In 1994, Congress adopted a policy that bars a bank from buying another bank if the combined entity would hold more than 10 percent of the country’s deposits. The cap was included in a sweeping deregulation bill, the Riegle-Neal Interstate Banking and Branching Efficiency Act, which allowed banks to merge and expand across state borders with virtually no restrictions.

In 1994, Congress adopted a policy that bars a bank from buying another bank if the combined entity would hold more than 10 percent of the country’s deposits. The cap was included in a sweeping deregulation bill, the Riegle-Neal Interstate Banking and Branching Efficiency Act, which allowed banks to merge and expand across state borders with virtually no restrictions.

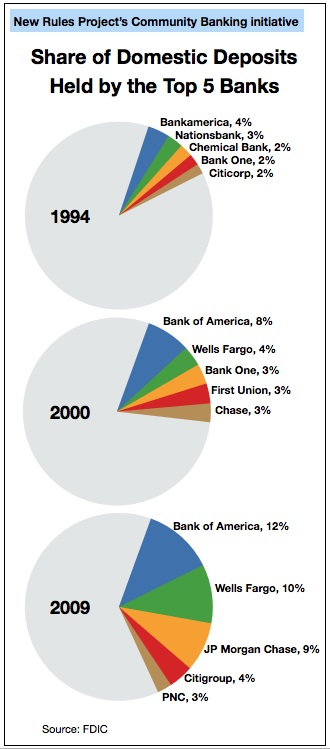

The deposit share cap was added to the bill in order to appease public concerns that a few banks would become too large and powerful. Those concerns proved well-founded. When the law passed, the top five banks together held 12 percent of U.S. deposits. A mere fifteen years later, the top five account for nearly 40 percent of deposits.

The law also established state deposit caps that prohibited banks from amassing, through mergers and acquisitions, more than 30 percent of the deposits in any state. The law gave each state the authority to raise or lower its own cap, or to abolish it altogether, which several states have subsequently done. (See our State Deposit Caps page for details.)

The national deposit cap has several flaws. One problem is that it permits a bank to exceed the cap if it acquires a financial institution that is either in danger of going under or is organized as something other than a commercial bank, such as a savings and loan. These loopholes allowed both Bank of America and Wells Fargo, with the approval of the Federal Reserve, to expand beyond the cap when they acquired failing institutions in 2008 and 2009. (Bank of America absorbed Countrywide and Merrill Lynch, and Wells Fargo acquired Wachovia.)

Another problem is that the cap applies only to deposits. As Simon Johnson, former chief economist of the International Monetary Fund, has noted, the big commercial banks have funded much of their recent growth not with deposits, but with various forms of wholesale financing. The same is true of investment banks, which do little in the way of basic consumer banking and thus can grow to a massive size without running afoul of the cap.

Finally, the current cap is too large. It has already allowed banks to expand to dangerous proportions, and could permit as few as ten banks to run our entire financial system.

Simon Johnson and his Baseline Scenario colleagues James Kwak and Peter Boone have called for capping the size of commercial banks to no more than 4 percent of U.S. gross domestic product (GDP) and investment banks to no more than 2 percent of GDP. They argue that making GDP the benchmark is key because the size of the financial industry tends to artificially swell during bubbles, like the recent housing bubble, so individual banks need to be measured against a more reliable indicator, such as the overall size of the economy.

At least ten banks are currently larger than this threshold. The top five – Bank of America, Citigroup, JP Morgan Chase, Goldman Sachs and Morgan Stanley – would have to be broken into 3-4 pieces each. That might sound radical at first, but it is hardly so. It would simply return us to a industry configuration similar to the mid-1990s when banks were plenty large.

During the debate on the Dodd-Frank Financial Reform law, Senator Sherrod Brown introduced an amendment to cap non-deposit liabilities at 3 percent of GDP and force banks that grow beyond that size – either on their own or through acquisitions – to divest some of their assets or otherwise shrink. His amendment did not pass, but did garner the votes of 33 senators.

Since then, support for downsizing big banks has only grown stronger. On May 9, 2012, Brown introduced the SAFE Banking Act, a bill that would would place size and leverage limits on big banks. It would eliminate loopholes in the existing federal deposit cap law by strictly prohibiting banks from holding more than 10 percent of U.S. deposits. It would also bar banks from holding non-deposit liabilities in excess of 2 percent of GDP. These measures would effectively limit banks to no more than $1.3 trillion in assets. That’s still enormous and arguably far too big, but, nevertheless, it would force the four largest banks — JP Morgan Chase, Bank of America, Citigroup, and Wells Fargo — to downsize. JP Morgan Chase, for example, currently has $2.3 trillion in assets.