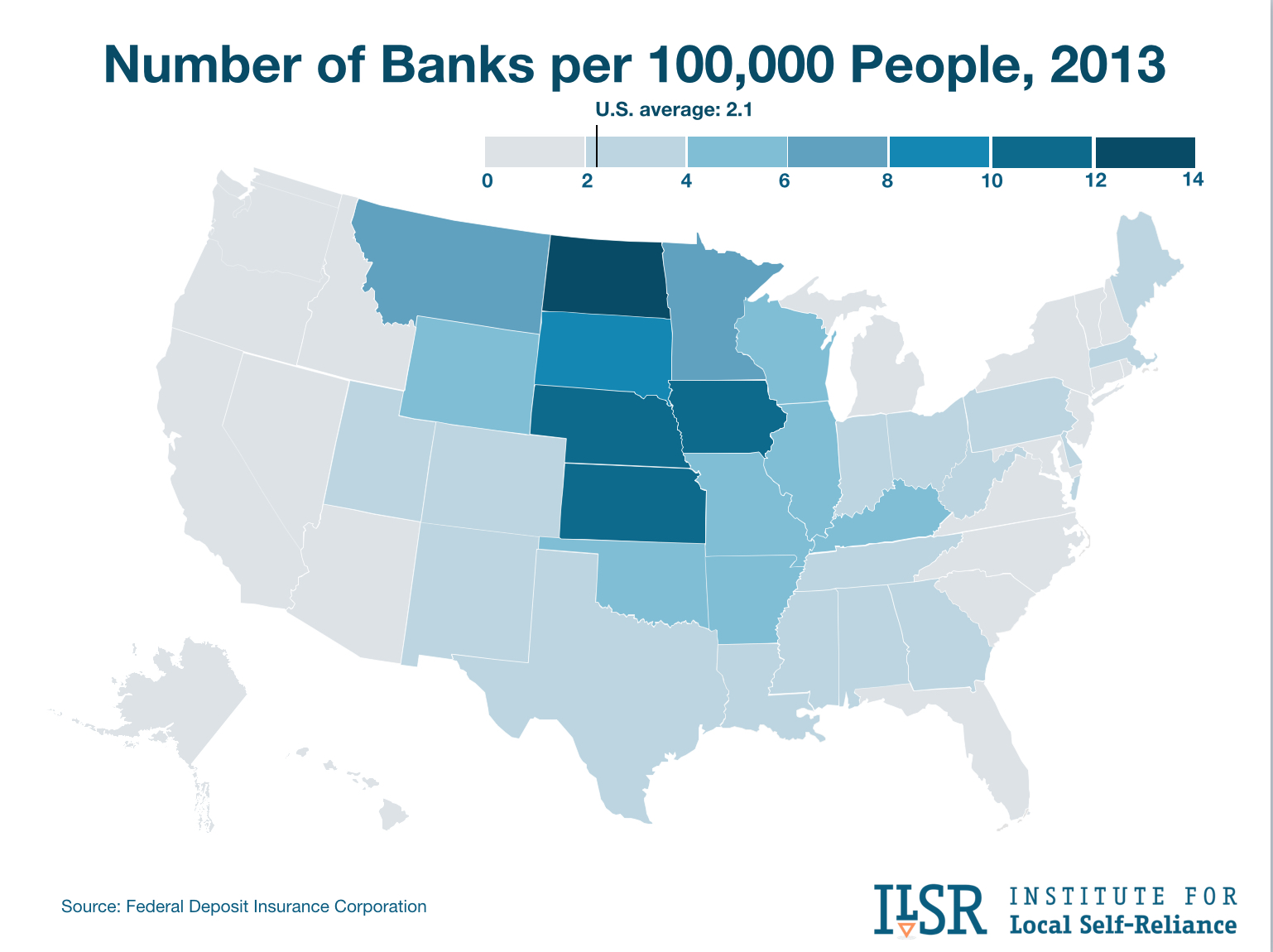

Take small business lending, the factor that Bank Local weighs most heavily. Small businesses, which create the majority of new jobs, depend heavily on small, local banks for financing. In 2014, even though community-based financial institutions controlled just 24 percent of all banking assets, they made 60 percent of all small business loans. As the banking sector has become increasingly concentrated, small businesses have had a harder time accessing the capital that they need to grow.

In Bank Local’s algorithm, if a bank dedicates 20 percent or more of its total assets to small business lending, it earns three points toward its total score and is marked as “outstanding” in that category. The lowest tier is for banks that devote less than 5 percent of their total assets, which receive a score of zero and a rank of “insignificant.” In Oakland, Calif., for instance, Mission National Bank uses 24 percent of its assets for lending to small businesses, and none for speculative trading, which helps it earn a high overall score for local impact. Citibank, meanwhile, deploys just 1 percent of its assets for small business loans and 9 percent for speculative lending.

Once Marino and Plante had come up with the criteria and the algorithm for scoring, they were able to expand their new tool to cover the rest of the country. They pulled all of the data they needed, and then used a service that geolocated every financial institution.

Along the way, they found that there isn’t much else out there that’s like their tool. One predecessor was the Oregon Banks Local project, which laid helpful foundations in determining criteria, but that project only looked at financial institutions within the state of Oregon, and it no longer exists. At Bank Local, Marino and Plante plan to continue to update the data annually.

“I think what’s really great about the site is that it’s full coverage of every institution in the country, and every town and city in the country, and it’s not going to be static,” says Marino.

There have already been surprises. For starters, Marino says, it’s not only the predictable giants, like JP Morgan Chase and Bank of America, that aren’t good stewards of local lending. There are also a number of large regional banks that fall below small community institutions in Bank Local’s algorithm.

The project has received recognition from the University of New Hampshire’s Social Venture Innovation Challenge, and Marino and Plante hope that it will be a resource people can use to help them move their money.

Already, they know of at least one success. Since starting the project, Marino himself has moved his own banking to an institution in his town.