How Tax Policies Fuel Monopolies and Undermine Small Business

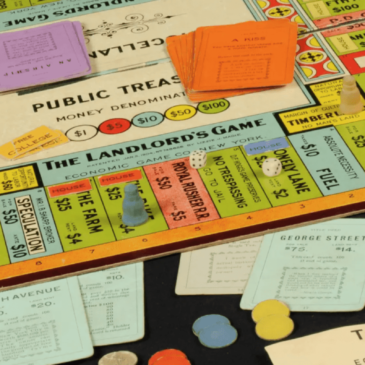

Amazon’ strategy for dominance — which includes securing government favors, particularly tax advantages — offers a road map of how to harness the tax system to build a monopoly.… Read More