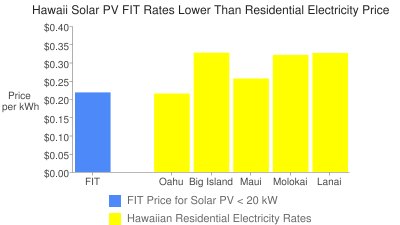

On Monday we posted a news story about the launch of Hawaii’s feed-in tariff program, and in a review last night we found an interesting anomaly: the price paid for power for residential solar PV (projects smaller than 20 kW) is lower than the residential retail electricity price on most of the Hawaiian islands. On the most populous island, Oahu, the price paid under the feed-in tariff is three-tenths of a cent per kilowatt-hour (kWh) higher than the retail electricity price, but it’s as much as 11 cents per kWh lower on other islands including Maui, Molokai, Lanai, and the Big Island.

On Monday we posted a news story about the launch of Hawaii’s feed-in tariff program, and in a review last night we found an interesting anomaly: the price paid for power for residential solar PV (projects smaller than 20 kW) is lower than the residential retail electricity price on most of the Hawaiian islands. On the most populous island, Oahu, the price paid under the feed-in tariff is three-tenths of a cent per kilowatt-hour (kWh) higher than the retail electricity price, but it’s as much as 11 cents per kWh lower on other islands including Maui, Molokai, Lanai, and the Big Island.

Why pay less than the actual retail electricity price?

First, Hawaii has a very strong solar resource. A typical rooftop crystalline silicon PV array could produce nearly 1,600 kWh AC per year for each kW of DC capacity. This is a capacity factor of over 18%.

Second, the state of Hawaii provides a personal tax credit for the lesser of 35% of the system cost or $5,000. This is on top of the federal 30% tax credit.

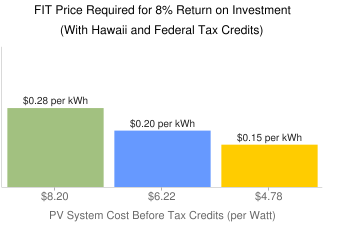

So what does a Hawaiian solar producer need to make a reasonable return on their solar PV investment (8%)? The following chart illustrates the prices needed for three different system costs.

While a typical individually contracted solar PV system will have a total cost of $8 per Watt or higher, group purchasing of solar PV systems (as discussed in this earlier post) has dropped installed costs down to as low as $4.78 per Watt in a group purchasing program in Los Angeles. At that upfront price, Hawaiians that go solar would only need $0.15 per kWh to make an 8% return on investment! Based on the actual FIT price of $0.21 per kWh, a Hawaiian group solar purchase could offer participants a 13% return on investment!

Note: You may wonder at the choice of installed costs for the chart. These are based on Solarbuzz’s solar price index and our previous analysis of distributed solar PV prices.

Note 2: I’m awaiting confirmation that the Hawaii tax credit is taken off the system cost, rather than cost after the federal tax credit. The FIT prices shown would rise by about 1.5 cents per kWh if the state tax credit is calculated on the system cost after the federal credit. Update: the federal tax credit does not reduce the basis for the Hawaii state tax credit.